The data shows that prices were up 0.2% higher, meeting estimates measured month to month, and were 2.6% higher than last year. It seems that we’re on track for the Fed to implement another cut to interest rates.

And though inflation may be progressing at a pace that’s moderated from previously torrid levels, there’s scant relief to be felt in the aisles, as consumers spend more to eat and to have four walls around them.

Indeed, the divergence between what the data tell us and what households feel in their collective wallets is stark. PYMNTS’ Karen Webster noted last October that consumers have all but shrugged at the monthly reports.

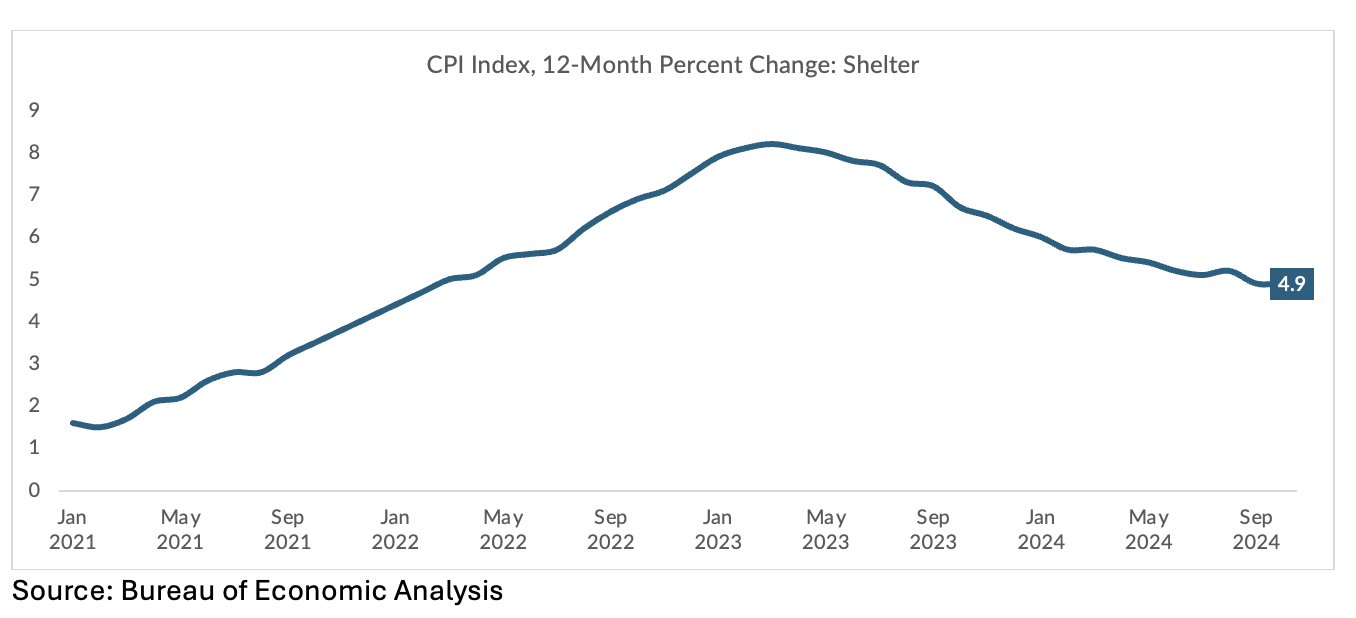

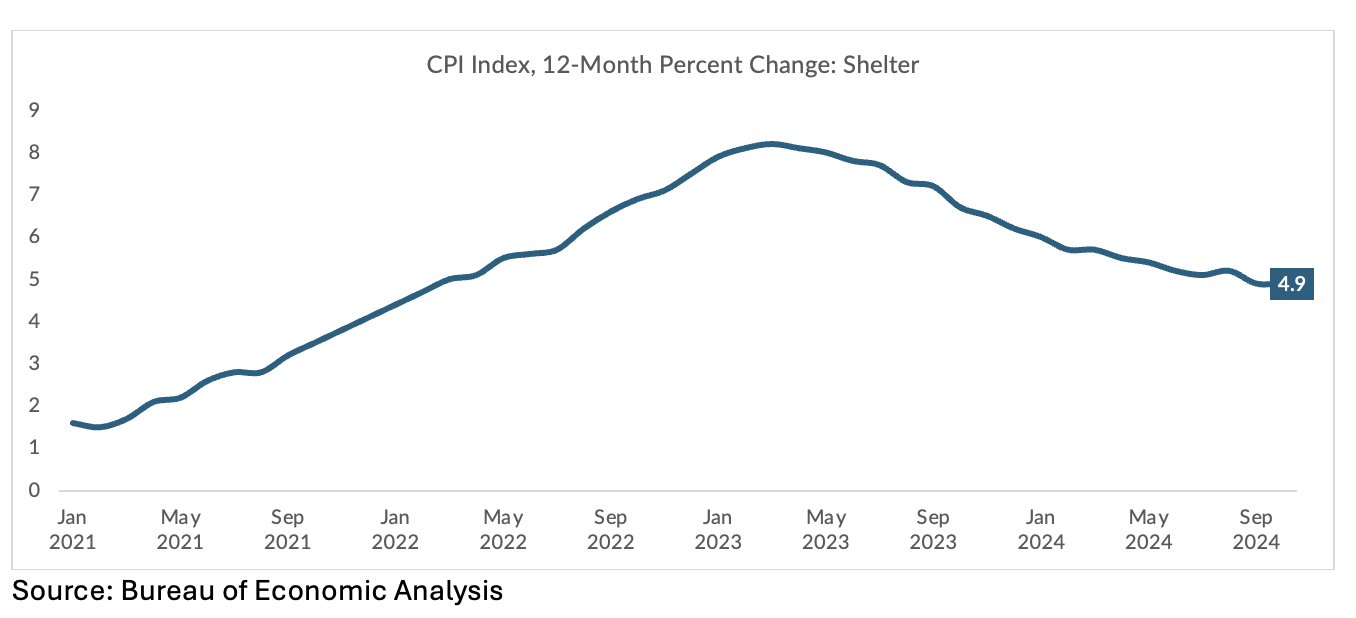

The latest CPI report shows that some of the costs tied to daily life — most notably, shelter, this time around — are still rising at a steady pace. The CPI report details that shelter was 0.4% higher month on month, up from the 0.2% gain seen in September, and resuming a 0.4% to 0.5% monthly march that had been seen over the past several months. Housing inflation now stands at 4.9% versus a year ago.

Grocery prices (defined by the CPI as “Food at Home”) were 0.1% higher in the most recent reading, ratcheting down from 0.4% in September, but resuming the pace seen earlier in the year.

Advertisement: Scroll to Continue

Food costs saw a year-over-year increase of 2.1%, with notable variances across specific categories. Food consumed away from home, such as restaurant dining, rose by 3.8%. Grocery prices have shown a mixed trend: while cereals, bakery products and dairy each posted gains of around 1.0%, the cost of meats, poultry, fish, and eggs declined, with eggs alone dropping by 6.4% in October.

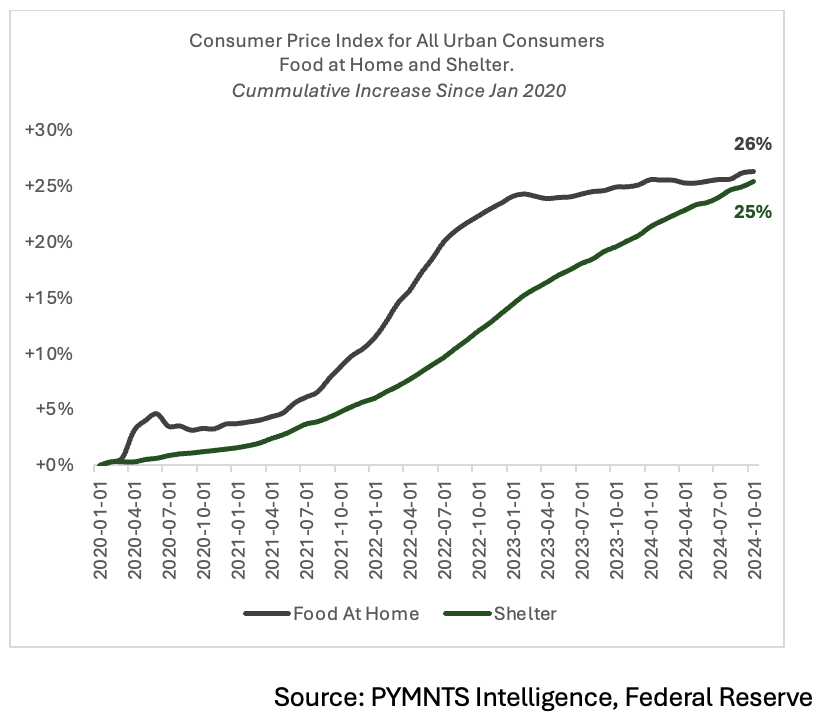

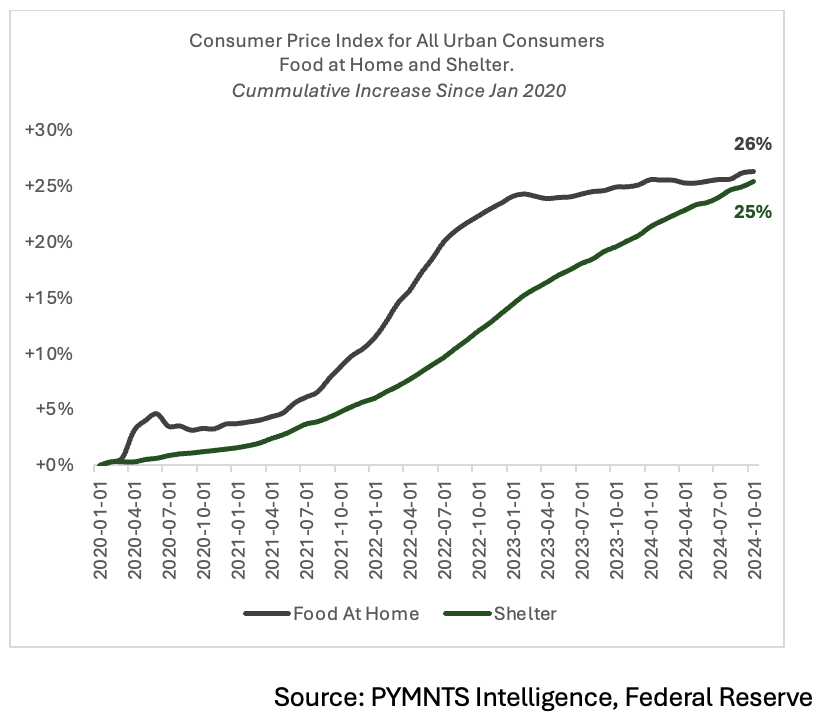

It’s worth noting that the October increase also marks the first annualized gain since the March CPI report from this year. And the charts above illustrate how sticky inflation really has been. Though the increases have roughly plateaued, they are still increases, representing a roughly steady trend.

As we reported Tuesday (Nov. 12), U.S households are seemingly eyeing inflation to be a longer term fact of life. The Fed’s latest survey on consumer expectations found that when projecting price increases through the next year, survey respondents said the rate would be about 2.9%. They also said that they’d expect spending to increase by 4.9%, which indicates that they will buy more goods and services (as the rate of spending outstrips price gains).

That’s an overall, headline number. But if food prices are, as per the Fed data, expected to rise 4.3%, for example, the logic follows that more money might be earmarked out of the household budget just to keep people fed.

The chart below, indexed to January of 2020, gives a visual representation of just how far prices have soared for housing and for food — we’re nearly in lockstep, at a roughly 25% surge in each category.

Housing costs have increased amid the red-hot market that was spurred by the pandemic, as folks sought to relocate and everybody worked from home and various rent moratoriums were lifted. Grocery prices reflect the pressures of commodity costs.

Household incomes are expected to rise by only 3%, so the pressures on the budget are apparent: Either consumers will continue to tap credit/savings to fund the daily essentials, or they will pull back on their spending. That’s especially true for paycheck-to-paycheck consumers, as our data shows that a third of these consumers are grappling with high debt loads.