Inflation is at a multiyear low, according to July’s Consumer Price Index from the U.S. Department of Labor.

Inflation has broken through an important psychological barrier, so to speak. The Federal Reserve’s impetus to cut interest rates may have just gotten a bit stronger.

But the question remains as to whether the more than 60% of U.S. citizens who live paycheck to paycheck will feel much relief, if any at all.

The Consumer Price Index, released Wednesday (Aug. 14), rose 2.9% in July from a year earlier, which signals a break below the 3%+ level that has been in place for months. The latest reading is the lowest report since 2021, when the pandemic was still raging. Month over month, inflation was at 0.2%, up from the 0.1% decline that had been seen in June, and May’s flat reading versus April’s levels.

Although the Fed may indeed cut rates sooner rather than later, a dive into some of the key categories of everyday spending shows that inflation is sticky, which in turn indicates that paycheck-to-paycheck pressures will still be challenging.

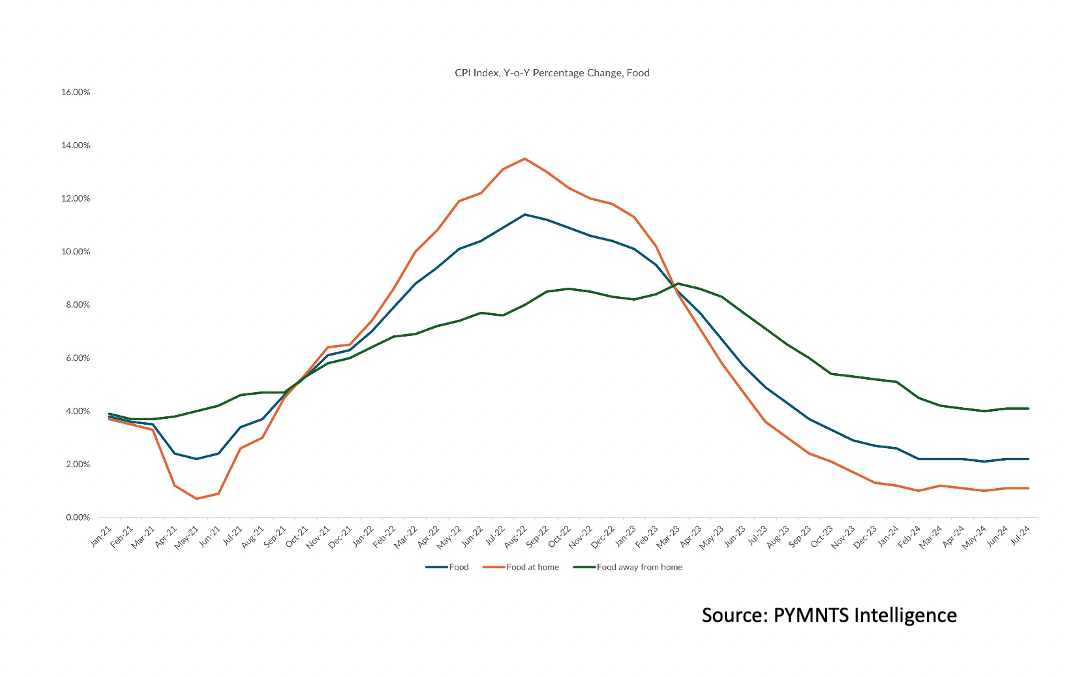

The data showed that the overall food category saw prices increase by 0.2% in July, the same pace as in June, while quickening from the flat-to-0.1% gains in the preceding several months. The “food at home” segment, which is a read-across for groceries, was up 0.1% in July and up 1.1% from a year ago. The “food away from home” data, which indicates pricing at restaurants and other establishments, was up 0.2% month on month in July, as the annualized price increases stood at 4.1%.

But the standout here seems to be shelter, where the 12-month increase was 5.1%, and in July the month-over-month increase was 0.4%, which was a rebound from the 0.2% rate seen in the previous month.

PYMNTS Intelligence data noted earlier this year that coming into the summer months, consumers were paying about 20% more, cumulatively, than they paid before the pandemic for groceries. Shelter accounts for more than a third of the take-home pay for households earning less than $50,000. The tally winnows down to about 13% for households above the $50,000 threshold, but it is still significant. PYMNTS Intelligence estimated that the combined food and shelter bills account for about 60% of the take-home pay of consumers and households with up to $50,000 in annual income.

Food inflation is off its peak, but it remains a force to be reckoned with.