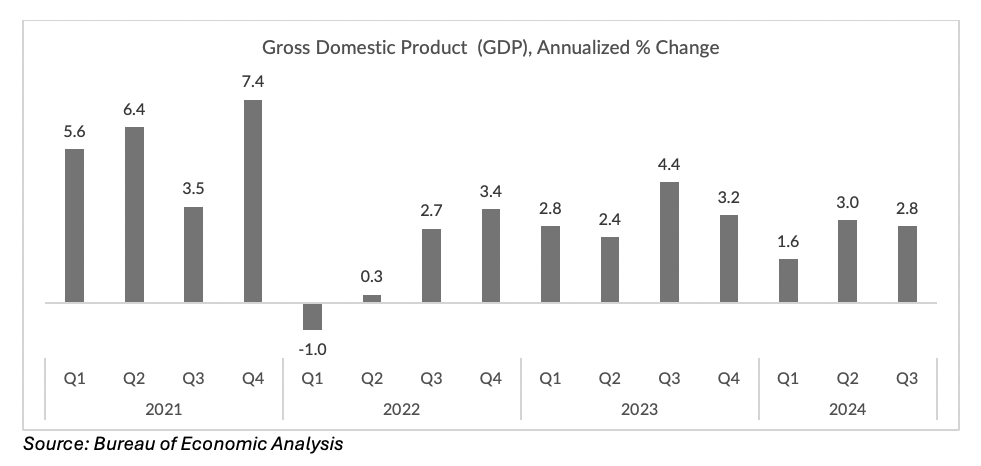

The Bureau of Economic Analysis confirmed Wednesday (Nov. 27) that third-quarter GDP grew at a 2.8% rate, unchanged from a previous estimate.

However, there are several puts and takes that bear watching, indicating where consumer spending, which has long been the key growth engine of the economy, might be headed.

Deceleration remained a hallmark of several areas of measurement, per BEA data. Growth in GDP slowed from the second quarter’s 3% pace.

Consumer spending was 3.5%, up from the 2.8% seen in the previous quarter. Although spending itself increased, the pace was revised downward from the original estimate of 3.7% growth.

Inflationary pressures remained controlled, with the Personal Consumption Expenditures (PCE) price index increasing by 1.5%, consistent with previous estimates.

The stability has likely helped support consumer spending in the face of rising financial pressures.

Disposable income growth remains a challenge, with current-dollar disposable personal income up only 2.3%, and adjusted real growth at 0.8%. The data also indicated a downward revision of disposable income, to the tune of 0.8%.

When that key metric is pressured, so too might the sustainability of GDP growth in the fourth quarter.

Personal saving was $934.4 billion in the third quarter, “a downward revision in change of $34 billion from the previous estimate,” the BEA said.

The personal saving rate — personal saving as a percentage of disposable personal income — was 4.3% in the third quarter, a downward revision of 0.5%.

Wages and salaries have seemingly not been enough to pad savings accounts.

“Private wages and salaries are now estimated to have increased $65 billion in the second quarter, a downward revision of $91.8 billion,” the BEA said.

The PYMNTS Intelligence report “Average Credit Debt Hits More Than $7,000 for Financially Struggling Cardholders” found that financially struggling cardholders now carry an average balance of more than $7,000, above the sample average that has been slightly north of $5,000. Since the data was collected by PYMNTS in October, after the end of the third quarter, this is an indication of the pressures that are already in place, at least in terms of spending power.

Separately, the PYMNTS Intelligence report “Paycheck-to-Paycheck Consumers Continue to Struggle With High Interest Rates” found that beefing up savings has been a longstanding challenge. Struggling paycheck-to-paycheck consumers average $2,447 in savings, while those living without difficulty average $7,558.

Meanwhile, 51% of paycheck-to-paycheck consumers struggling with monthly expenses have no readily available savings. Roughly 21% of all consumers said they have no access to readily available savings. By income, that translates to 38% of consumers earning less than $50,000, 16% of households earning between $50,000 to $100,000, and 8.4% of high earners, who see their incomes at about $100,000.