European middle-market firms have the second-highest need for working capital solutions.

That’s according to “The 2023-2024 Growth Corporates Working Capital Index: Europe Edition,” a PYMNTS Intelligence and Visa collaboration that looked at the working capital needs of growth corporates, or middle-market organizations generating annual revenues between $50 million and $1 billion. The five regions included in the study were Asia Pacific (APAC); Central Europe, the Middle East and Africa (CEMEA); Europe; Latin America and the Caribbean (LAC); and North America.

Typically, the capabilities and business needs of these middle-market firms are in danger of escaping the attention of traditional solution providers, which are used to working with either smaller businesses or larger enterprises.

Seventy-nine percent of European middle-market firms accessed working capital solutions in the past year — the second-highest rate among all five regions we surveyed. Only those firms in LAC had higher levels of working capital needs last year.

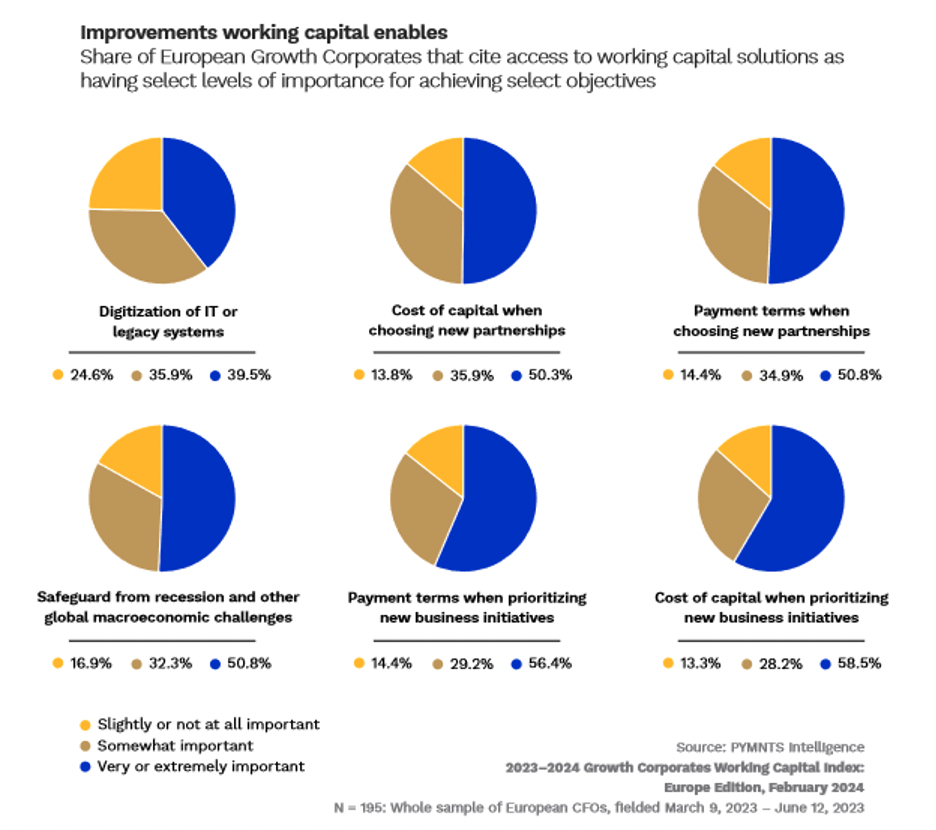

The objectives and priorities of European middle-market firms can vary, but working capital can play a key role in many improvements. Among the European firms PYMNTS surveyed, external financing was especially important when it came to underwriting new business initiatives. Eighty-seven percent of local growth corporates said so directly, while 86% said external working capital helps achieve favorable capital costs when building new partnerships.

Seventy-five percent said that working capital plays a significant role in digitizing their legacy technology, and nearly 83% noted working capital as important in safeguarding against unforeseen economic challenges.

Europe operates in a unique economic and monetary environment, as multiple countries share one currency. Businesses there face the same economic headwinds that affect the rest of the world, and the European economy is notably stagnant, growing by less than 1% in 2023 and offering a moderate outlook for 2024.

Against this backdrop, European middle-market firms face myriad challenges, which makes using external working capital solutions — and taking advantage of the improvements they can enable — especially important. Going forward, these organizations must proceed with caution if they hope to retain their market viability.