Truebill Reels In $45 Million For Personal Finance App

Silver Spring, Maryland-based Truebill announced on Tuesday (June 1) that it has raised $45 million. The company said the cash will be used to “expand its platform of financial management tools to give users more visibility and control of their money.”

In a press release, Truebill said the latest funding round was led by Accel. Existing backers Bessemer Venture Partners, Cota Capital and Eldridge Industries also upped their investments. The venture funding brings Truebill’s total funding to $85 million.

In a press release, Truebill said the latest funding round was led by Accel. Existing backers Bessemer Venture Partners, Cota Capital and Eldridge Industries also upped their investments. The venture funding brings Truebill’s total funding to $85 million.

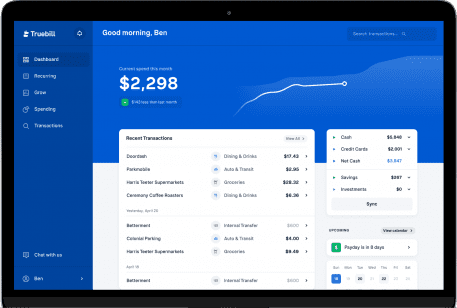

The company offers a personal finance app that monitors users’ spending habits, helping them to manage subscriptions, lower their bills and automatically set aside money to reach their savings goals. Truebill said it “has saved members more than $100 million since 2016.”

Nate Niparko, partner at Accel, said his firm is “impressed by the loyal following Truebill has amassed and at how rapidly the company has grown over the past year.”

“More than 10,000 members sign up for Truebill every day seeking to better understand and improve their finances,” said Haroon Mokhtarzada, the company’s co-founder and CEO. “With this new capital, we’re transforming Truebill into an all-in-one, holistic platform that makes it easy for members to not only manage subscriptions and spending but also … make informed decisions to improve their financial health.”

Since Truebill’s November 2020 $17 million funding round, the company has grown its active user base from one million to two million. In addition, its revenues have tripled since March 2020. The company said it has also more than doubled its staff since November to over 100 employees. Truebill said it plans to do more hiring in the product, data science, engineering, marketing and user support areas.

While interest in personal finance apps is growing, Americans’ knowledge of the topic remains low. Finance site GOBankingRates found that only 3 percent of individuals surveyed passed a six-question quiz tied to financial literacy.