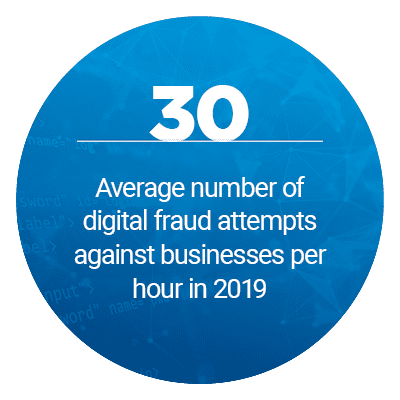

Digital fraud and cybercrime are constant worries for financial institutions (FIs) of all sizes, with these businesses seeing an average of 30 cyberattacks per hour in 2019 for a total annual cost of $1.45 trillion in stolen funds.

Digital fraud and cybercrime are constant worries for financial institutions (FIs) of all sizes, with these businesses seeing an average of 30 cyberattacks per hour in 2019 for a total annual cost of $1.45 trillion in stolen funds.

Fraudsters deploy an array of techniques with a variety of objectives, with some targeting funds directly while others go after customers’ private data.

This fear of cybercrime comes at a time when banks are exploring open banking systems en masse, which is only exacerbating security concerns. The application programming interfaces (APIs) that fuel open banking are popular targets for cyberattacks, with 473.5 million such attacks aimed at APIs between December 2017 and November 2019. Banks are leveraging multi-factor authentication (MFA) and machine learning (ML) to protect these systems, but customers fear this may not be enough.

The June Preventing Financial Crimes Playbook explores the latest financial crime developments, including the effect of open banking on FI security, the authentication measures banks and developers are deploying to protect themselves, and the massive impact that the ongoing pandemic is having on financial crime.

Developments Around the Financial Crimes Space

Developments Around the Financial Crimes Space

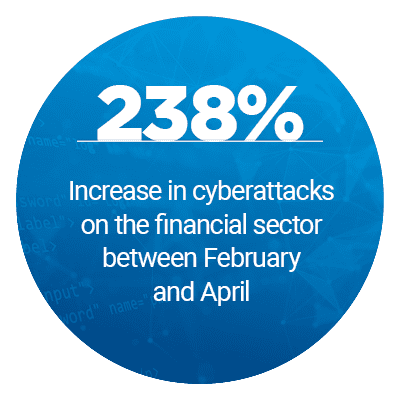

The ongoing pandemic has resulted in a surge of cybercrime, with a survey from California-based tech company VMware finding that such attacks against the financial sector increased by 238 percent between February and April this year. Fraudsters have deployed a wide variety of methods when conducting these attacks, with 64 percent of banks seeing an increase in wire fraud transfers and 82 percent reporting increased instances of social engineering attacks. There were also nine times more ransomware attacks within the same time frame.

One popular target for cybercrime is debit and credit cards as the pandemic leaves customers uncertain about their financial futures. The Federal Trade Commission (FTC) has reported 61,898 pandemic-related complaints since the outbreak began, totaling $45.1 million in losses and a median loss of $459 per incident. The FTC advises customers to use payment services or credit cards rather than debit cards when conducting transactions, as debit cards do not offer users the opportunity of canceling transactions before the money is lost forever.

Developers, meanwhile, are working on solutions to fight this rising tide of financial crime. A new partnership between NICE Actimize and Infosys allows the latter company to offer NICE Actimize’s end-to-end financial crime prevention software to its customer base, where it will be marketed as Actimize Digital Suite. The new solution is designed to help businesses both prevent digital fraud and improve back-end efficiencies.

For more on these and other financial crime news items, download this month’s Playbook.

Building Consumer Trust With Open Banking Security

Building Consumer Trust With Open Banking Security

More than 10,000 FIs around the world are exploring the use of open banking, but this widespread implementation is facing a severe lack of customer trust. Approximately 49 percent of consumers fear that their banks will not keep their personal data safe from fraudsters and other bad actors.

In this month’s Feature Story, PYMNTS talked to John Elliott, head of open banking at banking and wealth management group Investec, about how banks can improve this lack of trust by securing the portals in which customers enter their private data.

Deep Dive: The Cybersecurity Threats Facing Open Banking

Open banking initiatives are gaining steam around the world, allowing banks, FinTechs and developers to collaborate on new technologies by freely accessing each other’s data. The APIs that fuel open banking can often be vulnerable to cybercrime, however, with fraudsters deploying credential abuse, digital signature impersonation and a diverse host of other techniques against them.

This month’s Deep Dive explores the financial crime threats that open banking systems face in their deployment, and how MFA and ML systems are being leveraged to protect them.

About the Tracker

The monthly Preventing Financial Crimes Playbook, a NICE Actimize collaboration, offers coverage of the most recent news and trends in the financial crime prevention space.