The fraud prevention race is the same as it has always been, with merchants and security companies sprinting to stay ahead of cybercriminals to keep data safe and secure. Participants in this race, both legitimate and illegitimate, have more room to play, however, as upgraded technologies and diverse customer behavior lead to new channels of payment and commerce.

Although fraud losses from banks, retailers and online platforms have continued into 2020, so has security innovation. Companies are searching for fraud prevention tools and software that can help them protect the different channels they must support to stay successful in today’s global economy. That means protecting both mobile and online purchases as well as finding ways to better identify legitimate customers as fraud becomes more sophisticated.

In the latest Merchant Fraud Decisioning Playbook, PYMNTS takes a close look at the  way fraudsters are changing their approaches and how businesses, payment providers and security players are responding. The Playbook also analyzes how artificial intelligence and automated technologies can give merchants an edge over fraudsters.

way fraudsters are changing their approaches and how businesses, payment providers and security players are responding. The Playbook also analyzes how artificial intelligence and automated technologies can give merchants an edge over fraudsters.

The Latest Fraud Decisioning Developments

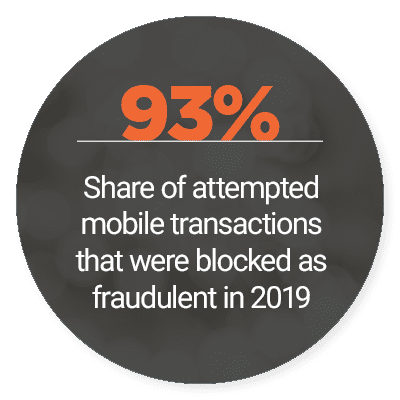

While fraudsters are fond of experimenting with innovative scams, they do have a few favorite tricks. One recent report found 93 percent of all mobile transaction attempts were fraudulent in 2019, for example, as consumers’ migration to online and mobile payments continue. The report looked at data from 31 mobile payment operators across 20 countries and found that fraudsters attempted to make 1.6 billion illegitimate transactions over one year on their platforms. This would have led to $2.1 billion in missing funds had the attempts gone unflagged.

Phishing is another favored tactic for cybercriminals, who continued to make use of this tried-and-true method in 2019 with the illegal use of some of the most popular eCommerce logos to draw in unsuspecting consumers. The Better Business Bureau (BBB) of Kentucky is warning residents against such an online scheme, for example, where fraudsters are using the logo of eCommerce company Amazon to attempt to steal funds. The BBB advises consumers not to click on links in suspicious or surprising emails.

Phishing is another favored tactic for cybercriminals, who continued to make use of this tried-and-true method in 2019 with the illegal use of some of the most popular eCommerce logos to draw in unsuspecting consumers. The Better Business Bureau (BBB) of Kentucky is warning residents against such an online scheme, for example, where fraudsters are using the logo of eCommerce company Amazon to attempt to steal funds. The BBB advises consumers not to click on links in suspicious or surprising emails.

The movement of customers to different platforms and payment types also means that security software and protection measures are increasing in complexity. Australia reported a 5 percent drop in online fraud from 2018 to 2019, for example, with losses decreasing from the $479 million reported for 2017 to 2018 to $455 million. The decrease comes as more Australians are downloading payment apps such as Apple Pay, which come attached with upgraded security standards of their own.

For more on this and other stories, visit the Playbook’s News And Trends.

Greyhound Puts Omnichannel Security Behind The Wheel

Outdated fraud protection measures are as damaging to today’s businesses as outdated customer service standards. Merchants need online platforms that can help their customers quickly fulfill their needs while making sure that they do not fall victim to bad actors working to steal their data or financial information. That is why bus line company Greyhound has upgraded its cybersecurity features and software to keep fraudsters at bay, says Todd Koch, vice president of strategy, marketing and customer engagement for the company. To learn more about Greyhound’s fraud protection strategy, visit the Playbook’s Feature Story.

Outdated fraud protection measures are as damaging to today’s businesses as outdated customer service standards. Merchants need online platforms that can help their customers quickly fulfill their needs while making sure that they do not fall victim to bad actors working to steal their data or financial information. That is why bus line company Greyhound has upgraded its cybersecurity features and software to keep fraudsters at bay, says Todd Koch, vice president of strategy, marketing and customer engagement for the company. To learn more about Greyhound’s fraud protection strategy, visit the Playbook’s Feature Story.

Orchestrating Complex Authentication And Fraud Decisioning

Fraudsters are attacking merchants and sensitive data from multiple points, relying on the expanding nature of online commerce to shield them. Retailers need to operate multiple channels to appease disparate generations of consumers, with differing payment preferences based on their ages or geographic locations, and bad actors are hitting them in every single one of these channels. One way to authenticate consumers and block cybercriminals is thus no longer enough for businesses to protect their users, as fraudsters begin to create attack strategies that can carefully bypass more simplistic verification measures. Creating complex, varied authentication measures is critically important for businesses to keep customer data secure. For more on why robust authentication measures are necessary in today’s fraud environment, visit the Playbook’s Deep Dive.

About the Playbook

The Merchant Fraud Decisioning Playbook, a PYMNTS and Simility collaboration, is a monthly report highlighting how eCommerce merchants, financial institutions and other businesses are embracing fraud decisioning solutions to reduce chargebacks and account takeovers, enabling secure and seamless experiences for legitimate users.