eCommerce has been on the rise for the better part of 30 years, but it got a huge boost from the pandemic as safety measures severely curbed brick-and-mortar retail traffic and forced consumers to shop online.

The year 2020 saw $3.9 trillion spent on eCommerce marketplaces around the globe — up from $1.3 trillion in 2014 — and this number is expected to swell to $4.5 trillion by the end of this year. Studies estimate that there are currently as many as 24 million eCommerce sites in operation globally, but they are not created equal. Less than a million of these eTailers sell more than $1,000 of merchandise a year, with the market dominated by industry giants like Amazon, Alibaba and eBay.

One problem that does not discriminate on the basis of size is eCommerce fraud, with bad actors targeting online platforms and their users with abandon. Each online merchant saw an average of 344 fraud attempts per month in 2020, an increase of about 24 percent since 2019. Merchants’ fraud prevention techniques are also growing less effective over time as fraudsters deploy new strategies, with only a little over 34 percent of fraud attacks prevented as opposed to approximately 56 percent in 2019.

Merchants need to be cognizant of the digital fraud threat they face if they have any hope of preventing it. The following Deep Dive explores the various methods fraudsters use to target eCommerce marketplaces and the challenges these platforms face in implementing effective fraud prevention measures.

Fraud Methods And Effects

Bad actors leverage a countless number of fraud methods against eCommerce merchants, but the one that keeps fraud prevention professionals up at night the most is identity theft, cited as causing concern by 71 percent of respondents in a survey. This method includes both exploiting eCommerce websites to steal customers’ identities and leveraging the stolen identities to make illicit purchases, often by implanting fake checkout pages that can harvest the email addresses and payment information that customers unwittingly enter.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Whichever method a fraudster decides to leverage could have an outsized effect on the merchant in question beyond the actual dollar value stolen. A survey found that for every dollar lost to fraud, companies lose an actual total of $3.36, an increase from $3.13 in 2019 and $2.40 in 2016. A number of reasons account for this ripple effect, but one of the most significant is the impact of a business’s security on customer perceptions. More than half of consumers say that if they were victimized by identity theft on a website, they would cease using the site altogether.

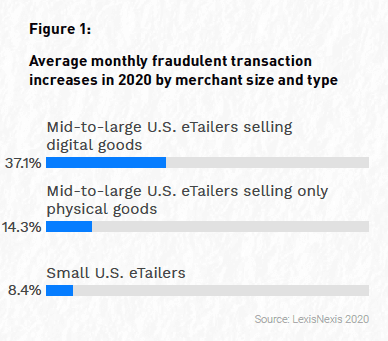

The survey also found that medium-sized and large eCommerce merchants are the most affected by fraud, outpacing eTailers that make less than $10 million in annual revenue. Fraud has been going up across eCommerce verticals, but not equally. The average volume of fraud attacks against large merchants increased by about 37 percent over the past year, and large merchants that sold only physical goods rather than digital ones saw their fraud rates increase by only about 14 percent.

This increase likely correlates with the pandemic-related rise in traffic volume such merchants experienced as brick-and-mortar retail locations closed and consumers were forced to shop online for their goods. These retailers will need to deploy effective fraud prevention measures to keep bad actors at bay, but many initiatives run up against challenges of their own.

Obstacles In Fraud Prevention

Preventing identity theft in the eCommerce space largely relies on proper identity authentication, but this is a tall order. Half of all eCommerce companies in the U.S. have reported difficulties authenticating their customers on browsers, and 58 percent say they struggle to verify mobile users, even when using advanced systems that incorporate artificial intelligence (AI) or machine learning (ML). Ninety-three percent of businesses say AI will have a positive or cost-reducing impact on their fraud prevention efforts, however, even if these systems will not fix the threat of identity fraud entirely.

Another persistent problem in identity fraud prevention is false positives, or incorrect declines of legitimate transactions due to suspicions of fraud. False positives can be devastating to customer loyalty, with 40 percent of customers saying they would not give repeat business to a company that declined their payment card on a legitimate purchase. Overzealous fraud detection programs deployed in an effort to foster customer loyalty could ironically result in the opposite effect, which may leave many eCommerce merchants feeling that they face a Catch-22.

There is no silver bullet to prevent fraud in the eCommerce space, and existing measures can result in either underbaked identity verification or overenthusiastic transaction flagging. The rewards for merchants that can successfully walk this fine line, however, are likely to be long-lasting in terms of customer loyalty. Advanced systems that use tools such as AI and other technologies for authentication stand the greatest chance of helping merchants find the right balance.