In Reframing Anti-Fraud Strategy: Developing a Proactive Approach to Fraud Risk Management, a PYMNTS and TreviPay collaboration, we examine how businesses can alter the way they manage risk to grow their businesses successfully.

In Reframing Anti-Fraud Strategy: Developing a Proactive Approach to Fraud Risk Management, a PYMNTS and TreviPay collaboration, we examine how businesses can alter the way they manage risk to grow their businesses successfully.

Lacking a comprehensive anti-fraud strategy model can limit business growth. Businesses must have a clear idea of what a successful anti-fraud strategy looks like and why modern digital solutions are essential for that success. A strategy model represents an organization’s approach to fraud monitoring and risk management. Manual, reactive strategy models tend to cost businesses more over time. Risk management approaches with the speed of innovation — with strategies and risk management policies adjusted according to fraud threats’ evolution — are key to developing efficient anti-fraud practices.

Businesses often do not think seriously about modernizing their protections against new attacks until after a fraud event occurs, but this is a risky and ultimately costly way to do business.

Organizations that use manual solutions or wait until evidence of fraud emerges may naturally experience greater revenue loss due to human error or inefficient identity verification or vetting procedures. For example, 46% of organizations using manual anti-fraud solutions said fraud concerns made it difficult for customers to work with them, whereas just 26% of organizations using automated anti-fraud solutions proactively said the same.

For example, 46% of organizations using manual anti-fraud solutions said fraud concerns made it difficult for customers to work with them, whereas just 26% of organizations using automated anti-fraud solutions proactively said the same.

A proactive anti-fraud strategy starts with transparency across all transactions.

The ability to view transactions and track accounts payable/accounts receivable (AP/AR) flows is essential to successfully stopping fraud attacks before they cause revenue loss. A tightly integrated AP/AR management system and the ability to view all transactions, regardless of the device used to complete a payment, is also key to providing great user experiences and monitoring for fraud risk.

Business-to-business transactions take place on a range of devices and platforms, and anti-fraud strategies should easily adapt to new payments models. User experiences should be frictionless and secure, providing intuitive user experience features, such as pay-by-invoice at checkout, that address fraud and poor user experiences simultaneously.

Finding the right tech stack is key to blocking fraud at scale.

Finding the right tech stack is key to blocking fraud at scale.

Businesses may try to “roll their own” tech solution for fighting fraud, but both the expertise and research and development time needed to create a custom solution can drain resources and elicit inconsistent results. Some businesses are seeking third-party solutions to accelerate their digital transformation process.

Barriers to innovation strategy include overreliance on legacy tools, limited human and technological resources and professional knowledge gaps around modern anti-fraud tools and risks. Many businesses turn to third-party anti-fraud solutions to launch a modern strategy quickly.

Businesses that used proactive, automated solutions were the least likely to be impacted by fraud-related concerns. To learn more, download the report.

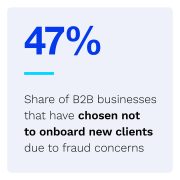

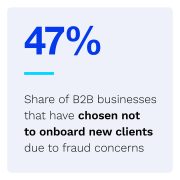

Today’s businesses are not only battling economic uncertainty — they are also fighting fraud with tools that many feel are inadequate. Recent PYMNTS research reveals that nearly half of businesses are turning away new clients because they doubt their current anti-fraud measures are sufficient, yet 71% of organizations still feel that the right digital solution can transform their businesses’ ability to fight fraud.

Today’s businesses are not only battling economic uncertainty — they are also fighting fraud with tools that many feel are inadequate. Recent PYMNTS research reveals that nearly half of businesses are turning away new clients because they doubt their current anti-fraud measures are sufficient, yet 71% of organizations still feel that the right digital solution can transform their businesses’ ability to fight fraud.