PYMNTS Intelligence: Leveraging Technology to Combat Identity Fraud

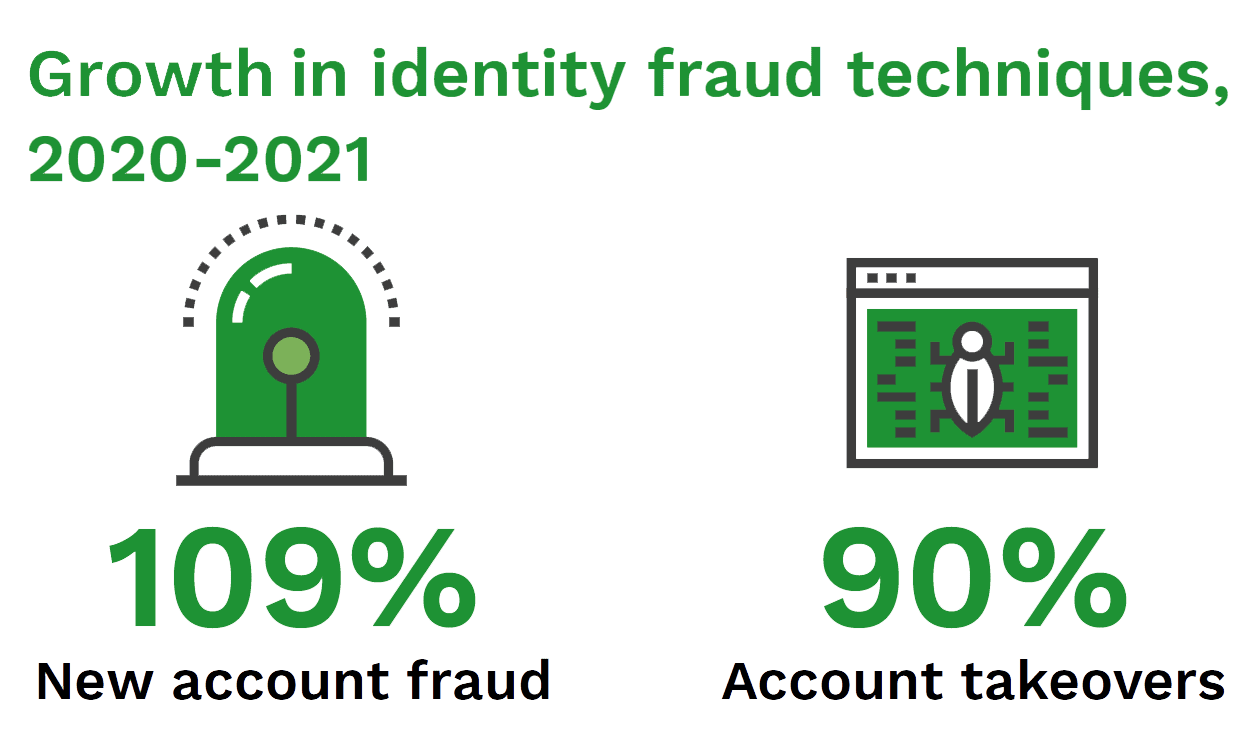

A recent study found that businesses lost $52 billion to identity fraud in 2021, a shocking 79% increase year over year. This fraud was split between several different types, with new account fraud up 109%, account takeovers growing 90% and credit card fraud seeing a 69% jump.

The growth in identity fraud loss is untenable for businesses, especially if it continues on its current trajectory. This month, PYMNTS explores the various types of identity fraud leveraged by bad actors and how businesses can protect themselves by implementing advanced AI systems.

The Many Faces of ID Fraud

A 2020 survey of financial institutions (FIs) found that, at 55%, stolen identities formed the basis for the top fraud method resulting from digital account opening, while synthetic identity fraud took second place, at 44%. Both methods consist of fraudsters assuming a false identity, but the specifics differ significantly: While the former involves stealing other people’s identities for fraudulent use, the latter consists of constructing new identities altogether. Victims of identity theft will generally notify their FIs of fraudulent applications or purchases made in their names, but organizations on the receiving end of synthetic identity fraud have no consumer victims to report these crimes. Instead, FIs are utterly reliant on their own security systems to catch synthetic identity fraud. This type of fraud costs organizations up to $20 billion a year, and traditional identity verification solutions miss up to 95% of these fraud instances.

Identity fraud is growing even more sophisticated as fraudsters leverage advanced techniques such as AI to fool banks’ and businesses’ automated verification systems. Bad actors are deploying deepfake voices and video to trick bank employees into changing account numbers and making transfers, for example, which can be extremely difficult to reverse once initiated. The growth of digital banking over the course of the pandemic has made these techniques even more effective, as fewer customers are verifying themselves in person at bank branches.

Pulling Out All the Stops to Prevent Identity Fraud

AI-based fraud prevention systems have proven to be some of the most effective at stopping identity fraud, as they can pinpoint minute inconsistencies in stolen or manufactured identities that would pass unnoticed by human analysts. PYMNTS research found that 75% of acquiring banks are currently leveraging AI to fight fraud, including identity fraud.

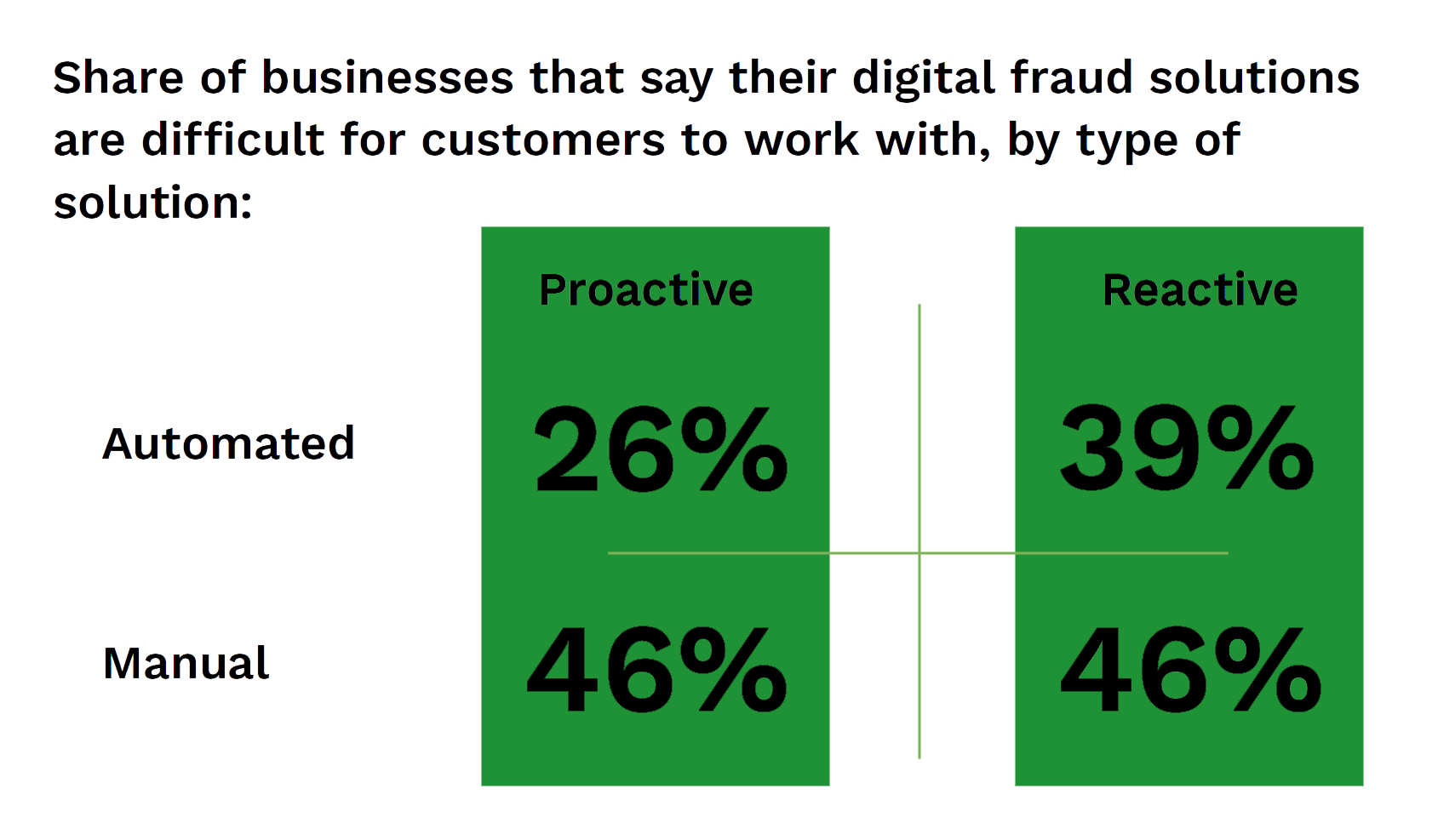

AI-enabled fraud prevention systems have the added advantage of reducing customer friction, especially when onboarding. Another PYMNTS study found that businesses that proactively used automated anti-fraud solutions fared better than those that do not use them when it comes to customer experience.