FIs Depend on AI/ML Partners to Fight Next-Gen Fraudsters

PYMNTS Intelligence recently found that more than 40% of financial institutions (FIs) see increasing fraud and financial crime. This advancing wave likely poses a significant threat to the financial services industry. Security is a top concern, and these institutions need cutting-edge tools to fight this rising tide of fraud and financial crime.

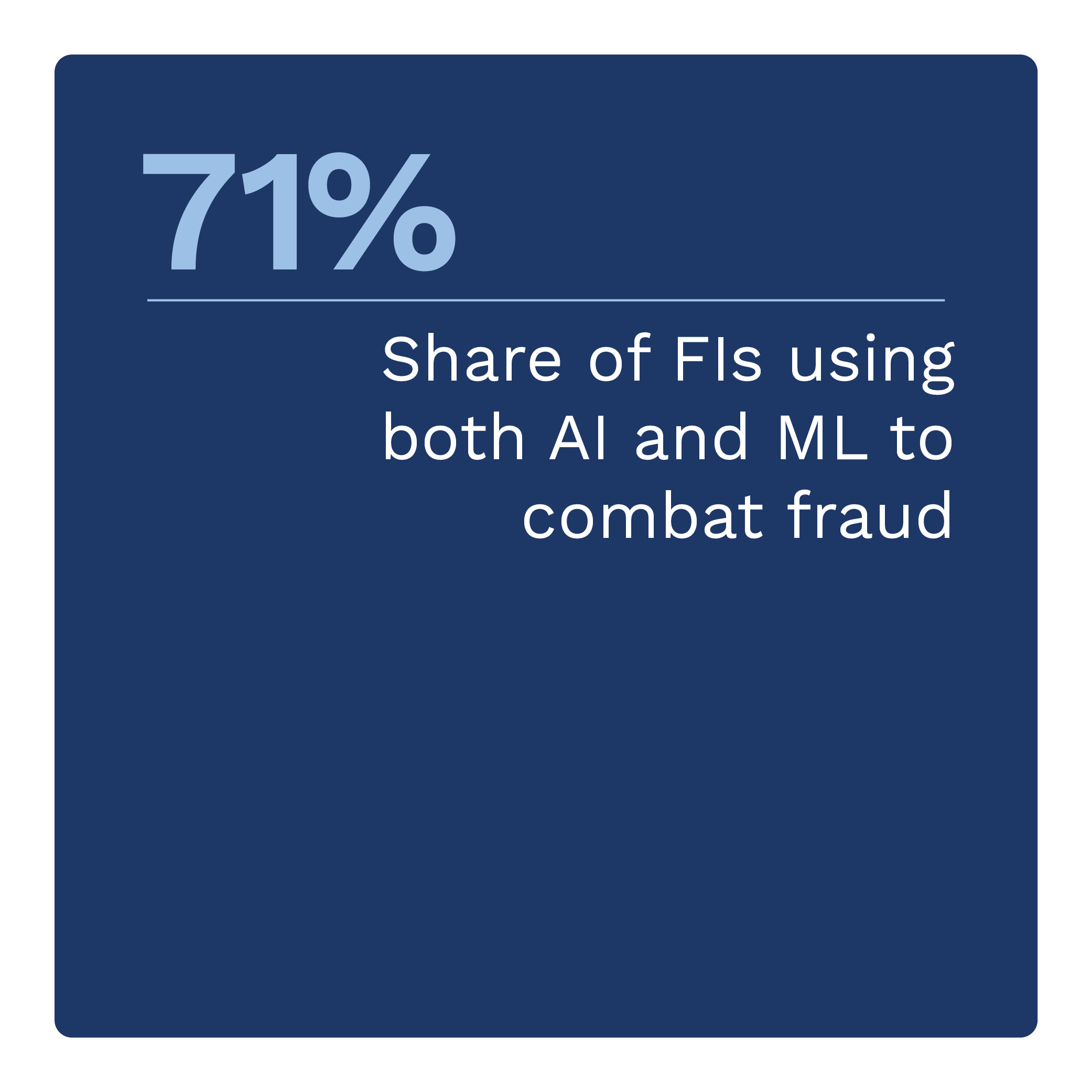

FIs typically use a combination of in-house and third-party technologies to address fraud and financial crime risks. Still, third-party providers are an essential piece of the puzzle, as most FIs plan to use them to combat fraud. The provider’s reputation in developing these technologies is key to nearly all decision-making.

These are just some of the findings detailed in “Financial Institutions Revamping Technologies to Fight Financial Crimes,” a PYMNTS Intelligence and Hawk AI collaboration. The brief explores the characteristics, sentiments and behaviors of FIs. We surveyed 10 FIs in North America between Oct. 10 and Oct. 13 to examine their choices and behavior pertaining to technological solutions to improve their fraud and financial crime prevention operations.

Other findings from the report include:

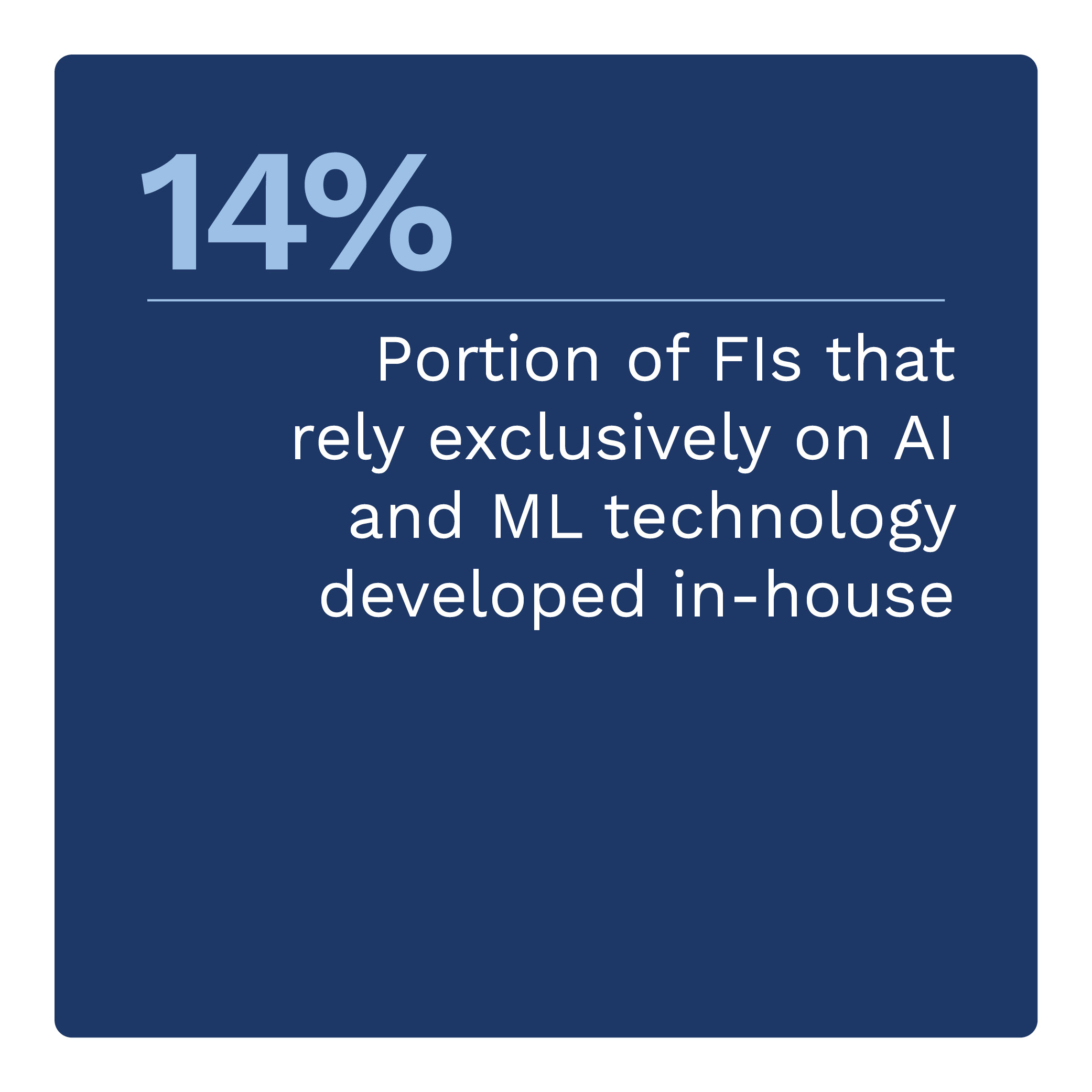

Just 14% of FIs rely exclusively on in-house AI and ML fraud-fighting tools.

Much of the financial industry still uses in-house teams to develop fraud prevention tools. The newest wave of technologies has pushed most institutions to partner with external providers for at least some of their AI and ML tools. On average, they develop 48% of the technologies and 57% of the processes they use to combat fraud in-house.

FIs seek to leverage third-party providers to revamp their financial crime technology.

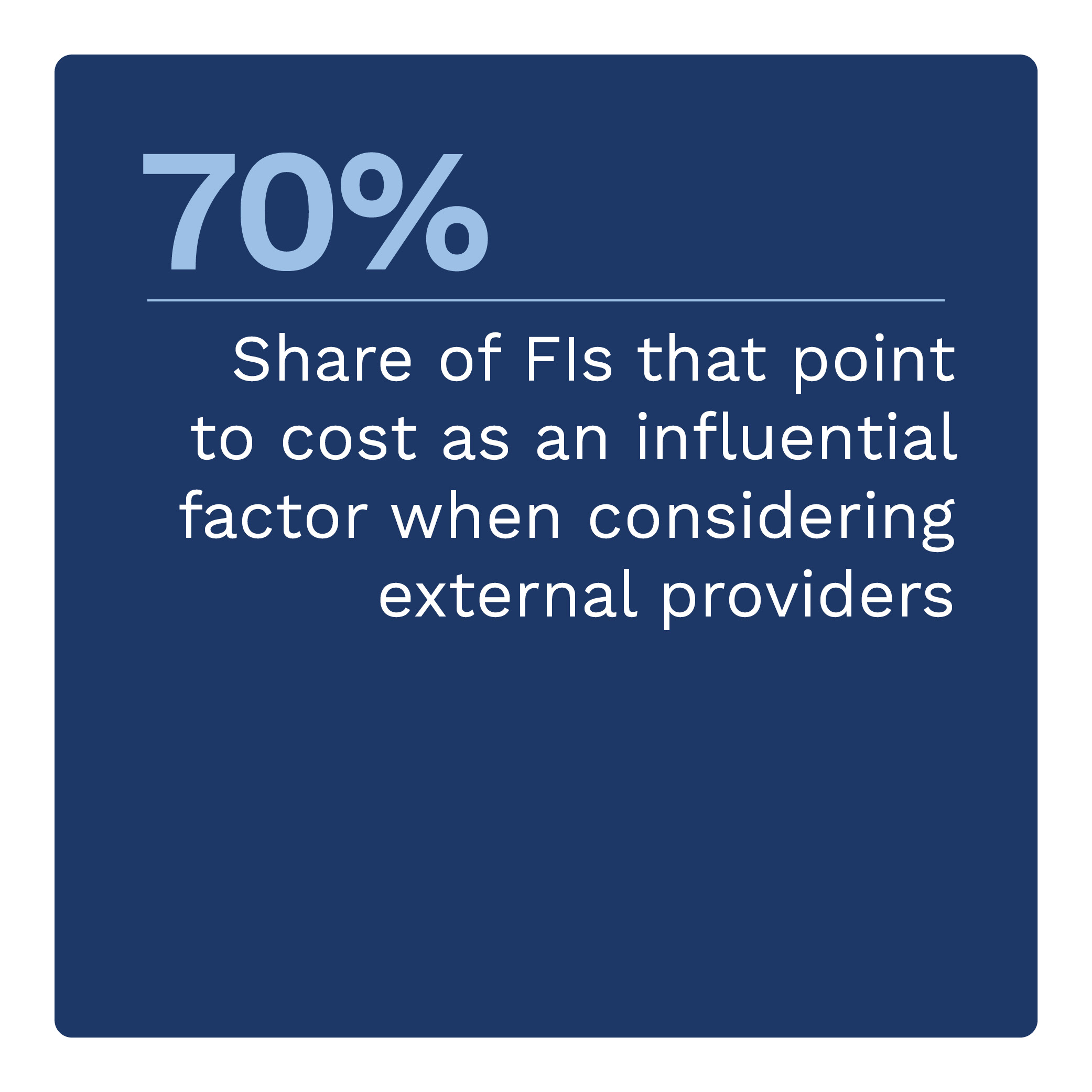

Eighty percent rely on a mix of third-party providers and their own technology. The rest say that instead of developing their own technologies, they will integrate third-party technologies into their existing systems. Ultimately, 70% of FIs will rely on third-party solutions to use ML, AI and fraud scores provided by payment processors.

Reputation reigns as a top reason for selecting a provider.

The reputation of a prospective provider and the ease of integrating its solution are crucial in decision-making. Ninety percent of FIs mention these as top considerations when choosing a particular third-party provider. On the other hand, feedback from employees and customers’ needs are low on the list of influential factors.

Rising fraud and financial crime in the financial industry forces these institutions to revamp their technological tools to stay ahead of fraudsters. Download the report to learn how next-generation AI and ML technologies are used in fraud prevention.