The rise of digital banking and faster digital payment methods has accelerated fraud and financial crime, prompting banks and financial institutions (FIs) to enhance their systems and processes.

In “Increasing Fraud Heightens Need for Newer, Better Technologies,” PYMNTS Intelligence examines the state of fraud and financial crime FIs experienced in 2023 compared to 2022, including the rising costs of fraud and what actions they have taken to mitigate fraud.

As detailed in the study done jointly by PYMNTS Intelligence and Hawk AI, 43% of FIs experienced increased fraud compared to the previous year. FIs with assets of $5 billion or more saw a staggering 65% increase in the average cost of fraud.

The leading source of fraud is the misuse of account information, accounting for nearly 40% of fraudulent transactions. Notably, digital wallets such as Samsung Pay, Google Pay and Apple Pay have witnessed significant increases in fraud rates since 2022. Additionally, same-day automated clearing house (ACH) and regular ACH payments have become targets for fraudsters.

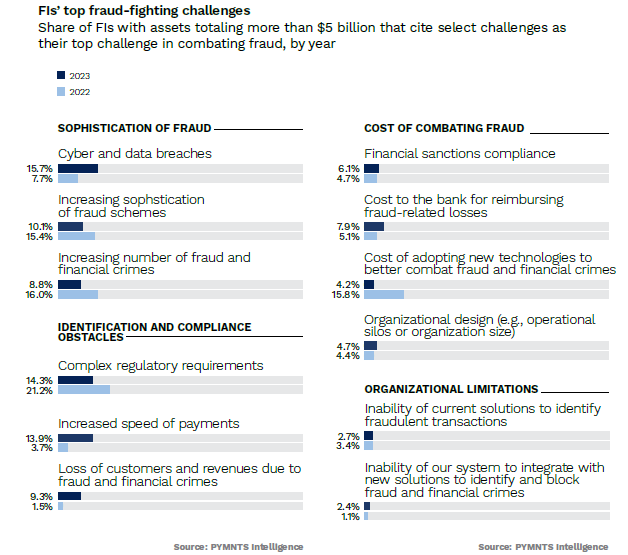

The report also highlights the significant hurdles FIs are facing in their fight against fraud. These challenges primarily include data breaches, the accelerated pace of payment transactions and complex regulatory demands.

Notably, the proportion of FIs with assets exceeding $5 billion highlighting cyber attacks and data breaches has almost doubled in 2023 when compared to 2022, from nearly 8% to 16%. Furthermore, this year, 14% of them pinpoint the heightened speed of payments as their primary challenge, a stark contrast to the 3.7% who expressed this in 2022.

On the upside, the share of FIs citing complex regulatory requirements as their top challenge has slightly reduced from the 21% that expressed the same concern in 2022 to 14% in 2023. Similarly, the 15% of FIs that cited increasing sophistication of fraud schemes in 2022 has reduced to 10% in 2023.

That said, these challenges need to be addressed head-on and FIs are increasingly incorporating artificial intelligence (AI) and machine learning (ML) technologies into their fraud prevention systems, with larger FIs leading the way.

The report further suggests that FIs should reduce outsourcing and develop in-house systems to improve fraud detection and prevention and increase their chances of minimizing financial losses and keeping fraudsters at bay.