Advancements in digital banking and the proliferation of faster digital payment methods have accelerated the rise in sophisticated fraud and financial crime, with financial institutions (FIs) battling with a surge in losses.

According to a recent PYMNTS Intelligence report, which draws from a survey of 200 executives at the largest banks in the U.S., 43% of FIs have experienced increased fraud, with the average cost of fraud for FIs with assets of $5 billion or more increasing by 65%.

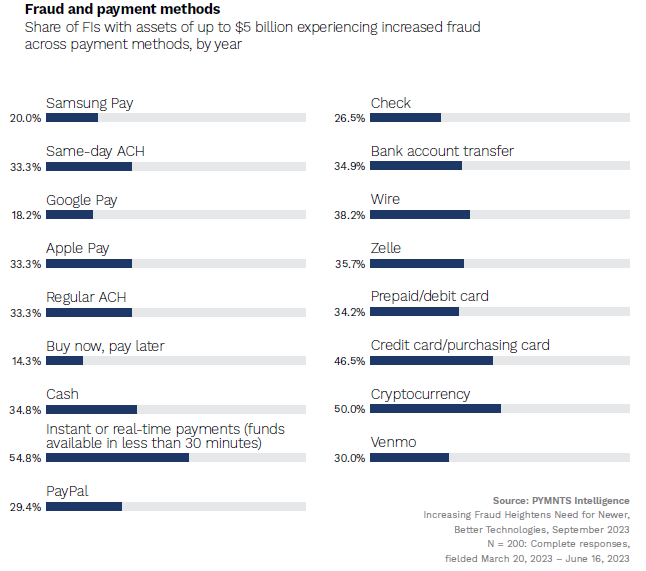

Misuse of account information, which accounts for 38% of fraudulent transactions, remains the leading source of fraud, per the study. And when it comes to digital wallets, Samsung Pay, Google Pay and Apple Pay have seen significant increases in fraud rates since 2022, as have same-day automated clearing house (ACH) and regular ACH payments.

Crypto fraud, in particular, remains a bane for banks, with the study revealing that half of FIs with assets of up to $5 billion are experiencing an increase in the number of frauds and scams associated with cryptocurrencies.

In the U.K., where crypto scams surged 45% between July 2021 to June 2022, the situation is so dire now that it has prompted FIs to take proactive measures to protect their customers. On Tuesday (Sept. 26), Chase UK told its customers that they will be blocked from making cryptocurrency transactions starting next month, in a bid to safeguard them from potential risks.

“To help keep your money safe from frauds and scams, we’re changing the types of payments you can make from Chase,” the bank said in its email to customers, a copy of which was shared with PYMNTS. “From 16 October 2023, if we think you’re making a payment related to crypto assets, we’ll decline it.”

This move by Chase UK follows similar actions taken by other U.K. lenders, including HSBC and Nationwide Building Society, earlier this year, further underscoring why FIs and banks must act fast to stem the growing risk.

As criminals become more astute and sophisticated in their attacks, banks and payment firms have had to upgrade their systems and processes, while ramping up investments and deployments of machine learning (ML) and artificial intelligence (AI) technologies to combat fraud in the next year.

And what capabilities exactly do these newer technologies offer? According to the PYMNTS study, AI and ML technologies play a critical role in helping FIs identify anomalies in user profiles and assess the type of fraud at hand, giving them a comprehensive and consistent overview of fraudulent activities.

Additionally, these advanced technologies can bolster user authentication methods and enhance the early detection of unauthorized users, further boosting security measures against scammers. By leveraging ML and AI, FIs can also reduce false positive rates and improve their overall fraud prevention efforts.

As noted in the PYMNTS Intelligence report, FIs that have embraced these newer, more advanced technologies already recognize their effectiveness in detecting and preventing fraudulent transactions and report lower rates of fraud and fraud losses compared to those that do not.

FIs are also departing from the traditional approach of outsourcing their fraud detection and protection efforts, with outsourcing currently the least popular option to improve existing solutions, per our study. Instead, FIs are moving to develop their own in-house systems to combat fraud, with this share of those opting for this path increasing in the past year.

“In 2023, 46% of FIs with assets totaling more than $5 billion cite developing new in-house systems to improve existing fraud solutions, compared to 11% in 2022. At 53%, FIs with assets of $100 billion or more are the most likely to cite plans to develop new in-house systems to improve existing fraud solutions,” the report said.

The rising threat of fraud in the digital banking era shows no signs of slowing down and calls for the adoption of advanced, sophisticated technologies such as ML and AI by banks of all sizes if they are to be well equipped to win the fight.