As financial fraud evolves in the digital age, the picture that emerges is a complex one.

As financial fraud evolves in the digital age, the picture that emerges is a complex one.

On one hand, fraud in 2022 was at its lowest rate since 2014, affecting 65% of organizations. Signs also indicated that companies were duly implementing measures to combat it, with 45% of all United States financial service firms having fully integrated digital fraud prevention systems, up from 28% in 2020.

Nevertheless, fraud continues to spiral upward in new ways. FinTech fraud was up 13% in 2022. Threats such as identity fraud are taking a severe toll on the sector, with nearly half of all FinTechs impacted by the use of fake documents. These findings suggest that while the financial industry is responding to the challenge, vigilance and adaptability will be key to succeeding as fraudsters continue to seek — and find — loopholes in defenses at every turn.

The Double-Edged Sword of Technology

Although technology can offer powerful solutions, it is also an undeniable culprit in the growing battle against fraud. Scams using stolen credentials were once easier to detect, but synthetic identities developed with these credentials have changed the game in fraudsters’ favor, according to an April report. Fake identities created with real credentials can challenge or fool many fraud-fighting systems’ defenses.

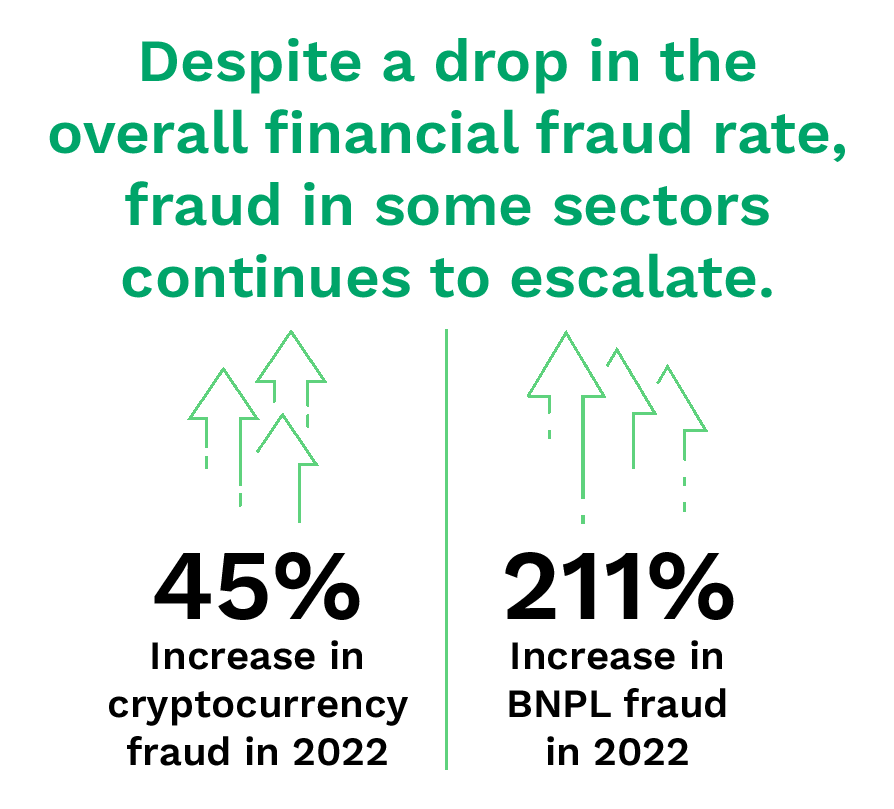

In addition to the increase in FinTech fraud, digital goods and services fraud was up by 27% and cryptocurrency exchange fraud by 45%. Buy now, pay later (BNPL) fraud topped the list with an alarming 211% jump. Moreover, as technology makes it easier to commit fraud, elite criminal organizations are cropping up to offer “as-a-service” fraud products on the dark web.

Fraudsters — and those in training — can now purchase and leverage automated scripts to run their scams, allowing perpetrators to overwhelm fraud management teams that lack the proper tools to combat these attacks. Researchers also noted that programs such as ChatGPT will make fraud more difficult to detect by allowing bad actors to eliminate the grammatical and similar mistakes that are the historic hallmarks of fake sites and phishing emails.

Changing Tactics Call for Adaptable Solutions

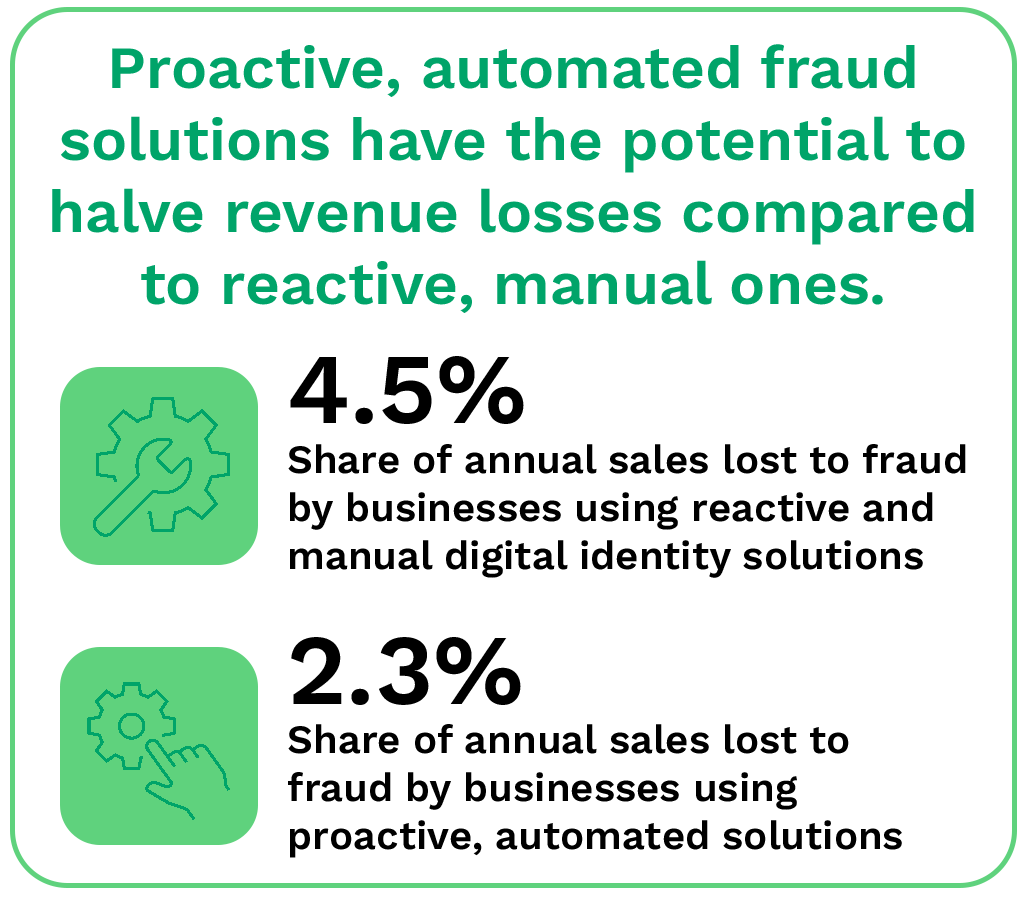

Artificial intelligence (AI) and machine learning (ML) have a vital role to play in promoting profitability through fraud protection for the FinTech industry. PYMNTS’ research has found that companies relying on legacy reactive and manual digital identity verification solutions lose above-average shares of annual sales to fraud, at 4.5%. However, firms using proactive and automated solutions, such as those powered by AI and ML, reduce their share of lost sales to 2.3%.

In addition, AI solutions using behavioral analytics are both highly accurate and undetectable to users, making for smooth experiences to reduce onboarding time and friction as well as enhance customer loyalty. These factors mean that AI-powered fraud solutions could be a revenue generator for FinTechs — both as end users and as developers offering such solutions to their customers.