Financial institutions (FIs) are increasingly recognizing the importance of fraud-fighting technologies as they confront more sophisticated fraud and financial crimes. In fact, the surge in digital banking and faster digital payment methods has intensified this phenomenon, prompting banks to strengthen their systems and processes to tackle fraudulent transactions and the resulting financial losses.

According to findings detailed in “Increasing Fraud Heightens Need for Newer, Better Technologies,” a report by PYMNTS Intelligence, 43% of FIs reported an increase in fraud in 2023 compared to the previous year. Moreover, FIs with assets of $5 billion or more saw the average cost of fraud rise by 65% between 2022 and 2023, from $2.3 million to $3.8 million.

Overall, over 40% of banks in the U.S. observed an increase in fraud during the same period, resulting in a surge in major fraudulent transactions and financial losses.

The research study, produced in collaboration with Hawk AI, also revealed that misuse of account information remains the leading source of fraud, accounting for 38% of fraudulent transactions. Notably, digital wallets such as Samsung Pay, Google Pay and Apple Pay have seen substantial increases in fraud rates since 2022. Additionally, same-day automated clearing house (ACH) and regular ACH payments have experienced notable spikes in fraudulent activities.

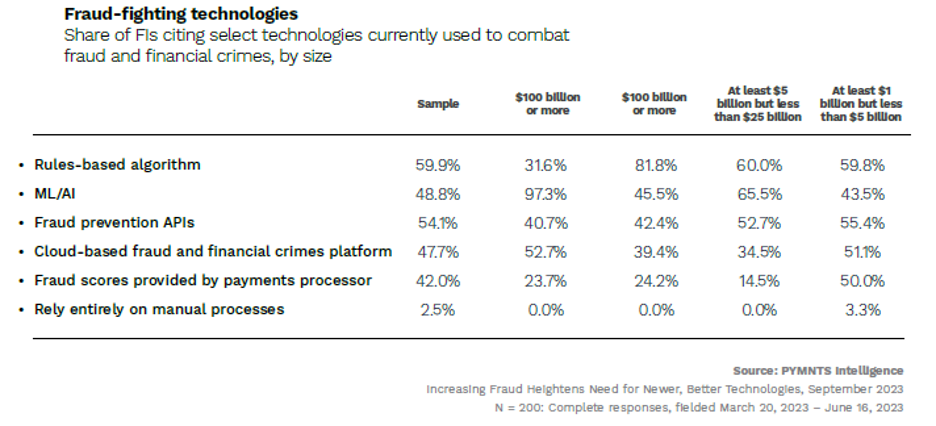

To combat the growing threat of fraud, FIs are taking proactive measures to enhance their fraud-fighting efforts. These include ramping up their investments in machine learning (ML) and artificial intelligence (AI) technologies, recognized as cutting-edge tools in curbing fraudulent transactions. Currently, 66% of FIs with assets of $5 billion or more are utilizing ML and AI technologies to combat fraud, a significant increase from 34% in 2022.

The data also reveals a direct correlation between FI asset size and the integration of AI/ML, particularly evident in larger banks. For instance, while only 44% of FIs within the $1 billion to $5 billion asset range rely on these advanced technologies to combat fraud, the share rises to 97% among institutions with over $100 billion in assets.

Yet still, FIs still face several hurdles in the ongoing fight against fraud. These include data breaches, the accelerated speed of payments, complex regulatory requirements, and the cost associated with deploying new technologies. These challenges underscore the urgent need for improved user authentication protocols, advanced technology solutions, and increased investments in ML and AI technologies moving forward.

In sum, as the threat of fraud and financial crimes continues to escalate, adopting advanced fraud-fighting technologies has become essential for FIs striving to outpace fraudsters. By harnessing the potential of ML and AI technologies and enhancing customer communication, alongside developing in-house solutions, FIs can significantly bolster their capability to detect and prevent fraudulent transactions.

This proactive approach not only safeguards these institutions and their customers from financial losses but also ensures a more robust defense against evolving fraudulent tactics.