Convenience, cost, speed and loyalty are the top mobile app payment priorities of all consumers when paying for gas. But one segment of consumers is more likely than the rest to use mobile apps to pay for gas and is, therefore, well-positioned to wield considerable purchasing influence over the market: High Income Millennials.

Who are High Income Millennials? These consumers were born between 1978 and 1995. They earn incomes that fall within the range of $75,000 to $150,000 per year and are more likely to have a college degree.

In our analysis, we zeroed in on how High Income Millennials’ gas-buying habits compared to the broader sample. This group accounted for 7 percent of the larger sample size.

At 33, High Income Millennials were considerably younger than the average age of the rest of our sample (47). They’re also more likely to earn higher salaries compared to the sample. The average annual income for the sample of consumers was $59,800. On the other hand, High Income Millennials boasted a higher average annual income of $103,600.

In terms of education, High Income Millennials were more than twice as likely to hold college degrees. While roughly one-third (31 percent) of the sample held a college degree, the rate was 65 percent among High Income Millennials.

Advertisement: Scroll to Continue

While High Income Millennials accounted for just 7 percent of the entire sample, their purchasing power warrants special attention. Since High Income Millennials are younger than average, their opinions and spending habits regarding gas purchasing are likely to play a strong role in shaping how gas pump retail locations appeal to consumers in the coming years.

The Mobile App Features That Matter To High Income Millennials

One factor that points to the influence High Income Millennials could have on how consumers buy gas is the frequency at which this group of consumers buy gas.

PYMNTS found High Income Millennials are more likely to visit the gas pump at a higher rate than average consumers. Sixty-five percent of High Income Millennials made at least one gas purchase per week, compared to 58 percent of all consumers. Meanwhile, 11 percent of High Income Millennials bought gas at least once per day, compared to 7 percent of the sample group.

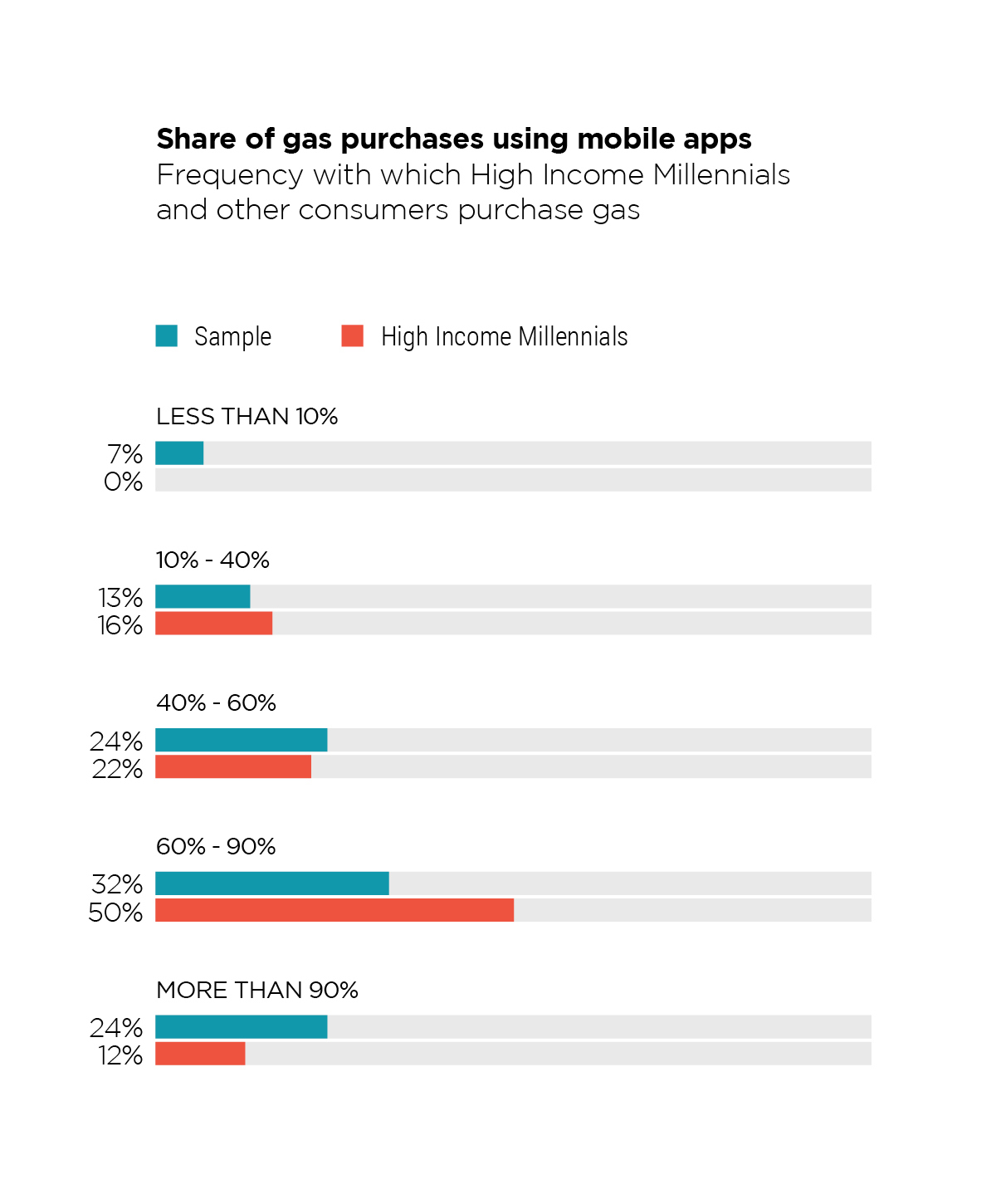

Mobile apps also play a strong role in how High Income Millennials buy their gas. Half of the surveyed High Income Millennials said roughly 75 percent of their gas purchases were made using mobile apps in the past three months. Just under one-third (32 percent) of the sample group said the same thing.

It’s worth noting that a higher share of sample consumers (24 percent) said 90 percent of their gas purchases were made using mobile apps, compared to just 12 percent of High Income Millennials. This finding may indicate that High Income Millennials are not the only consumers who are inclined to use mobile apps for their gas purchases.

When it comes to paying for gas, High Income Millennials are more likely to use a mobile app. Only one-third said they did not use a mobile app to make gas-related purchases, compared to 52 percent of the sample.

However, buying gas ranks on the lower end of High Income Millennials’ priorities in terms of the reasons for using apps. Only 7 percent of High Income Millennials use an app to pay for gas, compared to 4 percent of the sample. This might be a low rate, but High Income Millennials’ usage of mobile apps to pay for gas is close to twice the rate of the sample size. This indicates that, as High Income Millennials’ purchasing influence further expands, demand for mobile app functionality that enables payments at the gas pump would likely increase.

So, what are High Income Millennials’ reasons for using a mobile app for their gas purchase? The highest share of High Income Millennials said they used mobile apps to find the best gas prices. Locating a gas station, getting directions and looking for loyalty programs also ranked among High Income Millennials’ top priorities.

So, what are High Income Millennials’ reasons for using a mobile app for their gas purchase? The highest share of High Income Millennials said they used mobile apps to find the best gas prices. Locating a gas station, getting directions and looking for loyalty programs also ranked among High Income Millennials’ top priorities.

When it comes to ranking the importance of mobile app features, High Income Millennials have a similar attitude that parallels with their reason for using a mobile app for gas purchases. Locating a gas station was considered a very or extremely important reason for using a mobile app among 43 percent of High Income Millennials. After locating a gas station, High Income Millennials want to be able to use mobile apps to get directions, access loyalty programs, find price discounts or look up a gas station’s hours.

How High Income Millennials Pay For Gas

When it comes to paying for gas, High Income Millennials prefer a wide range of options.

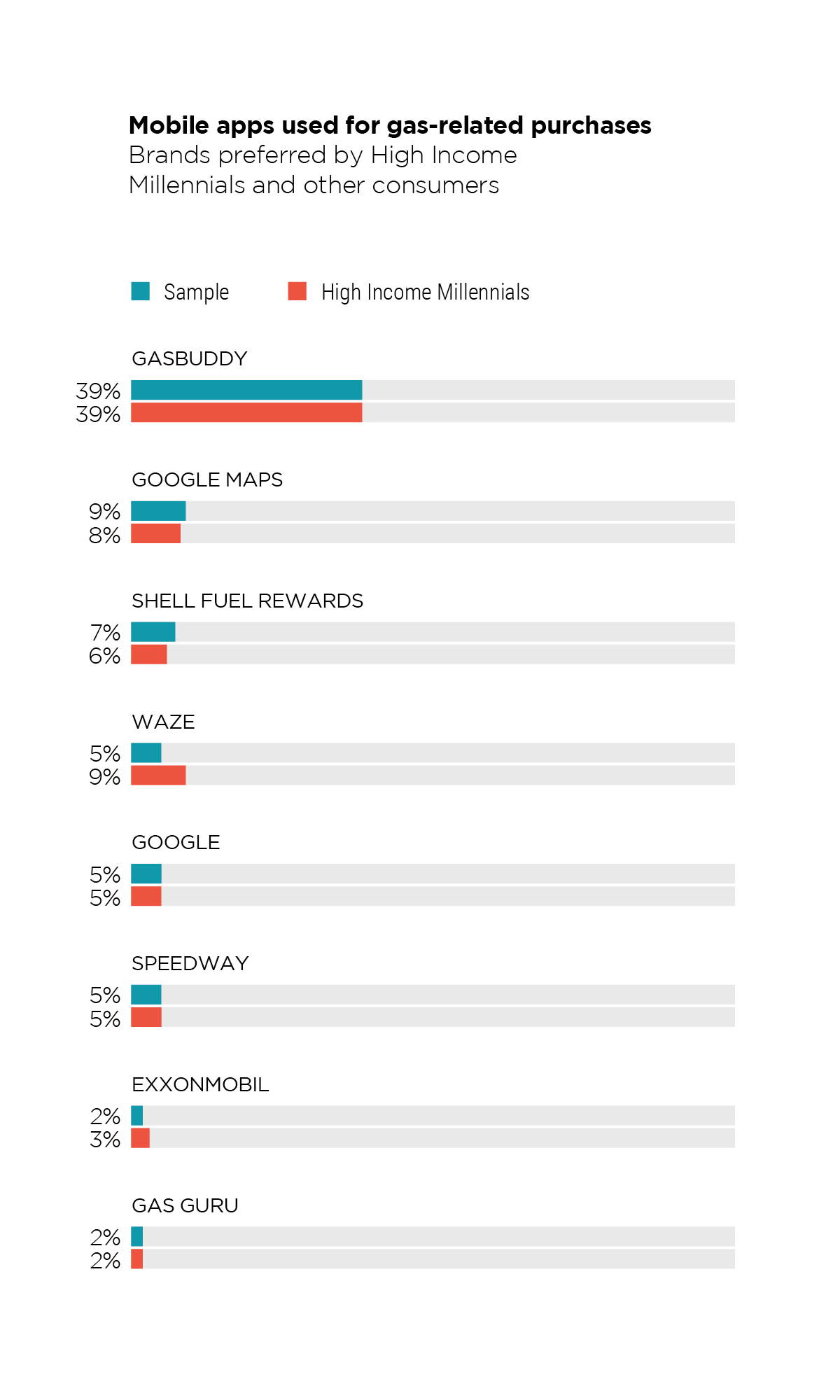

Among mobile apps, GasBuddy stands apart from the rest of the field for both High Income Millennials and the rest of the sample, with 39 percent of both sides choosing to pay for gas. Other apps — including Google Maps, Shell Fuel Rewards, Speedway, ExxonMobil and Gas Guru — saw lower overall usage among both High Income Millennials and other consumers.

Only one app saw a higher usage among High Income Millennials than the rest of the sample: Waze was the most commonly used gas-buying app for 9 percent of these consumers, compared to 5 percent for the rest of the sample.

Only one app saw a higher usage among High Income Millennials than the rest of the sample: Waze was the most commonly used gas-buying app for 9 percent of these consumers, compared to 5 percent for the rest of the sample.

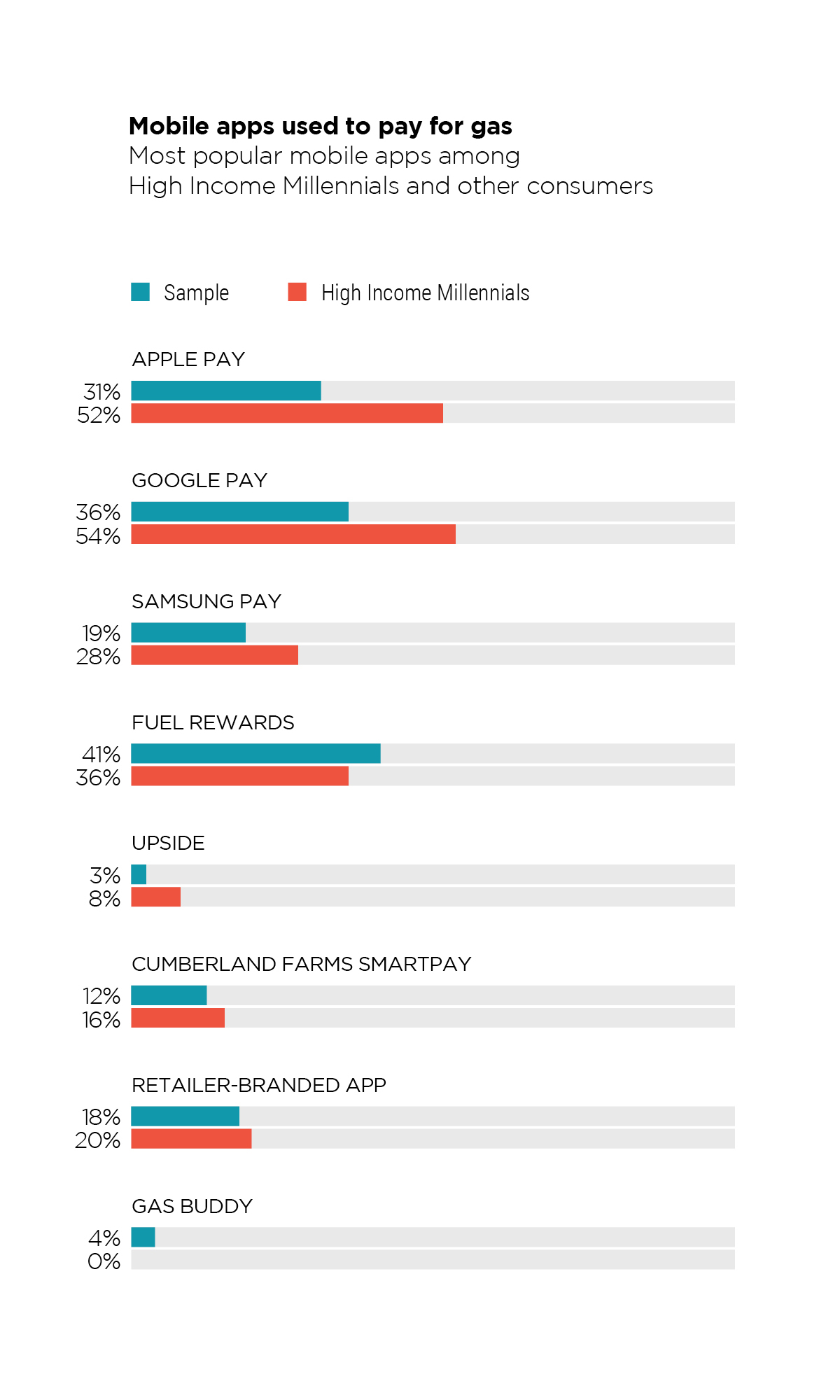

High Income Millennials are also more likely to use a mobile wallet to pay at the pump than the rest of the sample. Google Pay ranked highest for mobile wallets and was the top mobile app preference among this group, followed by Apple Pay on both counts.

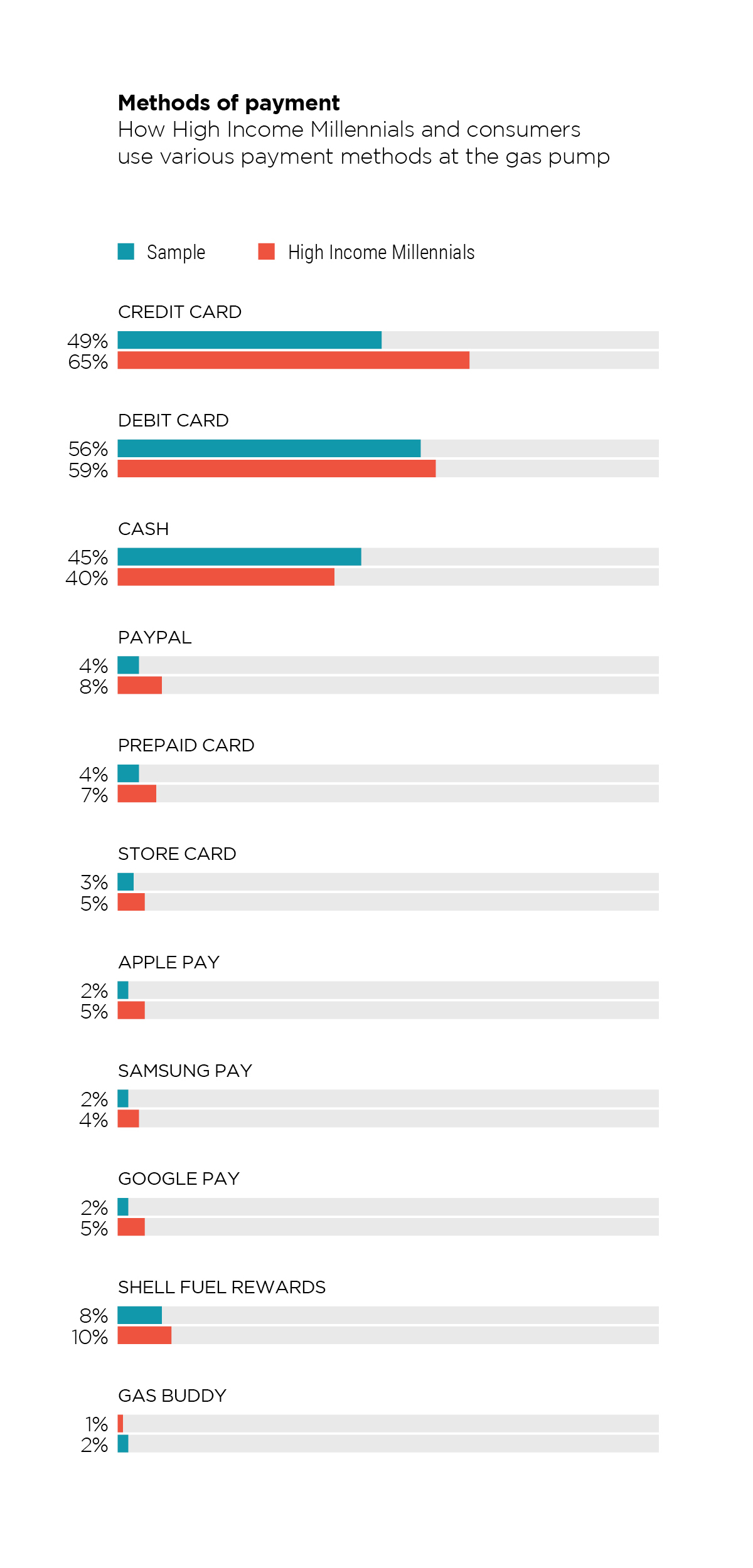

In addition to mobile payments, PYMNTS found High Income Millennials prefer traditional payment methods to pay for gas as well. Credit cards, debit and cash are the top three payment preferences among this group. In other words, while High Income Millennials are more likely to pay for gas using mobile apps, they still expect gas stations to accept traditional payment options.

The Importance Of High-Functionality Apps

Before gas stations can develop an app aimed at winning over High Income Millennial consumers, it’s important to understand the app functions they consider the most important.

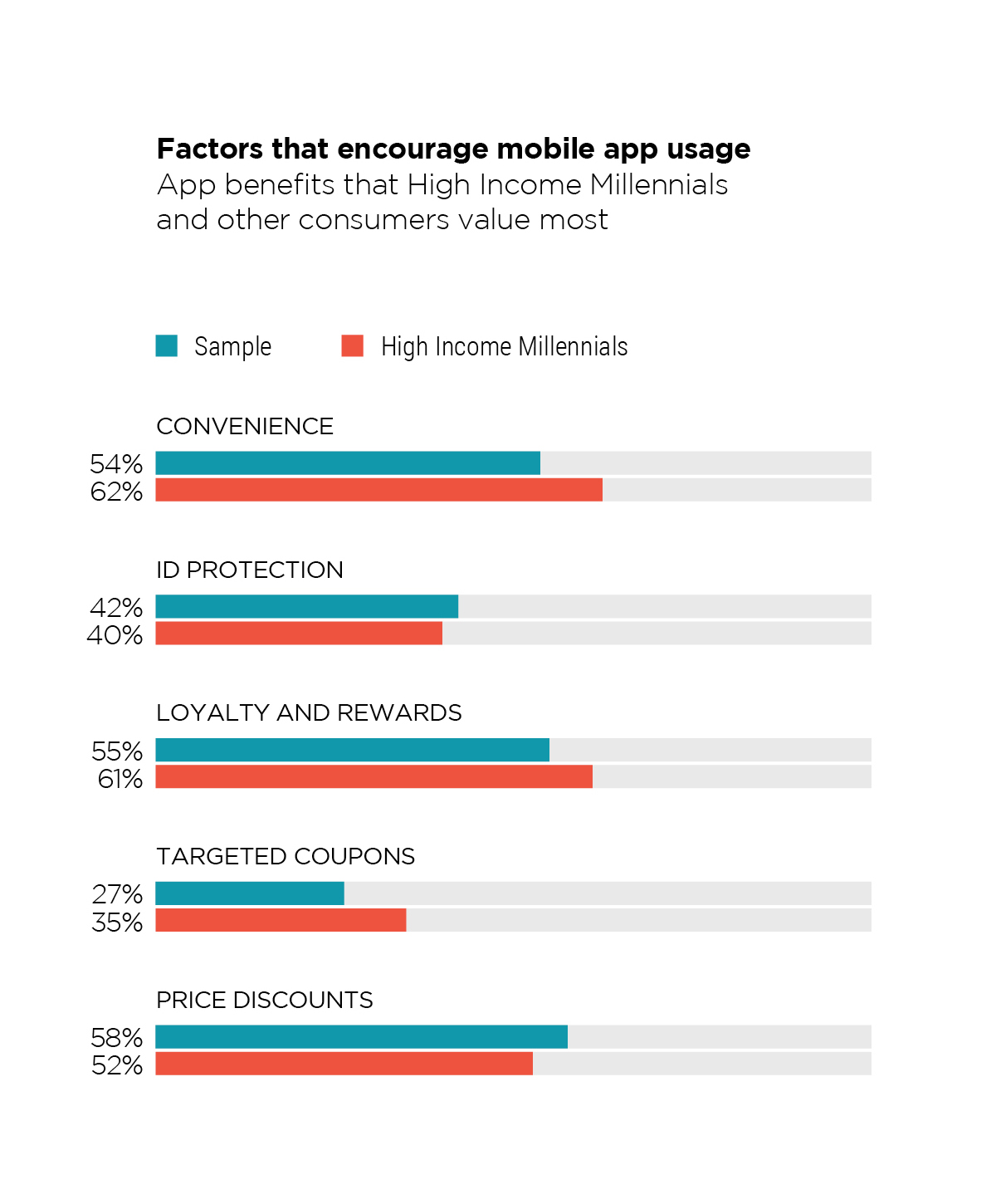

Like other consumers, High Income Millennials’ top considerations for using mobile apps were convenience, loyalty and cost. Most High Income Millennials said convenience would encourage them to use the app more frequently, followed closely by access to rewards and loyalty credits and price discounts. To the rest of the control group, price discounts were

the top mobile priority, followed by rewards.

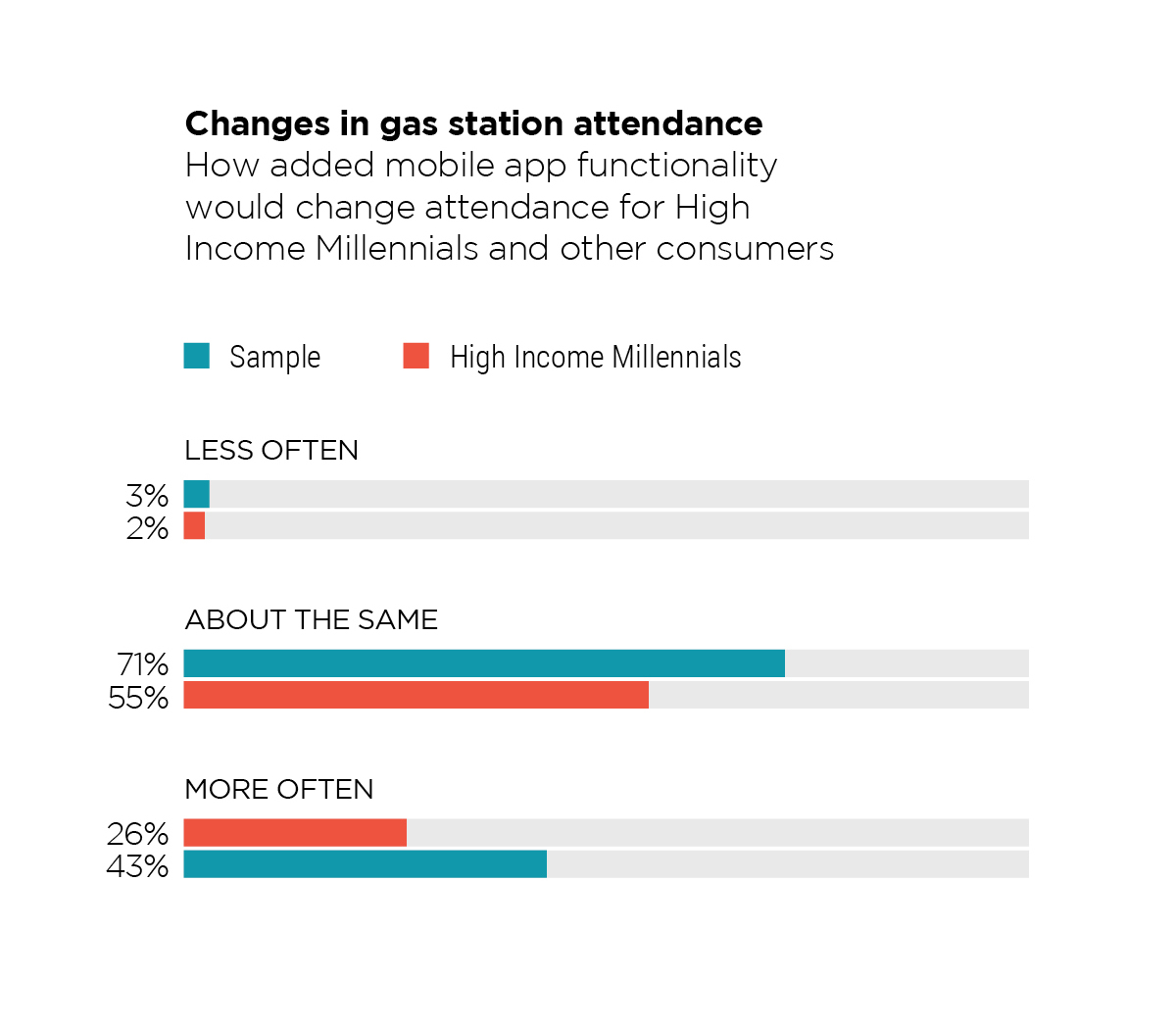

Gas stations that offer these functionalities in their mobile app could see an uptick in visitations from High Income Millennials. Forty-three percent of High Income Millennials said they would visit a gas station more often if these activities were available on a station’s mobile app.

Gas stations that offer these functionalities in their mobile app could see an uptick in visitations from High Income Millennials. Forty-three percent of High Income Millennials said they would visit a gas station more often if these activities were available on a station’s mobile app.

The same trend can be seen among the larger sample group, with 26 percent saying they would visit a gas station more often if their mobile app offered the functionalities they considered most important. This indicates that gas stations that invest in the right mobile app functionalities could win over more than just High Income Millennial customers.

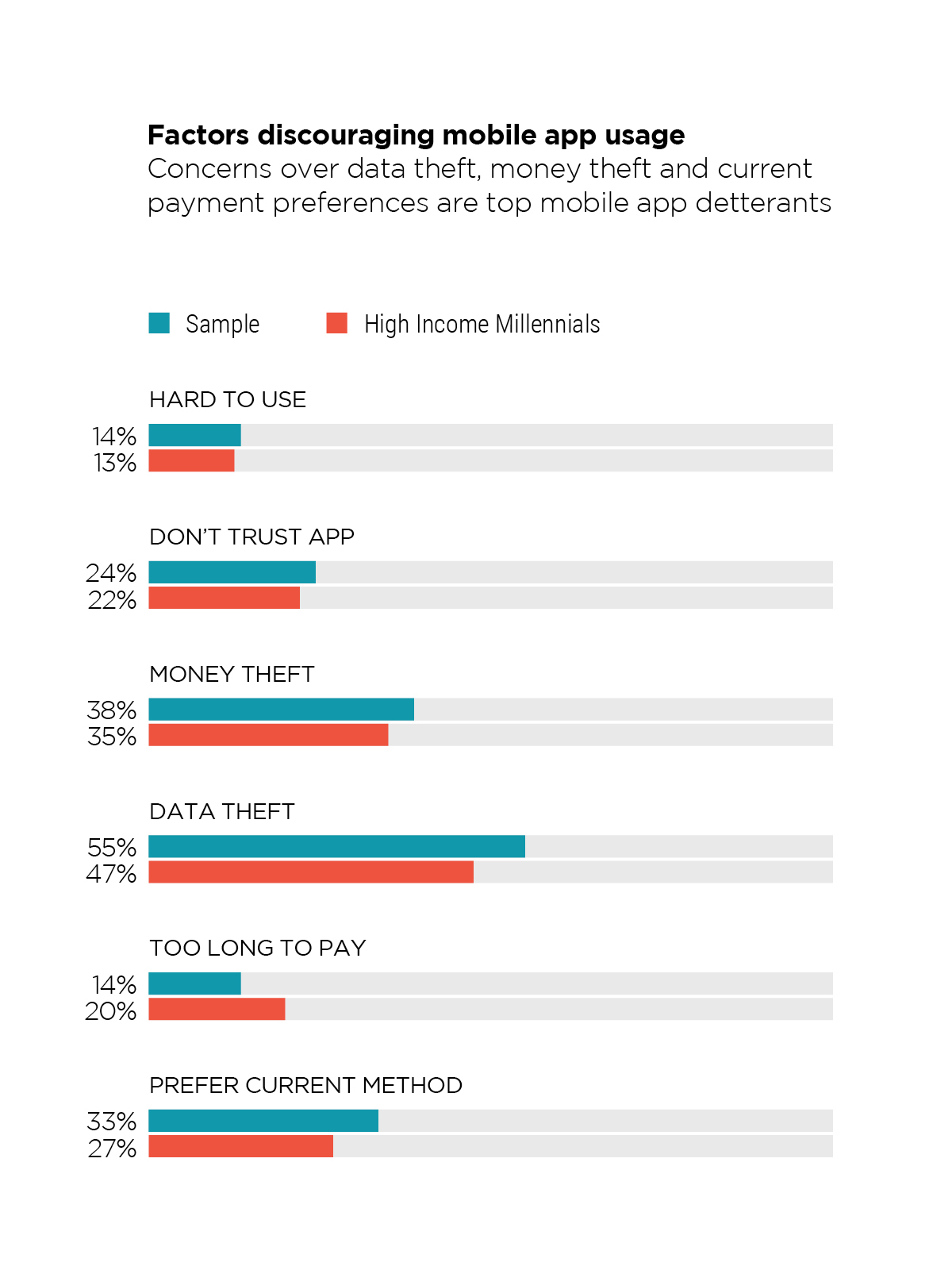

But it’s not enough for a gas station to simply offer an app to win over this group of customers. Both High Income Millennials and the rest of the sample emphasized they want assurances that a gas station’s app is safe and secure for storing their data and money.

Concerns over data privacy and financial security are the top deterrents for using a mobile app for gas purchases. Among High Income Millennials, 47 percent said that data theft concern was the top factor that discouraged them from using a mobile app, followed by 35 percent who said money theft was their top concern. These were also the top concerns of the rest of the sample, with 55 percent discouraged by data theft and 38 percent discouraged by money theft worries.

Conclusion

While High Income Millennials represent a small share of this sample, close attention should be paid to how this group prefers to use mobile apps in their gas purchases.

For gas station businesses, focusing on the needs of High Income Millennials could have wide-ranging benefits, because they closely align with those of a broader consumer base. Any mobile app offered by a gas station should focus on helping their patrons save money, provide rewards for their loyalty, find the business easily on their phones, help navigate consumers to their location and make their hours of operation easily accessible.

However, increased adoption of mobile apps will only happen if consumers feel confident that their personal and financial information is kept safe. Concerns over data security is one of most significant barriers to mobile app adoption at the gas pump. This puts pressure on gas station owners and app developers to build confidence in mobile app technology’s security, not just the efficiency.

For gas stations, this means it’s time to put mobile app innovation in the fast lane — or risk getting left behind.