The Gig Economy Index, a Hyperwallet collaboration, delves into the demographics and behaviors of workers in the gig economy — who they are, what services they supply and what percentage of their overall income the gigs represent.

It can seem as if companies like Uber and Airbnb are always in the news, whether with new announcements or courting controversies. On Monday (April 29), the U.S. Department of Labor ruled that gig economy workers are contractors and not employees, which has implications for much of the industry.

What amounts to bad news for workers could be a boon for tech companies like Lyft, Postmates and Uber that recently went public or plan to. Companies employing contractors don’t have to pay them the federal minimum wage, overtime or a portion of Social Security taxes.

Uber said in its IPO filing with the Securities and Exchange Commission (SEC) that classifying drivers as employees would result in “significant additional expenses” and would mean changing the company’s business model.

In collaboration with Hyperwallet, PYMNTS produced The Gig Economy Index to gather insights into the state of this growing industry.

In Q3 2018, 35.6 percent of respondents said they participated in the gig economy, the highest number since Q3 2016.

The survey, which was conducted in Q3 and Q4 2018, found that digital marketplaces like TaskRabbit, Uber and Airbnb continued to play a critical role for gig workers primarily — but not across the board — for skilled, non-seasonal workers.

In Q4 2018, roughly one-third (32.3 percent) said they needed very specific skills, an increase from 28.7 percent earlier that year.

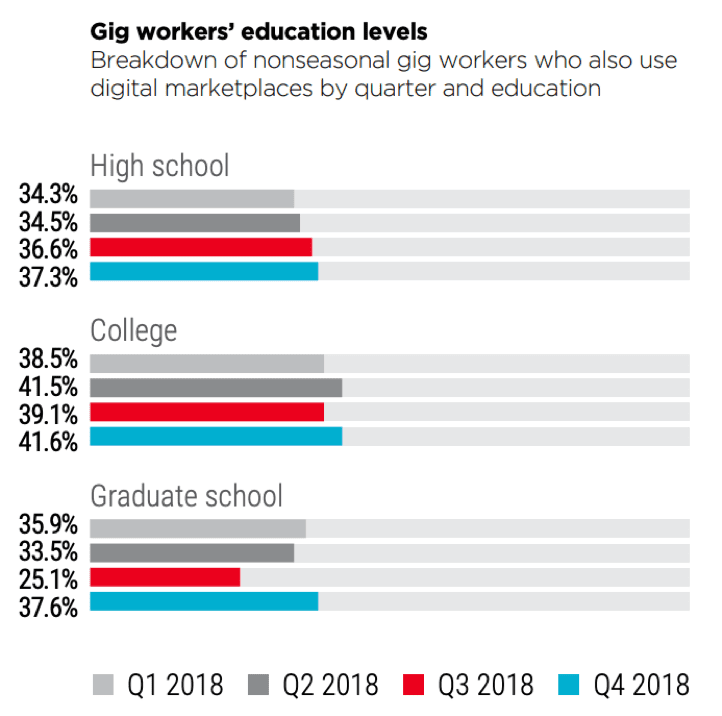

In Q4 2018, far more non-seasonal workers used digital platforms to look for gigs than seasonal workers: 38.4 percent vs. 16.4 percent. Education levels — and incomes — have risen among gig workers who use digital marketplaces. In Q4 2018, 41.6 percent of non-seasonal workers had college degrees and 37.6 percent had graduate degrees.

The proportion using digital platforms and earning more than $100,000 rose to 40.0 percent in Q4 2018, up from 30.0 percent in Q3, which reflects higher education levels leading to higher incomes.

Reasons given for participating in the gig economy shifted throughout 2018. Fewer in Q4 2018 reported saving for life events (22.9 percent) than in Q1 2018 (27.0 percent). Though flexibility was the top motivation in all quarters, that factor also shrunk throughout the year, from 42.0 percent in Q1 to 38.4 percent in Q4.

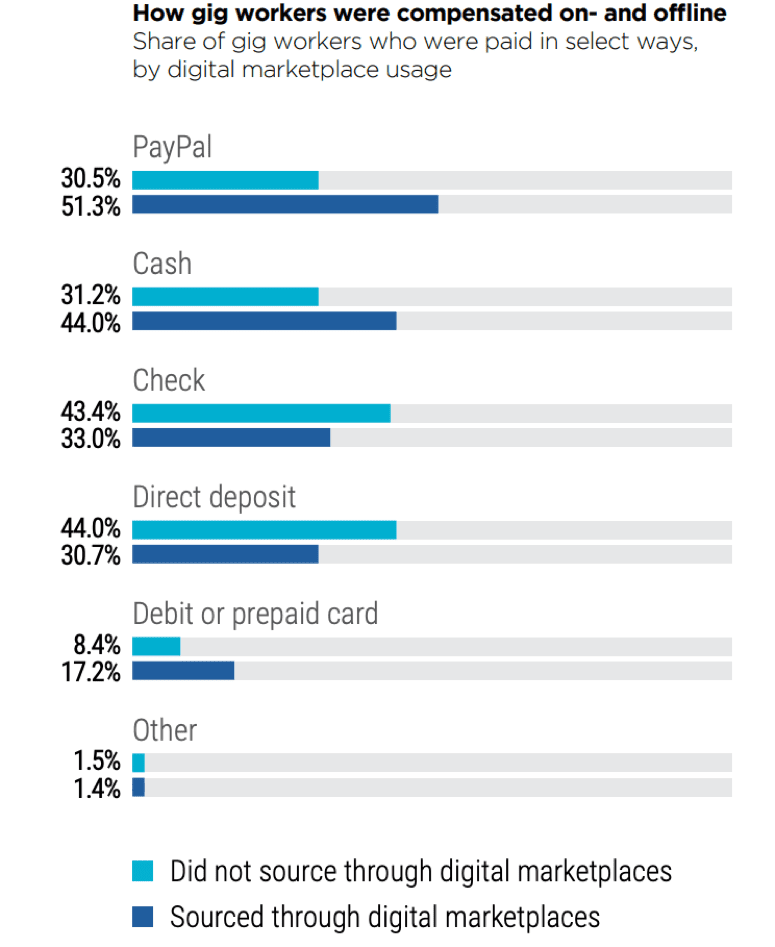

Digital platforms not only facilitate workers finding jobs, they also serve as payment platforms. PayPal was the leading (41.9 percent) gig payment method in Q4 2018. Cash (37.7 percent), check (36.7 percent) and direct deposit (38.2 percent) were also popular.

Over one-quarter (26.8 percent) of workers who sourced gigs through digital marketplaces were paid instantly compared to 22.3 percent who got gigs through other means. This correlates to the majority (51.3 percent) of digital marketplace gigs paying via PayPal. Direct deposits are also instant but aren’t typical of gig economy type jobs and are more common with W-2 income, which is likely why gigs not sourced on digital marketplaces were likelier to use direct deposit.

PayPal was commonly used as payment method, and 66.6 percent of gig workers said they were very or extremely satisfied with this method. Higher satisfaction came from direct deposit (70.1 percent) and cash (69.5 percent). Satisfaction likely correlates to speed of payment.

According to PYMNTS, 75 percent of consumers overall prefer faster payments. This is even more important in the gig economy where 85 percent of gig economy workers said they would work more often if they could get paid faster.

Workers ages 25 to 34 were most likely to be paid via direct deposit while more than half of those under 25 (52.9 percent) were paid through PayPal. At the other extreme, 44.4 percent of gig workers aged 65 and older were paid via paper checks in Q4 2018.

It’s not necessarily age that dictates payment methods, it also differs by industry. For example, in Q4 2018 construction gigs were far more likely to pay in cash (59 percent) while direct deposit was most used in business and finance (44.2 percent). PayPal dominated in sales (54.9 percent) and arts and entertainment (52.9 percent).

Two-week paychecks might not cut it in the near future. As the gig economy grows, participants are shifting from less educated and lower skilled workers seeking seasonal work to more specialized roles. Higher skills and wages come with higher expectations for immediate payment methods.