Digital interactions between patients and healthcare providers take many forms, but of all the technology upgrades happening now in the health space, taking the pain out of payments is sprinting ahead — before patients act like paying customers and take their treatment elsewhere.

“The Access Channel: How Healthcare Financing Keeps Patients Engaged,” a PYMNTS report with research sponsored by CareCredit, analyzed survey responses from nearly 3,550 adult U.S. consumers about their patient experiences through a lens of the paying customer — finding that payments choice and convenience found in retail, for example, has healthcare applications.

Get the report: The Access Channel: How Healthcare Financing Keeps Patients Engaged

Much of the issue tracks back to out-of-pocket expenses, even for insured Americans.

Per the study, “PYMNTS’ research has found that 54% of Americans earning between $50,000 and $100,000 annually live paycheck to paycheck,” with 40% of those earning more than $100,000 also reporting living paycheck to paycheck. This is true even though research also found that nearly 54% of U.S. households have family medical policies.

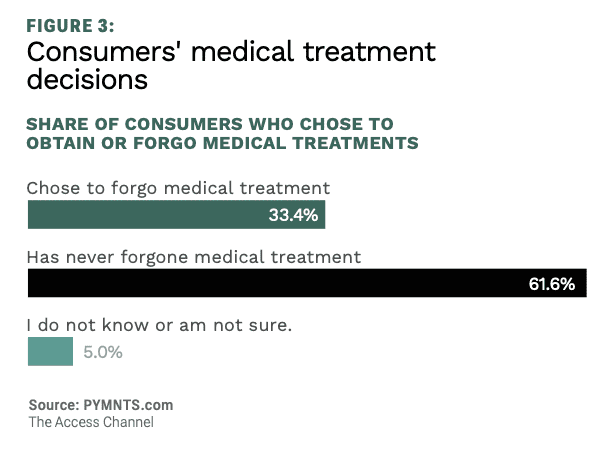

“Patients who live paycheck to paycheck tend to face barriers in accessing healthcare due to out-of-pocket costs, and they may even delay or skip a medical procedure because of financial challenges.” Additionally, the study notes that “costs not covered by health insurance rose 10% this year and are expected to continue increasing through 2026.”

Advertisement: Scroll to Continue

These factors are prompting providers to embrace digital payments and healthcare financing options faster, lest patients forgo needed treatments or choose a different doctor.

Get the study: The Access Channel: How Healthcare Financing Keeps Patients Engaged

Get the study: The Access Channel: How Healthcare Financing Keeps Patients Engaged

The Four Questions

Having determined that “many patients would consider leaving their healthcare providers in search of better payment options, especially as 21% of consumers are paying more in out-of-pocket costs this year than they have in previous years,” The Access Channel study identified four key questions to help providers assess patient needs proactively.

Those questions are as follows: Does the service offer the majority of its patients access to payment plans and healthcare financing options? Does the service offer transparent pricing and information on fees? Is the provider allowing particularly vulnerable demographics to access payment options that meet their needs? And is the provider making it simple for behavioral health patients to manage payments and healthcare financing options online?

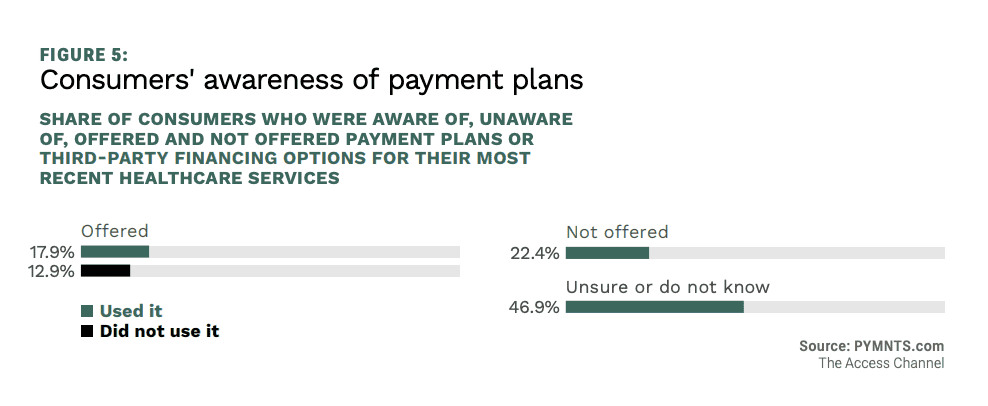

This is vital information for providers now more than ever. While nearly half of respondents didn’t know if their providers offered payment plans and options, the study states that “of the 31% who were certain their healthcare services providers offered payment plans or financing solutions, more than half used such options. The largest share of consumers who used payment plans said the option allowed them to stick to their budgets and continue paying other bills.”

Medical Practices Seek Digital Triage

Changing doctors is usually the last thing a patient wants to do, but a deadly virus and an unpredictable economy are forcing the issue. Many practices would like to speed up their digital transformation, but experience their own difficulties in doing so.

“As PYMNTS’ research shows, most patients are willing to leave healthcare providers when the financial experience is less than ideal,” the study states. “Still, many healthcare providers are technically unprepared to create new payment options for patients, though they may be interested in doing so. This is when working with an experienced healthcare financing partner could be a wise choice.”

By partnering with digital payments firms that are experts in the healthcare vertical, practices can quickly get up to speed and offer patients rapid payment processing, payment flexibility and payment options, as well as the ability to connect with new audiences.

Get the study: The Access Channel: How Healthcare Financing Keeps Patients Engaged

Get the study: The Access Channel: How Healthcare Financing Keeps Patients Engaged

Get the study:

Get the study:

Get the study:

Get the study: