Missed payments. Billings made in error. Bills in collection, resulting in only partial payments or none at all.

The Consumer Financial Protection Bureau shared data last week that 15% of complaints made by consumers were about debt collection tied to allegedly unpaid medical bills, which serves as an illustration of the friction inherent in healthcare payments.

Interaction between providers and patients can be made smoother with transparency and acknowledgment on both sides of the relationship as to the procedures being conducted, what’s covered by insurance, and what’s owed by the individual.

The CFPB said last week that the complaints centered around bills that had already been paid, were not owed by the patient or their family, or were for inaccurate amounts.

Part of the challenges lie with the complexities of insurance coverage. Joint research from PYMNTS Intelligence and Lynx showed that 41% of older consumers said they are “very familiar” with what’s on offer and covered by their health plans. About 55% said they are satisfied with the ability to set up payment plans online, and a similar amount said they are satisfied with the ways and means of seeking information about medical bills.

Separate PYMNTS Intelligence estimated Generation Z, millennials and lower-income patients are finding value in using healthcare financing options. Sixty-four percent of millennials who paid using a payment plan received unexpected bills, compared to 28% of baby boomers and seniors.

On a larger scale, there’s significant room for these plans to gain even more widespread use, as 11% of millennials and 10% of Gen Z patients reported using those plans, but just 2% of baby boomers said they used the payment options. By economic demographic, 13% of patients living paycheck to paycheck with issues paying their bills used a payment plan — and as many as 60% of consumers live paycheck to paycheck — compared to 3% of those not living paycheck to paycheck.

The providers themselves have access to CareCredit and Sunbit to offer payment plans. Weave, a platform focused on healthcare firms, partnered with Affirm in September to provide flexible payment options for eligible patients. Affirm’s pay-over-time options are being integrated with Weave’s patient experience platform. Patients can apply to pay with Affirm, with 0% interest over time.

The digital centralization of data can do much to help increase the transparency and visibility of what is owed, and when, which can help consumers explore and opt into new financing options.

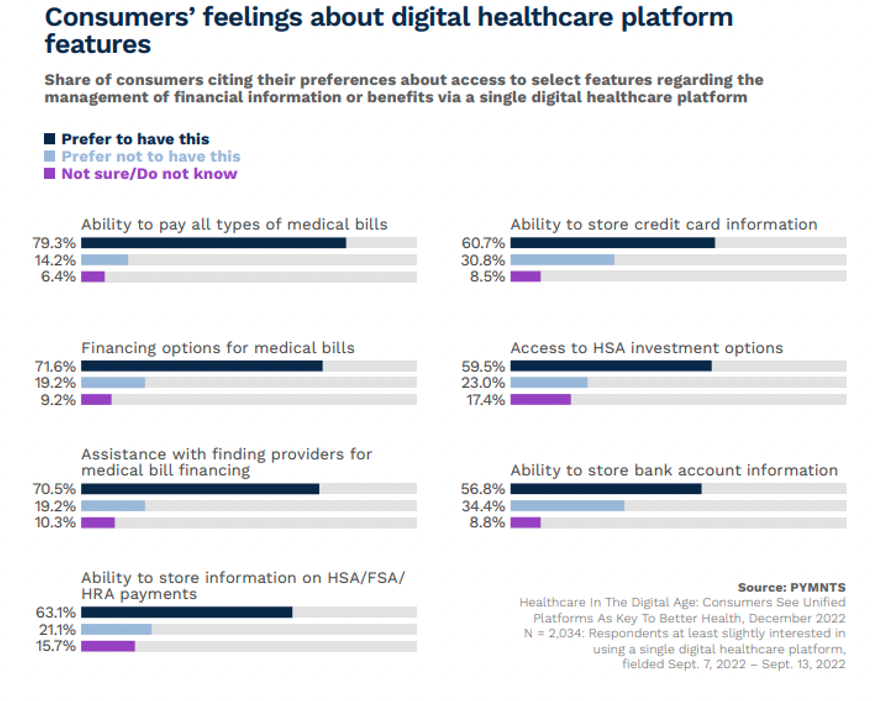

The report “Healthcare in the Digital Age: Consumers See Unified Platforms as Key to Better Health,” a PYMNTS Intelligence and Lynx collaboration, found that 79% of consumers want a platform that can help them manage and pay their medical bills. Seventy-one percent said they want to be able to leverage these platforms to explore financing options, and roughly 71% said they want to embrace these platforms to find providers who can help them with financing programs.