There’s a simple way to manage the pinch of rising health care costs:

Don’t get sick.

Beyond that strategy — and of course, it’s an impossible one — flexible financing at the point of care soothes the pinch of out-of-pocket health expenses.

Data this week underscore just how difficult it is to ensure financial wellness while striving to stay healthy, as the costs of insurance continue to eat away at paychecks.

KFF’s most recent survey of employers found that annual premiums for employer-sponsored family health coverage reached $22,463 this year. Within that coverage, employees paid a bit more than $6,100 — that’s the money they contribute before the deductible kicks in.

As for the deductibles themselves — which the employee pays before the insurance plan pays for covered services — those out-of-pocket expenses soared over time. Kaiser found that workers who face an annual deductible for single coverage, this year’s average is $1,76, up 61% in the past 10 years. Drill down a bit and there’s a stark reality confronting the workers at Main Street firms, the smaller companies that power the U.S. economy: workers at these smaller companies face much larger deductibles on average — $2,543 versus $1,493 for workers at larger companies.

The unpredictability of how much individuals and families must pay after the deductible — let’s call it sticker shock — has a negative ripple effect throughout the healthcare system.

Some of that sticker shock can be reduced by more accurate cost estimate and better communications between providers and patients. Experian Health President Tom Cox told PYMNTS’ Karen Webster this week that we’re in the “in the early innings” of a proactive approach where practitioners offer pre-care cost estimates, which can then help open up dialogues about costs and how to pay for it all.

As he told Webster, “If you don’t have that conversation about payment options, we could just exacerbate that unintended consequence of more care postponed, which is why making sure that you exhaust every payment option is important for the patient.”

In the paycheck-to-paycheck existence that confronts a majority of Americans — 63% of us at last count — healthcare becomes part of bill triaging. PYMNTS and Experian Health research found recently that 46% of unwell patients have canceled appointments due to high cost estimates. A staggering 60% of consumers living paycheck to paycheck with issues paying their bills canceled due to the surprise of a high cost estimate. The average amount of money paid out for “surprise” bills tops $675.

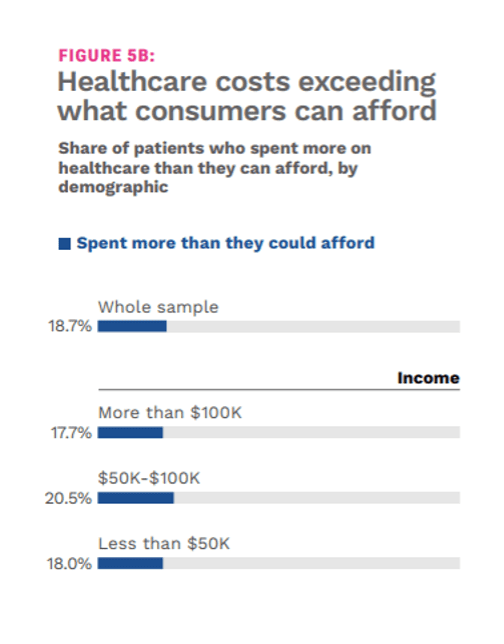

A significant percentage of consumers, as seen in the chart here, no matter their income level, have spent more on healthcare than they can afford.

As shown in this week’s study, “Managing Healthcare Costs: How Patients Use Payment Plans,” PYMNTS and Experian Health found growing recognition by consumers (and providers) that payment plans are critical to getting the care that’s critical: Nearly 1 in 10 patients have used a payment plan to pay for their most recent doctor’s visit. The plans themselves are a bit of a lifeline, as 37% of all patients who used payment plans to pay for their most recent doctor’s visits spent more on healthcare than they can afford — indicating that stretching out the payments over time is the way they find some breathing room in the budget in order to receive health services.

Payment plans are also becoming a strategic advantage for the providers: The data show that 54% of all patients who use a payment plan would switch healthcare providers in order to have a better payments experience.