Friction in accessing digital healthcare services may be a fixable barrier for low-income patients.

Beginning in July 2022, as part of a larger focus on the ConnectedEconomy™, PYMNTS began tracking day-to-day connectivity, specifically between U.S. income brackets, comparing the habits of the country’s highest- and lowest-paid consumers. With a specific focus on how the country’s digital transformation impacts the nation’s economy and consumers’ lives online, the results were surprising. Initial research into how these factors impact the ConnectedEconomy™ found that income disparities were closely related to “connectivity gaps.”

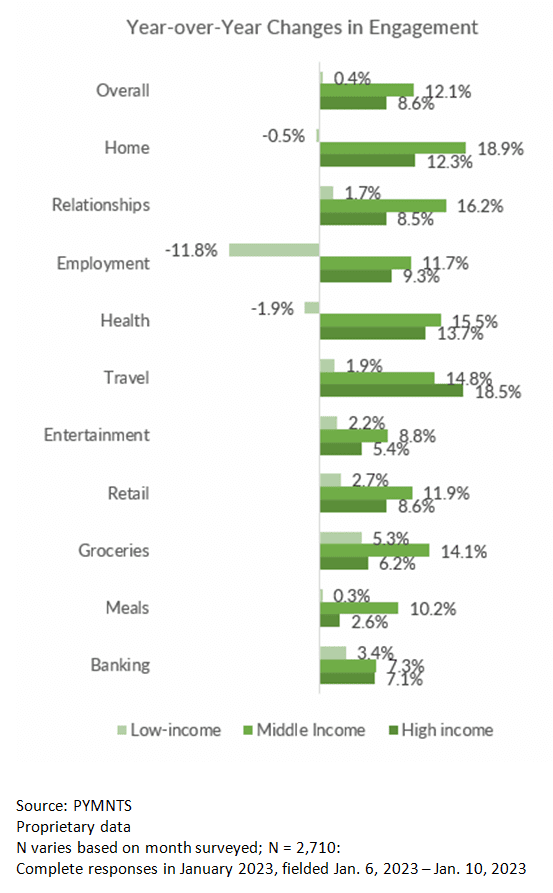

Following up six months later, PYMNTS’ “Digitally Divided: Work, Health and the Income Gap” found this connectivity gap has only widened. High-income consumers, making over $100,000 annually, participated in the ConnectedEconomy™ 9% more from the same time last year. However, participation for low-income consumers earning less than $50,000 per year has remained nearly flat during the same time period.

The chart breaks down the change in participation in specific online activity categories by annual income.

One activity with a noticeable connectivity gap is digital healthcare. High-income consumers are 69% more likely to access online healthcare services than their low-income counterparts, with 59% of high-income consumers participating versus 35% of low-income consumers.

Low-income consumers clearly have a connectivity gap. This is perhaps partially due to the friction that comes with accessing the multiple channels sometimes necessary to receive digital healthcare services. Often, these channels involve submitting paperwork such as insurance claims and payments. There is potential friction involved in satisfying any one of these conditions to accessing healthcare, digital or in-person. A unified platform giving consumers one-stop access to information such as insurance and medical records may help bridge that gap.

Unlike more discretionary activities such as entertainment or travel, healthcare services are essential, increasing the urgency of closing this specific connectivity gap. Yusuf Qasim, president of payments at Zelis put the current state of healthcare bluntly during a PYMNTS panel discussion. “We believe the healthcare financial journey from care to payment is broken. I’ve been through that journey where sometimes I have a bill, but I know it’s not a bill, and when do I pay it? I don’t know where to go.”

However, a solution may be found within that same discussion through the creation of a unified, or “all-in-one,” healthcare-focused digital platform. Matt Renfro, co-founder and CEO at Lynx, elaborated. “There’s no Plaid of healthcare payments, for the most part. HSA, FSA, largely the administrators are not built off banking infrastructure. The approach we’re taking is how can we complement such a massive provider payment network like this on the issuing side? I would love to be a part of solving that. I’ve been thinking about it for a long time.”

One platform or piece of software alone can’t solve all the issues behind the healthcare connectivity gap. However, digital solutions could help bridge some of the divide by reducing the friction of trying to access multiple platforms — and change individual lives for the better.