As costs climb, it may finally be time for health insurance companies to grow out of legacy paper check systems.

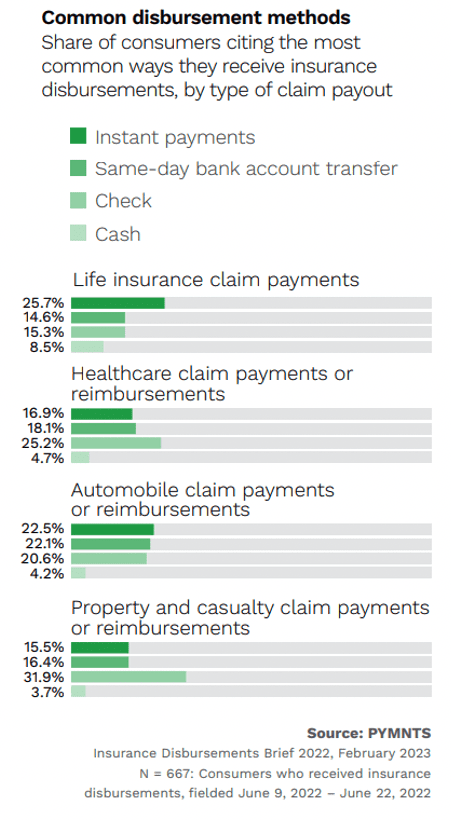

In our ever-increasingly connected digital age, an industry-wide reliance on analog solutions seems almost quaint — until one realizes the expense involved in this dependence. The latest PYMNTS/Ingo Money collaboration, “Insurance Disbursements Brief 2022,” noted the prevalence of these legacy solutions in the rate of paper checks still used for healthcare claim payments or disbursements.

This is particularly key because healthcare disbursements represent the highest share of payouts surveyed consumers receive, at 19%. (The corresponding rate of check payments for property and casualty claims is even higher, but those payments are rarer overall.) Annual numbers in total number of claims vary, but healthcare disbursements have been the most common type of consumer payout since 2020. They represent 14% of all claims, meaning an estimated 24 million U.S. consumers received at least one insurance disbursement in the 12 months preceding June 2022.

Although this represents a drop from 17% share of all claims that were health insurance-related in 2021, that year was unusual for the insurance industry, with the highest payout volume in July and numbers coinciding with fallout from the pandemic’s peak. Since that spike, in which 24% of consumers overall received at least one insurance payout within the 12 months preceding the survey, all sectors of the insurance industry have dropped back to their 2020 pre-pandemic levels.

But with industry-wide total payouts in 2022 totaling $1.37 trillion, that’s still a lot of paper printed.

Despite consumers’ demand for more options, many insurers across industry sectors have reduced or eliminated certain payment choices. For example, insurance companies overall gave consumers the option to choose instant payouts for 62% of received disbursements in 2022, a 12% decline from 2021. Specific to the sector, health insurance companies gave consumers receiving their disbursements a choice of receipt method 57% of the time, ranking last among the industry for payment choice.

Advertisement: Scroll to Continue

For health insurance companies, which may never be some patients’ favorite entities, automating payouts might not be about customer satisfaction or loyalty. However, the benefits of modernizing the check disbursement system for health insurance companies are still clear: lower processing costs, fraud reduction and personnel time-saving that could be spent on other, more important, matters.

This need for improvement isn’t news to sector and industry-wide leaders. Previous PYMNTS research found that 64% of healthcare and medical CEOs said digitization is at least a very important strategy to improving balance sheets, with 71% of finance and insurance CEOs claiming the same.

The switch away from checks to automation or other types of modernization for health insurance disbursements is likely a move that would have to be done in-house or with a close third-party partner, given the numerous regulations governing the sector. Currently, industry-wide solutions such as ePayPolicy exist, but no solutions widely available today are specific to the healthcare insurance industry.

Staying with the familiar makes sense only as long as it is beneficial. Change — such as finally letting go of paper checks — doesn’t have to be hard, especially when it could significantly benefit a firm’s bottom line.