Who’s Going In The Connected Car Driver’s Seat?

Before there was Alexa, Bixby, Siri and Google Assistant, there was Emma Nutt.

Emma Nutt, born in 1860 in a small town in Maine, was hired by Alexander Graham Bell in 1878 to be the world’s first female telephone switchboard operator. When Bell’s invention — the telephone — was first introduced, phones were sold in pairs, and calls could be made between those two parties only.

Emma Nutt, born in 1860 in a small town in Maine, was hired by Alexander Graham Bell in 1878 to be the world’s first female telephone switchboard operator. When Bell’s invention — the telephone — was first introduced, phones were sold in pairs, and calls could be made between those two parties only.

To ignite adoption and use of telephones, Bell knew he needed to create a network that could connect all telephone users with each other. Getting that going would require someone to make those connections, since there weren’t automatic switches back then.

At first, that intermediary was a bunch of boys tasked with intercepting calls made to a central switchboard. When a call came in, they would ask who the person wanted to be connected to, then they would physically scramble up and down the floor-to-ceiling boards of telephone lines to plug and unplug phone lines to connect those callers. That turned out to be less than ideal. The boys’ physical dexterity was overshadowed by their pranks and less than customer-friendly behavior.

That was when Bell decided women would be better suited to serve in that role.

The job description Bell reportedly posted was interesting: qualified candidates must have long arms — switchboards were tall — and be unmarried, since it was a 24/7 job. To accommodate that schedule, Bell would install switchboards into the homes of his female employees.

His first hire was Emma Nutt in 1878.

It turned out to be a stroke of genius and a turning point for Bell and the telephone.

I’ll spare you the infamous Margaret Thatcher quote about the need to hire a woman if one really wants to get something done…

The Power of (a Woman’s) Voice

Customers of Bell’s network lauded Nutt’s soothing, friendly voice and technical expertise. Based on that success, Bell hired Nutt’s sister and more women after that. Bell discovered that women could handle the physical aspect of the job and brought a more pleasant demeanor and reliable service level to the role.

Over the years, of course, long-armed women were replaced by the automated switching systems that evolved to become the backbone of the telephone switching systems that are in place today.

But it was Nutt, with her voice, that became the intermediary that helped ignite the telephone network we know and use today. She stayed with Bell and the Boston Telephone Dispatch Company for more than 30 years until her retirement.

At the end of her three-decade-plus career, about 25 percent of the U.S. population had a phone in their homes.

Voice as Intermediary 139 Years Later

One hundred years later — 139 years after the introduction of the telephone — another pleasant female voice has emerged to ignite the next generation of voice-activated networks: Alexa.

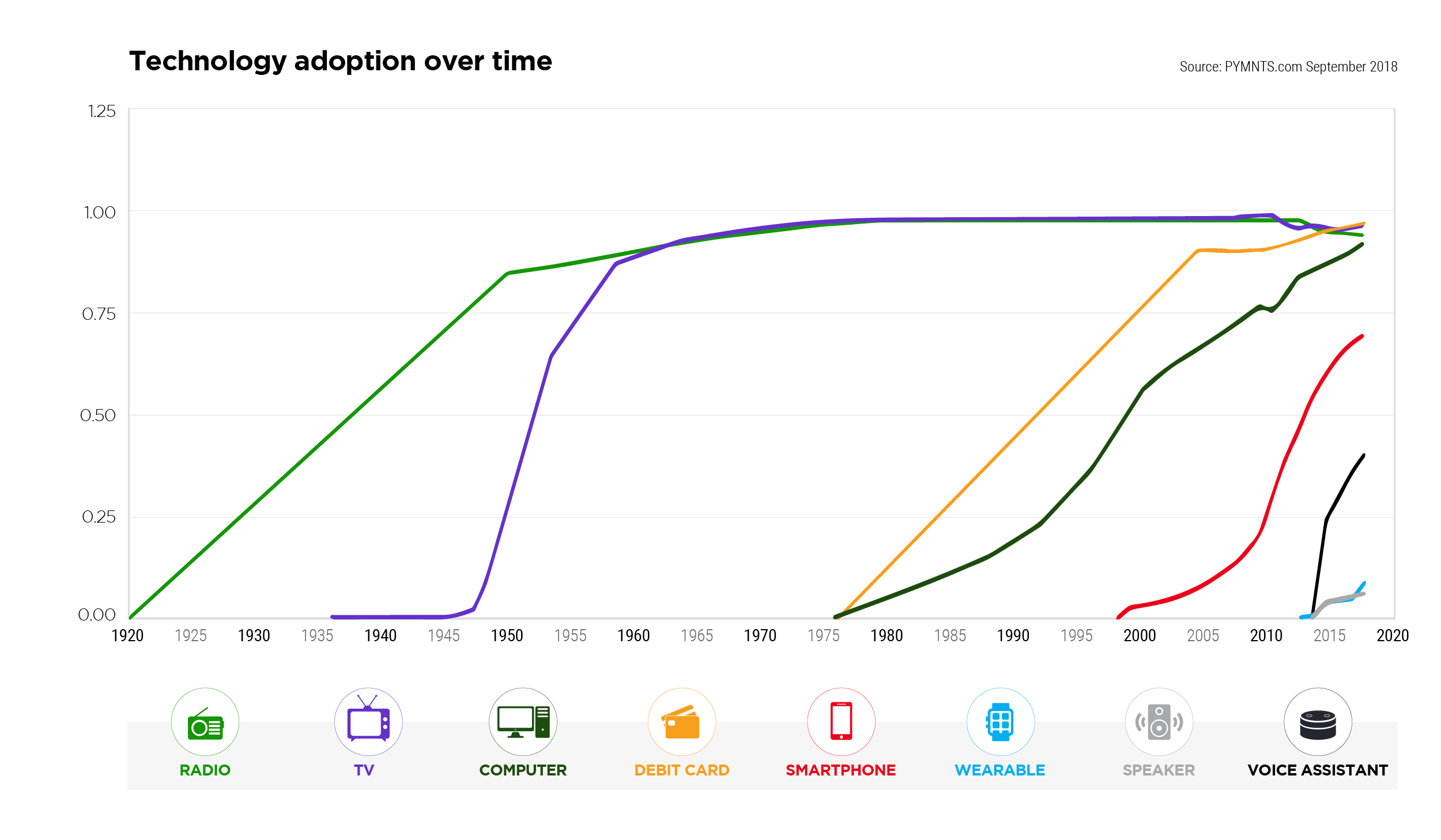

It’s only taken Alexa, her voice and the voice ecosystem that she and others have since spawned four years for 25 percent of the U.S. population to own a voice-activated device, many of which are powered by Alexa. That rate of penetration is astounding.

Amazon with Alexa wasn’t the first to leverage the consumer’s interest in using voice instead of typing and swiping as a way to access content and services. But Amazon has used a pleasant-voiced intermediary to create, and ignite, a voice-activated ecosystem.

That ecosystem today includes developers who create skills powered by Alexa, SDKs (software developer kits) for third parties to use to incorporate Alexa into their own devices and a suite of Amazon’s own hardware devices that consumers can purchase to bring Alexa and her skills into their homes and offices.

And cars.

The launch of Echo Auto last week, on the heels of the August release of the Amazon Auto SDK, makes it clear that Alexa wants to ride shotgun in the U.S. consumer’s automobile.

Every one of them.

Google’s recent announcement makes it clear that it isn’t about to let Alexa hog the road.

Google reported last week that it has reached a deal with the Renault-Nissan-Mitsubishi alliance to use its Android operating system as the in-dash operating system for the OEMs (original equipment manufacturers) that collectively sell more cars than any other auto OEM in the world — last year, some 10.6 million vehicles.

That deal starts in 2021. It’s a long way in the future, but it positions Google for the new 5G world in which connected cars will become more important.

Still, it’s three years off.

Consumers, of course, want it now. And have figured out ways to get it now.

The Voice-Activated Road Race

Cars have recently become a consumer-connected device even though they’ve been a powerful connected device in the fleet and transportation world for a long time.

Telematics have been used by fleets for nearly 20 years to improve vehicle performance and driver safety and to track freight and driver performance behind the wheel.

Cars have become a connected device not necessarily because of what OEMs have done to make them that way but because of the devices consumers have brought into their cars to create those in-car connected experiences.

Consumers use Bluetooth to connect the now nearly ubiquitous smartphone to their car’s in-dash system to make calls and listen to their Spotify playlists. The not-so-very attractive (but oh-so-very functional) suction windshield/dashboard phone mounts have made it safer for drivers to access navigation and other apps while behind the wheel, including the apps that drive (pun intended) commerce.

We did a study last year in collaboration with Visa that identified some $212 billion of commerce initiated by drivers in the U.S. during their commutes to and from work each year. Consumers now order everything from coffee in the morning to groceries or dinner for pick-up on the way home. They use apps to find, and sometimes even pay for, gas at the pump — as well as to find and pay for parking.

Car OEMs want in on all of that action. The question is: Can they, and will consumers let them?

Fearful of giving up ground to a tech intermediary — Apple, Google, Amazon — many OEMs are working with third parties to develop their own branded apps and connected in-dash experiences.

Ford has created its own system even though Alexa can be found in some Ford models. Mercedes-Benz announced it will use a third party to create its own. Xevo today powers 25 million vehicles with an in-dash platform that gives OEMs the opportunity to create a custom-branded experience that starts the moment a consumer buys a new car. Xevo says dealers use the new car buyer “onboarding” process to get car owners to download its branded app that connects the user to maintenance and other car-centric alerts. An impending use case includes linking car telematics to driver profiles to enable commerce and new use cases, such as usage-based insurance.

Consumers will have to buy a new car or a used car new enough to have this in-dash experience and join the ecosystem.

That might take some time.

Did I mention consumers want connected cars now?

Consumers are keeping their cars longer than ever before.

In the U.S. today, there are roughly 272 million cars on the road. The average age of those cars is 12.1 years. Two years have been added to that lifespan over the decade spanning 2007 to 2017.

Roughly 17.1 million vehicles were sold in the U.S. in 2017. Roughly 6.7 million of those were cars; the rest, light trucks and SUVs.

Consumers are keeping their cars longer for many reasons. New cars are more expensive than many people can afford, so they are opt to buy used cars instead. Used car sales in the U.S. are more than double that of new cars.

Cars are built better than they ever were, so they last longer. Many models also change very little in terms of look and feel from year to year, which makes keeping a car more aesthetically acceptable, too. And people just aren’t driving as much.

That’s not a problem for phone-based apps, which have been connected to many cars for a long time via Bluetooth.

But it makes getting a critical mass of OEM-branded, in-dash app users a very long-term prospect — and the prospects of engaging an ecosystem around those apps a long-term prospect too. That assumes, of course, that consumers want to pop open a separate app that is only about their car and what they do in that car using that app.

But that’s not the connected car experience consumers have and use today.

For OEMs to capture that experience, they might just have to share the road with the tech giants — two in particular.

On the Road to the Connected Life

I’ve been writing about the impact of voice and commerce ever since Amazon hit the scene with Alexa in 2014. It was Alexa, not Siri — despite being a part of the iPhone experience since 2012 — that put voice on the map as a powerful consumer access channel.

That’s because Amazon put her — and the devices that powered her — into the center of the consumer’s universe — in homes at first and later in smartphones that are carried everywhere. Today, Alexa has captured roughly 62 percent of the voice-activated market and has more than 30,000 skills for consumers to tap.

Alexa started out as a voice on the other end of a cylinder that sat on the kitchen counter that told jokes, played music and got the weather forecast on demand. All those things got consumers comfortable with talking to an inanimate object and getting reasonably coherent responses in return on a series of low-risk commands.

It also gave Alexa the chance to learn from consumers, better understand what they were saying and give her context.

Over time, consumers got more comfortable making Alexa their home command center, and Alexa got smarter in her responses. Today, consumers use Alexa on their phones and via the devices they have in their homes to control lights and security systems and locks and curtains and appliances using only their voices.

Even from their cars.

But Amazon didn’t build Alexa to serve only as a voice-activated on/off switch.

Amazon was built for commerce. Its marketplace is the digital intermediary and payments network that connects a shopper with a product to buy. The ecosystem it has created over the last two decades is about optimizing those commerce opportunities for its users and the sellers that wish to reach them — now on and off its branded marketplace.

Alexa was built as a layer on top of Amazon’s commerce platform — first connecting consumers with information, then tasks, then access to information and services that led to commerce: ordering flowers, calling an Uber, ordering pizza for delivery.

Alexa also wasn’t built to be device-centric, channel-centric or use-case centric. Alexa was built to go where her users take her — including while driving in their cars.

This isn’t to say that Alexa and Amazon have car commerce sewn up, nor even voice-activated commerce in the bag.

Google and Google Assistant has its roots in search and commerce too, and consumers are used to “asking Google” a lot, including where to buy things. Google has also introduced a line of hardware devices that have captured more than 25 percent of the voice-activated market and is assembling a cohort of merchants, including Walmart, that would like to give Alexa a run for her money. In the car, Google’s Waze and Maps are the driver’s go-to’s that are also integrated with connected commerce experiences, including a growing number of order-ahead options at quick-service restaurants.

But this is to suggest, and suggest strongly, that the race isn’t about OEMs wanting a spiffy in-dash, voice-activated, OEM-branded experience and being fearful of big tech getting into their space.

Big tech is in their space because the consumer has put them there.

The voice-activated, connected device experience those consumers are taking into those cars is just one stop on the connected journey consumers take every day. Consumers don’t want an experience that connects them to a device, but one that can connect them to their lives.

And they want it now.

At $29.99 (soon to be $49.99), the Echo Auto can put Alexa behind the wheel of every car on the road now. It will likely be under many Christmas trees this holiday season. For Alexa, connecting the car to commerce is first about connecting the consumer to commerce, then giving her the ability to take that experience on the road, wherever it may lead.

Still, I wouldn’t count Google out. It has significant strengths and a powerful Android-based ecosystem. Or, for that matter, Apple, which is pretty much nowhere today when it comes to a voice-activated ecosystem — a 4.1 percent share — but has all the incentives and the money to fight its way back into the game.

But this is going to be a race between tech giants who can power rich ecosystems inside of the car and out — not the car OEMs who don’t want today to share the road.

And at least one of those tech giants is using a pleasant, female voice as the intermediary that connects those many endpoints for the consumer.