Along with digital transformation, innovation has been a buzzword for some time. These may seem like abstract concepts, but innovation has had concrete results in the financial industry. For example, in the newly released J.D. Power 2019 U.S. Retail Banking Satisfaction Study, retail banking was declared to have bounced back reputation-wise over the past decade, due to improvements in customer service spurred by innovations like mobile banking.

In partnership with i2c, PYMNTS produced the March 2019 Innovation Readiness Index to assess the state of innovation in the financial industry.

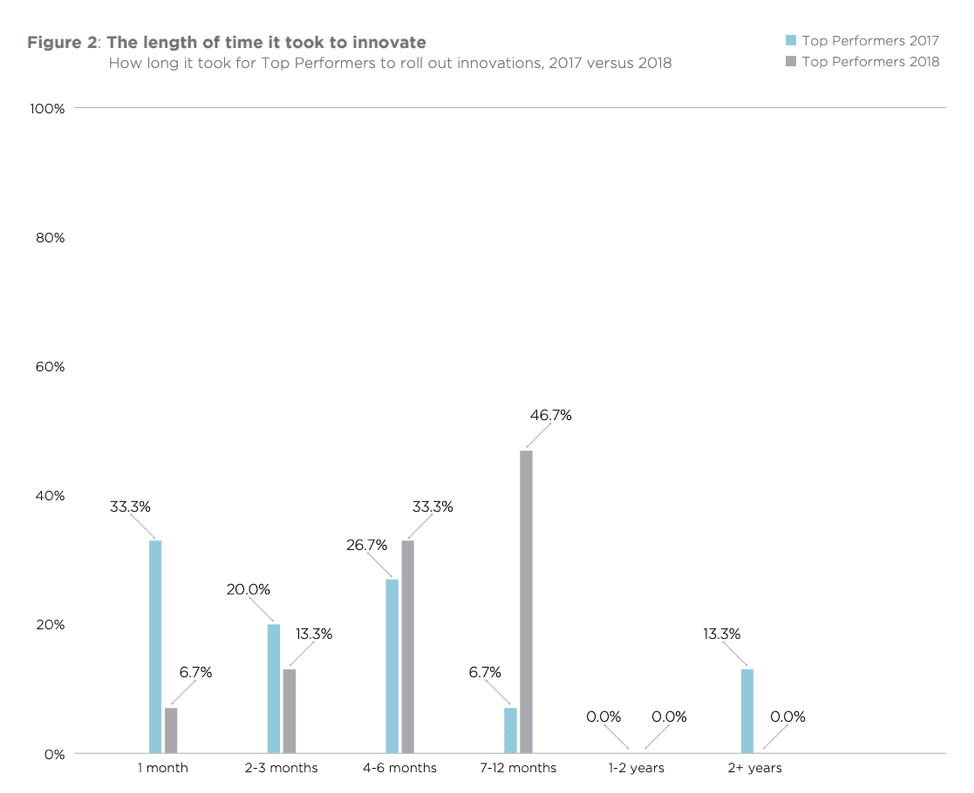

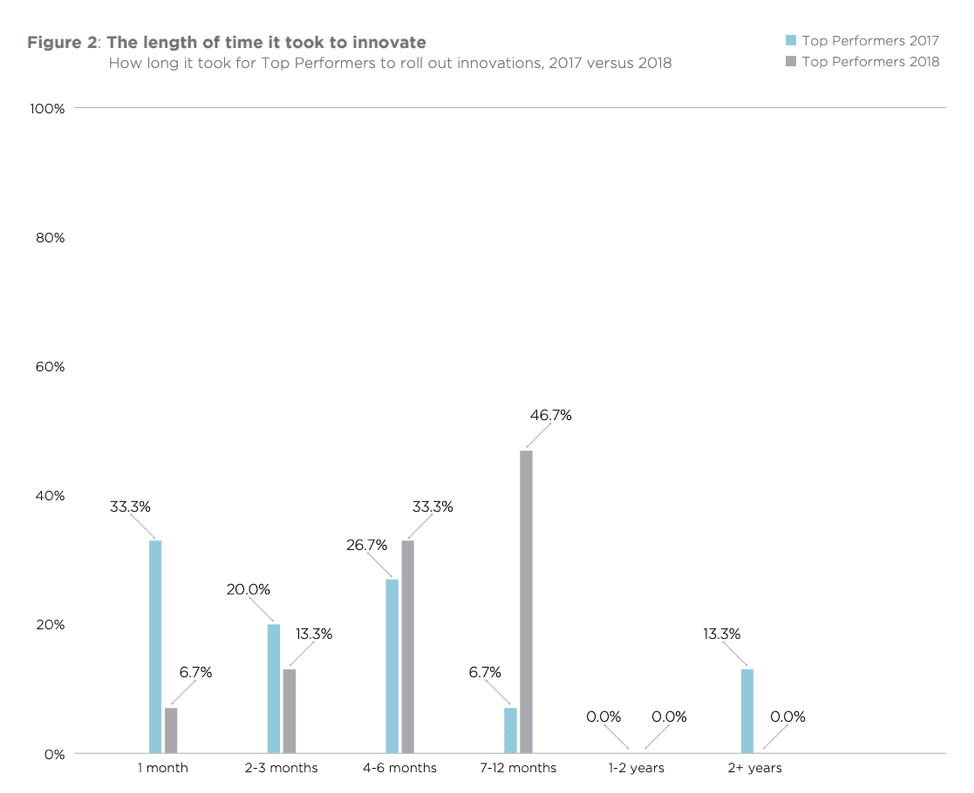

One finding that could be cause for concern was that the top performers seemed to be at a standstill. In 2018, it took longer to bring new features to market than in prior years. For 46.7 percent of those surveyed, it took seven to 12 months to launch innovations in 2018, compared to 33.3 percent only taking one month in 2017.

What changed year to year? In 2018, IT infrastructure was cited as the biggest barrier to innovation (37.8 percent). Community banks (45.6 percent) were far likelier to claim IT infrastructure as a hindrance than credit unions (CUs) at 35.1 percent or commercial banks at 32.4 percent. This makes sense, since commercial banks would appear to have larger budgets than community banks, and more revenue at the ready for investments.

However, innovation doesn’t necessarily tie directly to earnings. In the study, financial institutions (FIs) were given index scores on a scale of zero to 100, and, in 2018, the firms with the most assets did not outperform those with the least. For instance, banks with over $1 billion in assets scored a 31.5, while those with assets of less than $500 million scored higher at 35.2.

It can sometimes appear that there’s no rhyme or reason behind FIs’ fixation on innovation, like it’s just something one is supposed to do to stay relevant. When asked, this drive to innovate appeared to be consumer-driven — 68.2 percent said changing consumer behavior was the impetus, and bill payments were specifically a focus of innovation (72.1 percent) to meet this consumer demand.

Advertisement: Scroll to Continue

Most banks operated in specifics, and were responding to current (50.6 percent) or potential customers’ (63 percent) needs. Fewer were innovating due to the overarching theme of digital transformation (39.2 percent), to improve their reputations (35.9 percent) or to stay competitive (14.6 percent).

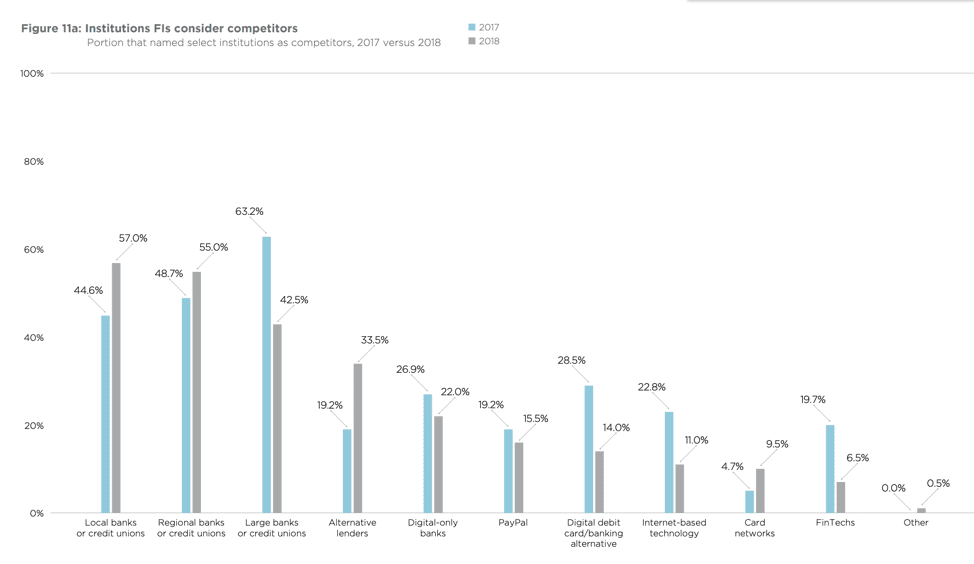

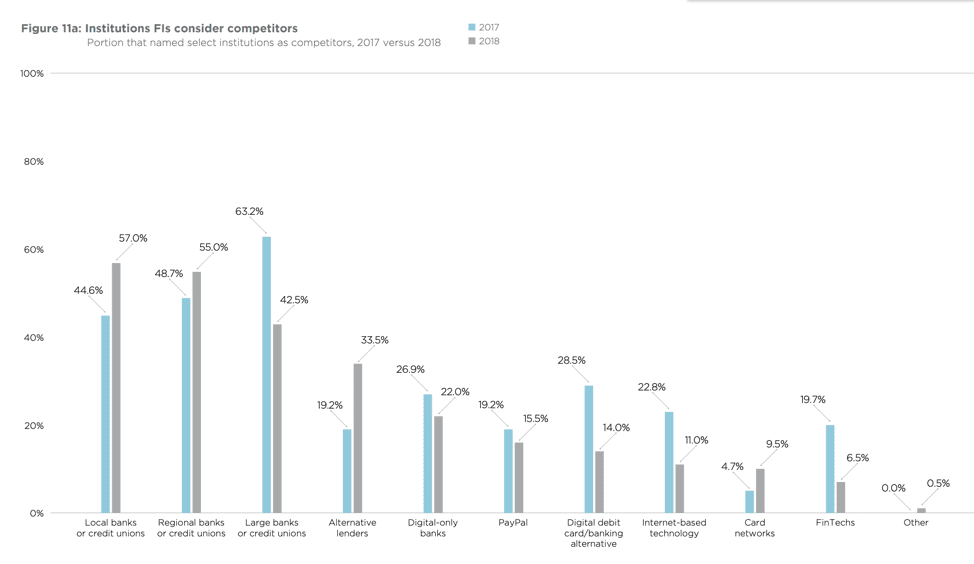

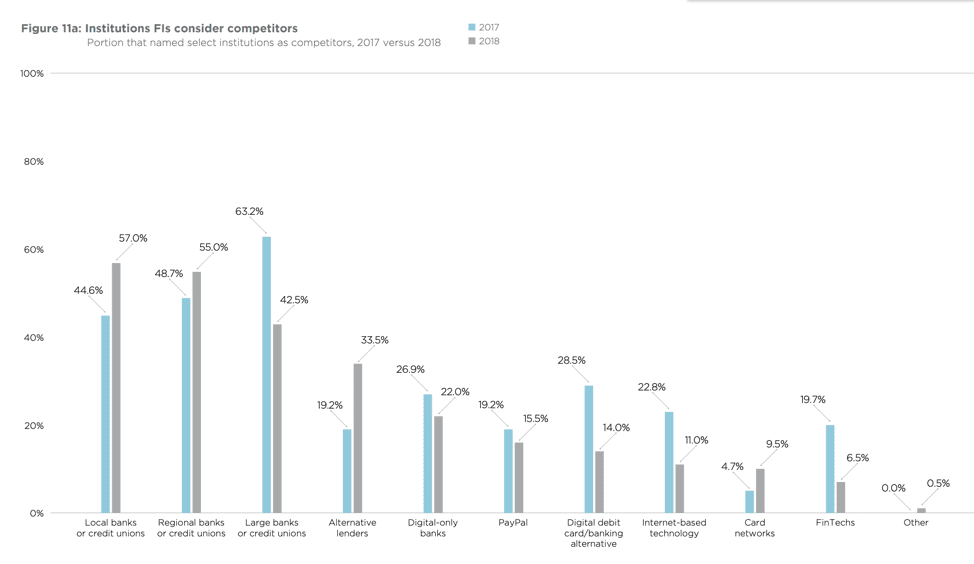

As cited above, bill payments were the biggest area of innovation among all FIs. By type, commercial banks were investing more heavily (84.5 percent) in bill payment innovations than credit unions (80 percent) or community banks (82.6 percent). Credit unions were more concerned with credit card innovations, both consumer (91.7 percent) and corporate (91.7 percent), and 35 percent of credit unions considered large banks to be competitors.

This is a fairly accurate self-assessment, according to the Credit Union Innovation Playbook, a collaboration between PYMNTS and PSCU. Credit union members, especially younger ones, expressed interest in banking options like mobile apps that many would associate with larger banks. The Playbook found 59.9 percent of current CU members considered it “very” or “extremely” important for their CUs to offer mobile apps, and 50.4 percent of Gen Z said they chose their CUs because of the mobile app offerings.

A large number of CU members (90.1 percent) said they are “very” or “extremely” satisfied with their CUs’ desktop/mobile websites. This doesn’t mean complacency, though, as 78.8 percent of CU members expressed willingness to switch from a CU to a FinTech, due to easier and more convenient services.

The Innovation Readiness Index also found that FinTech firms were a leading threat — not just to credit unions, but all FIs — because of their lack of fear in investing in innovative initiatives. However, just 6.5 percent of FIs in the study said they considered FinTech firms to be their competitors, far fewer than in 2017 (19.7 percent).

Recent developments point toward a different direction. Kabbage, Square and Amazon are all encroaching on traditional FIs’ territory by courting small businesses with innovative credit products. Both established and emerging FinTech firms are well-positioned to capture traditional FIs’ customers.