US Banks Plan 2023 Investments in Receipt Data Innovation

Collaboration between retailers, financial institutions (FIs) and FinTechs powers the rich, seamless commerce and banking experiences today’s digitally-savvy consumers expect. Often, this includes leveraging the full value of item-level receipt data in a simple, secure way to better engage with merchants and consumers.

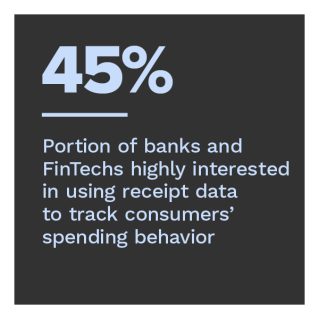

PYMNTS’ research finds that nearly half of financial service providers are highly interested in using receipt data to improve consumers’ understanding of their spending behavior. One-third also believe it will support innovation in new customer acquisitions. On average, 57% of highly data-ready firms are likely to invest in receipt data technology across all use cases we studied. FIs and FinTechs were mostly likely to cite investments in spending behavior and fraud-related solutions as important.

“Tapping Into The Benefits Of Item-Level Receipt Data,” a PYMNTS and Banyan collaboration, examines how financial service providers use item-level receipt data to build relationships with merchants and consumers. Between June 30 and July 27, we surveyed 351 executives representing  FIs with at least $5 billion in assets and FinTechs with at least 1 million active monthly users.

FIs with at least $5 billion in assets and FinTechs with at least 1 million active monthly users.

More key findings from the study include:

• Banks and FinTechs recognize the benefits of using receipt data, with 4 out of 10 firms utilizing this data for most or all of their operations. Most of the FIs and FinTechs surveyed support at least some of their operations with receipt data, while 41% use receipt data to support most or all their operations, including product development, marketing and fraud prevention. Widespread use of receipt data is more likely to take place at larger firms: 55% of large FinTechs use receipt data for all or nearly all operations, whereas 48% of large banks do the same.

• Nearly half of firms are highly interested in using receipt data to improve consumers’ understanding of their own spending behavior. This share increases to nearly 80% among firms with high data readiness.

Firms are particularly interested in using receipt data to improve consumers’ understanding of their spending behavior and to mitigate and prevent fraud. While high data-readiness firms are the most interested in using receipt data to boost consumers’ understanding of their spending behavior, 73% of these firms are very or extremely interested in using receipt data to prevent and mitigate fraud.

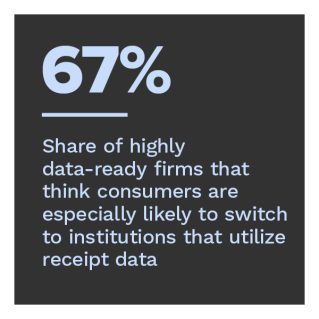

• Banks and FinTech firms believe that the use of receipt data will support innovation in new customer acquisition. Sixty-seven percent of surveyed firms with high data readiness think consumers would be very or extremely likely to switch to institutions that provide solutions that use receipt data. For specific solutions — such as streamlining expense management and loyalty and shopping offers — the belief in receipt data solutions as a driver of customer switching behavior jumps to 88% and 78%, respectively.

To learn more about how banks and FinTechs are utilizing item-level receipt data to build relationships with merchants and consumers, download the report.