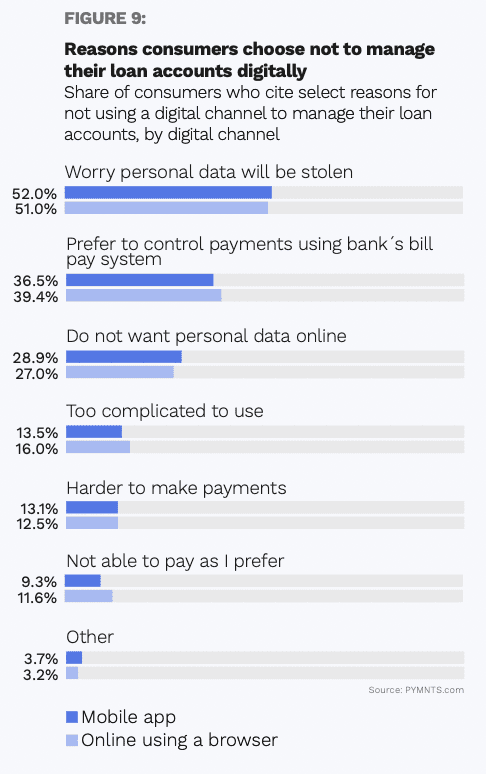

According to “Account Opening And Loan Servicing In The Digital Environment,” a PYMNTS collaboration with Finicity, a Mastercard company, 61% of consumers have loan accounts with outstanding balances.

Get the Report: Account Opening And Loan Servicing In The Digital Environment

These include several types of loan accounts. The most common type is held by homebuyers and landowners: 33% of consumers have a mortgage account open with an outstanding balance.

Another type of loan account that is very common is an auto loan, with 31% of consumers reporting they have one. The next most common types include personal loans (reported by 16% of the consumers surveyed) and student loans (14%).

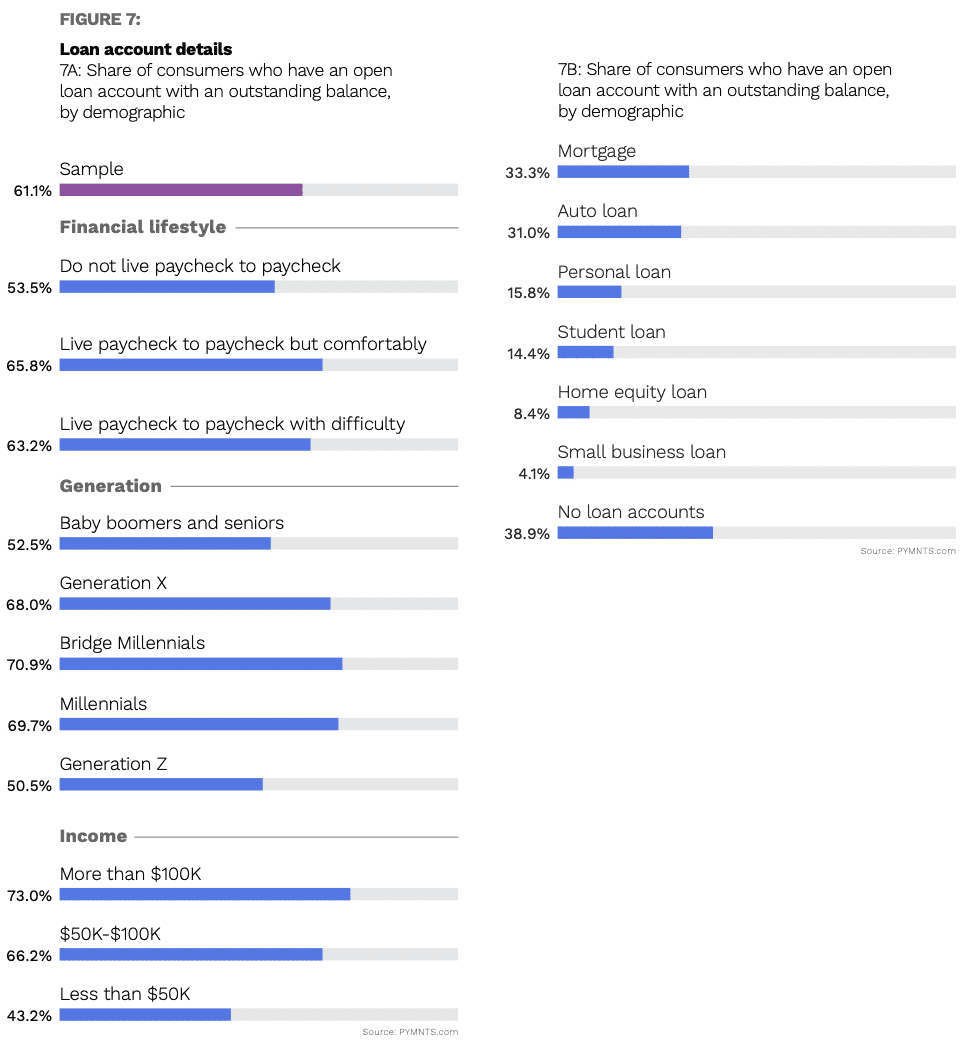

Seventy-two percent of consumers manage these accounts online. Among the consumers with loan accounts with outstanding balances, 51% manage their loan payments digitally and are willing to share access to their financial data for this purpose, while 21% manage their loan payments digitally without giving access.

Advertisement: Scroll to Continue

Only 29% of consumers manage these accounts non-digitally.

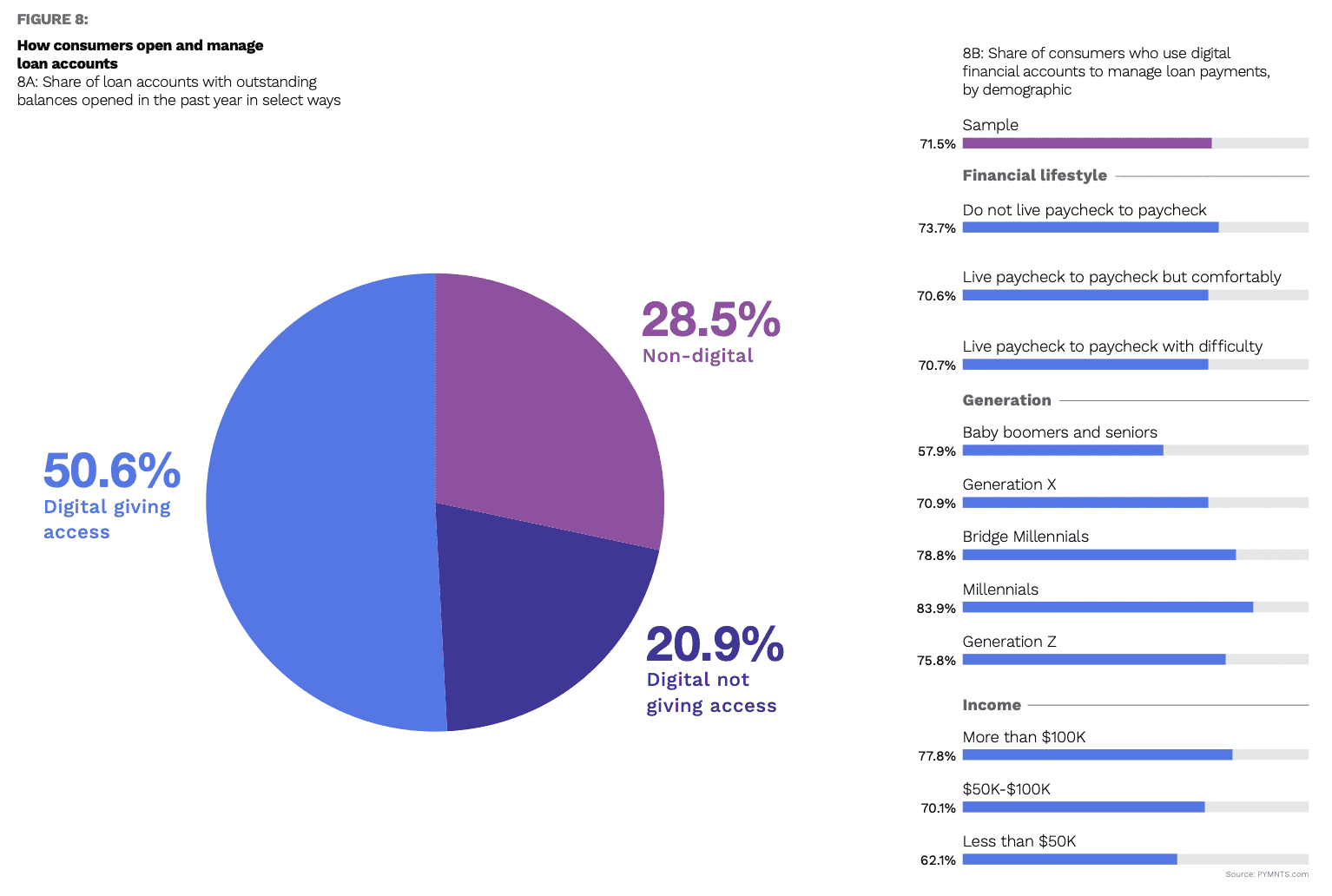

Among the consumers who do not manage their loan accounts online, most resist doing so because they worry their personal data will be stolen. Fifty-two percent of consumers who use mobile apps, and 51% of those who use web browsers, say that is a reason they choose not to manage their loan accounts digitally.

Among the consumers who do not manage their loan accounts online, most resist doing so because they worry their personal data will be stolen. Fifty-two percent of consumers who use mobile apps, and 51% of those who use web browsers, say that is a reason they choose not to manage their loan accounts digitally.

The next most common reasons cited by consumers are that they prefer to control payments using the bank’s bill pay system and they do not want their personal data online.

Smaller shares of consumers say they do not use a digital channel to manage their loan accounts because it’s too complicated to use, it’s harder to make payments or they are not able to pay as they prefer.

While the percentages vary among those who use mobile apps and those who web browsers, both groups of consumers rank these reasons in the same order.