As restaurant and grocery aggregators increasingly find new revenue streams to offset delivery losses, DoorDash is getting into lending.

The food delivery giant announced Wednesday (Feb. 9) that it is partnering with financial services technology company Parafin to launch DoorDash Capital, through which the delivery company can provide financing to restaurants with a “proven track record” on the platform.

“As we continue to listen to our partners and adapt our services and offerings to meet [restaurants’] needs, one key area where they have asked for support is quick and easy access to capital,” Tom Pickett, the company’s chief revenue officer, wrote in a DoorDash Newsroom post. “That’s why today, DoorDash is introducing DoorDash Capital, a new merchant service that provides fair and convenient access to financing for eligible merchants.”

Through the service, businesses can check their eligibility and see how much they are being offered through the Merchant Portal, and if they are interested, they can accept the offer for a one-time fee. Repayments are collected without interest as a percentage of DoorDash sales.

“In our evolving efforts to support restaurants, we will continue to develop products and services rooted in strengthening our restaurant community,” wrote Pickett.

Advertisement: Scroll to Continue

The move comes at a time when restaurant aggregators are being tasked with the challenge of working harder for the merchants on their platforms. For much of 2020, restaurants were more or less at the mercy of delivery marketplaces, relying on them to attract customers and fulfill orders. However, over the past couple of years, a combination of local regulations, digital innovations, challenger tech providers, shifting consumer habits and more has helped to loosen aggregators’ grip.

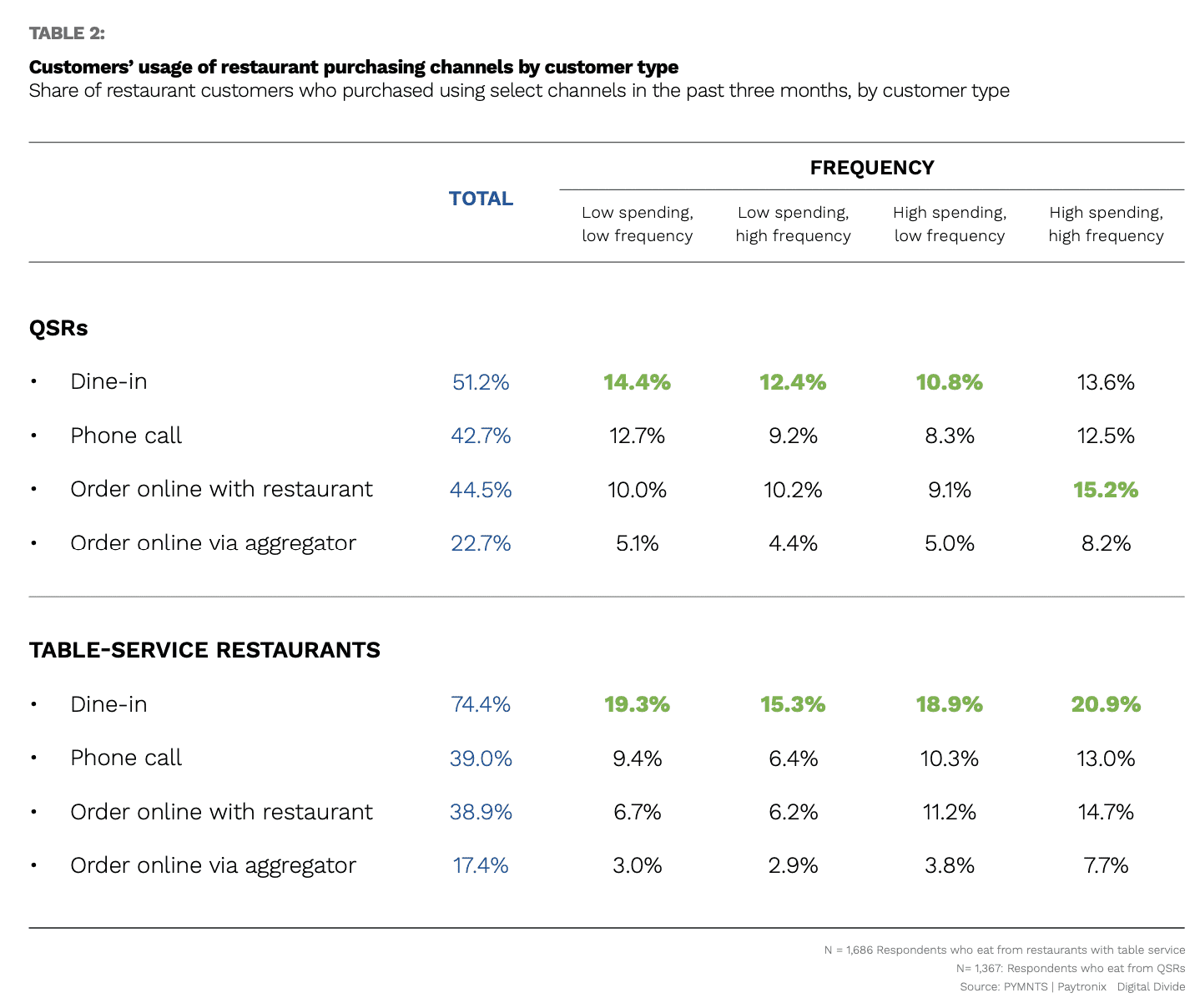

In fact, consumers now order online through restaurants’ direct channels more often than they do through aggregators, according to data from PYMNTS’ November 2021 study Digital Divide: Aggregators and High-Value Restaurant Customers, created in collaboration with Paytronix.

View the full report: Digital Divide: Aggregators and High-Value Restaurant Customers

The study, which surveyed a census-balanced panel of more than 2,200 U.S. adults about their food purchasing habits, found that 45% of consumers had ordered online from quick-service restaurants’ (QSRs) direct channels in the prior three months, while only about half that share had ordered online via aggregator. Similarly, 39% of those surveyed had ordered online from table-service restaurants’ direct channels in the same period, while only 17% had ordered from these restaurants via aggregator.

Given that restaurants are now attracting most of their online sales through direct channels, aggregators now have to compete for merchants’ loyalty. In November, for instance, DoorDash and Grubhub both announced features that offered restaurants more flexible fulfillment options, allowing them more choice with regard to when they do or do not use these services’ driver networks.

Related news: DoorDash and Grubhub Race To Offer Restaurants the Most Flexible Fulfillment

Of course, while a large restaurant brand such as a major QSR chain may be able to invest in competitive direct ordering platforms, smaller restaurants, many of which are still struggling to recover from the devastating impact that the pandemic has had on the industry, are in a very different position.

By becoming these restaurants’ financier, DoorDash is better able to secure these restaurants’ loyalty while promoting an initiative that runs couther to the restaurant-hostile perception of aggregators.