Student Loan Forgiveness Offers Cash-Strapped Consumers Breathing Room

The cancellation of student debt may be a bit of a political football. Some opponents argue that the debt should not be cancelled, as the burden would be shouldered by taxpayers.

Others cheer the concept but state that what’s on the table does not go far enough.

But for the paycheck-to-paycheck consumer, and by extension for the economy at large, having more money in-pocket, so to speak, will likely be a boon.

As is widely anticipated, the President Joe Biden administration is set to forgive up to $10,000 in federal debt for many Americans, specifically those earning up to $125,000. That action would have far-reaching impact. As noted by the Education Data Initiative, federal loans account for $1.6 trillion of the $1.7 trillion student loans in the United States — more than 92%.

Drill down a bit, and the data show households in the middle-class income bracket owe on average $43,090 in student loans. Households in the lowest income quartile owe an estimated 12% of all student debt, which translates to about $204 billion.

Elsewhere, as determined by the Congressional Research Service, 15 million borrowers, at about 33% of the total, would see their debt wiped out in its entirety.

The debt burden itself is keenly felt by all income strata, where student debt to income ratios are in the high 30% range for borrowers who make anywhere from $20,000 annually to about $60,000 annually. That ratio increases to about 40% for borrowers who make between $90,000 to $100,000.

Some Paycheck-to-Paycheck Relief

The read across here is that the paycheck-to-paycheck economy feels the sting most keenly — and the paycheck-to-paycheck economy is, well, most of us.

PYMNTS’ own data shows that all levels of income, increasingly, are living to paycheck to paycheck. In recent research, we found that nearly half of those earning more than $100,000 live that way; the ratio increases to 60% for those earning $50,000 to $100,000 and nearly 78% of consumers who earn less than $50,000.

Connect the dots a bit, and freeing up double-digit percentages of income would indeed give some breathing room to those consumers. We’re seeing, at least for now, some pullback in spending on discretionary items, as evidenced by Target’s earnings and any number of other retailers.

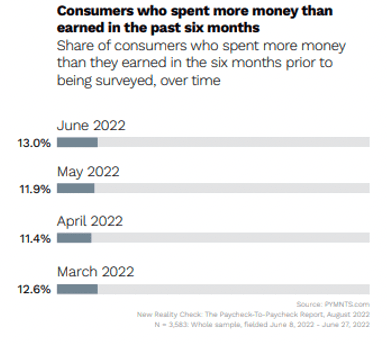

At the same time, the stretching of paychecks shows up in the fact that 13% of consumers have spent more than they have earned over the past several months, which indicates that covering the most basic obligations — mortgages/rent, car payments and student loans among them — has become harder to do. Eliminating one of those burdens (the student loans) in whole or in part, would go at least some way in restoring buying power to the cash-strapped consumers, and perhaps pad savings.