Driven by interest rates that, at least for the near future, the Fed hints will continue to rise, banks have reported the market value of issued loans are currently less than their balance sheet at the end of 2022. These declining loan values could put pressure on bank liquidity, leading to a further pullback of business lending that in February had already dipped to just below 15%, a 10-month low. This shift couldn’t come a worse time for small and medium-sized businesses (SMBs) already struggle to access credit. Sectors specifically affected include business-focused hotels, as lenders are now requiring more capital from hotel owners over concerns about future declines in occupancy rates that may lead to decreased property values.

A contraction in lending may be especially bad news for the significant portion of SMBs relying on bank-issued loans reflected in PYMNTS’ April collaboration with Enigma, “Main Street Health Report.”

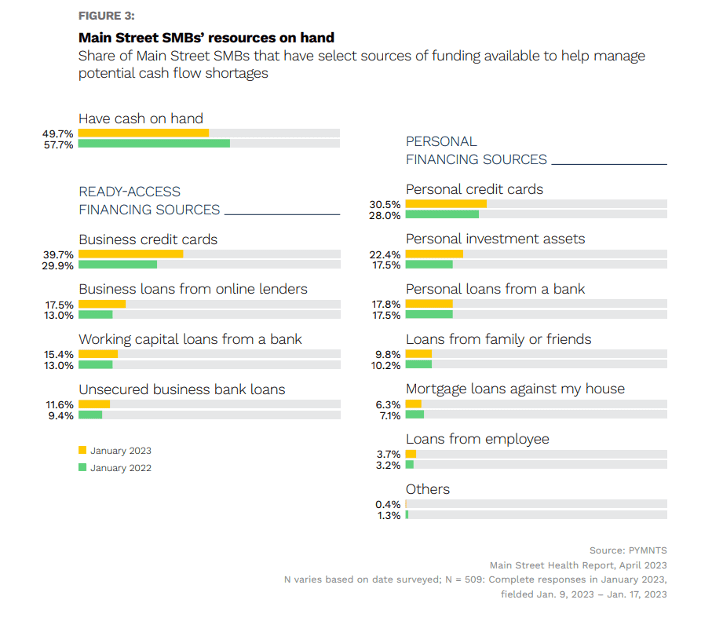

Of Main Street SMBs surveyed, over one-quarter rely on bank-issued working capital or business loans to help manage any potential cash flow shortage in January 2023. An additional 18% rely on personal loans from a bank, which are also at risk as banks reexamine their lending strategies.

Fortunately for SMBs seeking loans, alternatives to traditional financing exist that may fill this capital “gap.” In some cases, these solutions may come from the big banks themselves, including Citi and its Bridge Built by Citi platform, aimed at offering SMBs an avenue for capital. In an interview with PYMNTS’ Karen Webster, Head of Bridge by Citi Rohit Mathur described the current need for SMBs to get connected to lenders for capital needs up to $10 million. “There are always lenders looking to deploy capital; they just need access to the SMBs, and they struggle to find that access because they’re competing with large institutions and online lenders. Many of these [community] institutions don’t have the capital themselves to build that digital storefront [to compete].”

There are other services offering solutions to SMB financing, including digital banks, credit union matching marketplaces and FinTech commercial lending platforms. These options may be, at least, some help to SMBs as they weather the near-term financial future.