Traditionally, consumers rely on their primary financial institutions (FIs), such as banks or credit unions (CUs), for credit products like credit cards, mortgages, auto loans and personal loans. However, research indicates a shift in consumer behavior, with more individuals actively seeking better deals and turning to alternative financial service providers, including FinTechs, that provide these products.

In “Credit Union Innovation: How Credit Product Rates Impact FI Selection,” PYMNTS Intelligence draws on insights gathered from a survey of 4,000-plus consumers, 100 CU executives and over 50 FinTech executives to assess consumer criteria when selecting credit products, and how their decisions influence their choice of FIs.

According to the study, 83% of consumers indicated their primary FIs offer credit cards, followed closely by personal loans at 80%, auto loans at 79%, and mortgages at 77% — making up the top four commonly provided credit products. Comparing the range of credit offerings between CUs and other FIs, CU members more often perceived their primary FIs as providing a broader array of credit products, except for business lines of credit.

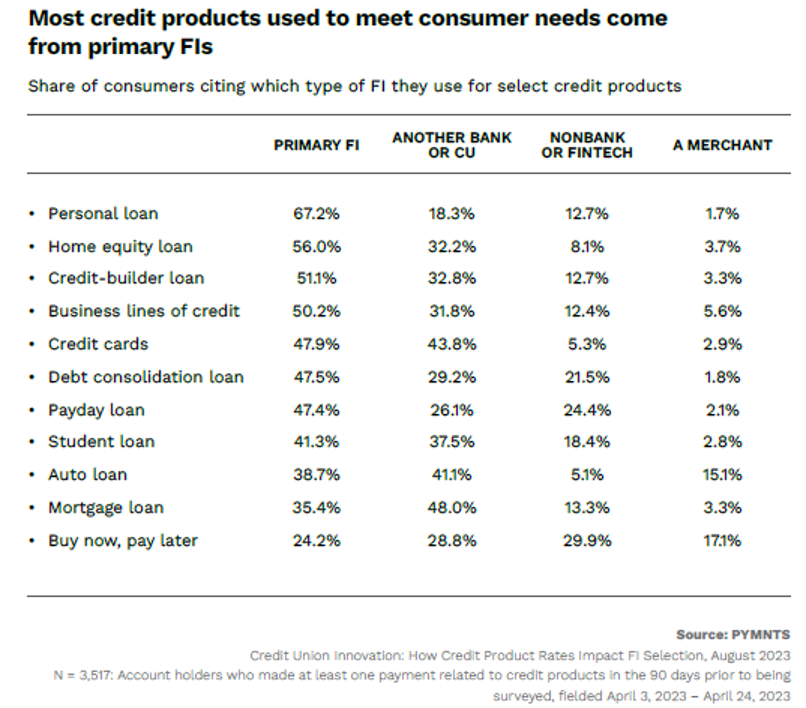

The study also showed that 63% of account holders possess at least one of these four credit products with their primary FIs. Among these, personal loans and home equity loans emerged as the most prevalent, held by 67% and 56% respectively. This could imply strong customer loyalty to primary FIs, potentially influencing decisions when rates and terms align across multiple FIs.

A closer look at the data also revealed that interest rates and payment terms are the most important factors for consumers when choosing an FI, and they are the primary reasons for account holders to switch to another FI with better offerings. Credit union members (32%) were found to be more likely to switch accounts based on rates and terms compared to non-credit union members (26%).

Aside from rates and terms, consumers also valued the speed at which funds become available after applying for a credit product. While credit unions have made significant progress in reducing setup times for many of their offerings, they still face competition from FinTech companies, particularly in providing installment payment plans like buy now, pay later (BNPL) directly to consumers.

The study further revealed that although 75% of account holders stated their primary FIs commonly provide major credit products, such as mortgages and auto loans, consumers are inclined to explore competitive interest rates and payment conditions for these specific loans.

Notably, 48% of mortgages and 41% of auto loans are sourced from banks or CUs distinct from consumers’ main FIs, suggesting that consumers actively seek better terms elsewhere, aiming to enhance credit affordability and save money by exploring alternate providers.

Overall, the study emphasized that interest rates, payment terms and the availability of funds are crucial factors for consumers when selecting an FI and credit products.

Credit unions, while striving to reduce setup times and compete on rates and terms, must adapt to consumer demands and expand their range of credit products to remain competitive in the evolving financial landscape. Failure to do so may result in the loss of members to other FIs, including FinTechs that capitalize on innovative payment methods and attractive rates and terms.