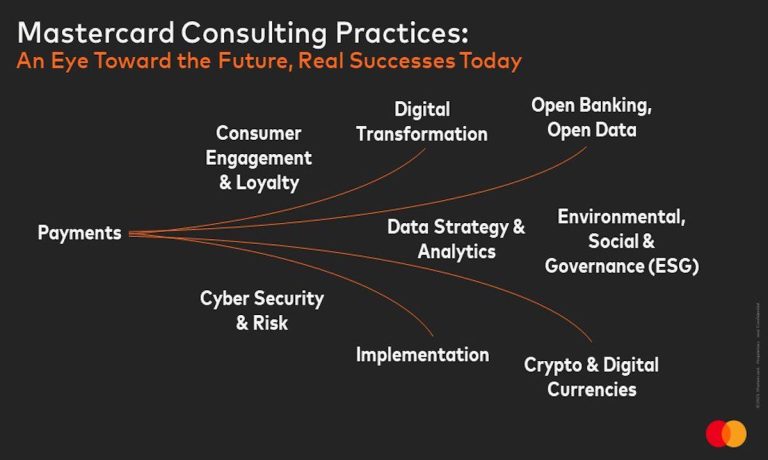

As the business environment continually confronts fast-changing technologies and consumer expectations, Mastercard’s payments-focused consulting service is beefing up its offerings to help clients leverage new opportunities while remaining compliant in a changing world.

Mastercard said in a press release on Tuesday (Feb. 15) that its expanded consulting service has practices dedicated to open banking, open data, cryptocurrency and digital currencies, and environment, social and governance (ESG).

Mastercard’s consulting service has played a central role in customer engagement for over 20 years, according to the release, with subjects covering multi-rail payments strategies, data governance opportunities and much more. The company’s Data & Services talent incubator has a roster of over 2,000 data scientists, engineers and consultants, serving customers in 70 countries around the world.

See also: Mastercard: 2021 was the Year of Digitization

There are also plans for Data & Services to expand its team at pace and add over 500 college graduates and young professionals.

“Payments are just the beginning,” Raj Seshadri, president of Data & Services, Mastercard, said in the announcement. “Over the past 20 years, we’ve worked with our customers across banking, FinTech, retail, travel and other sectors, helping them understand and navigate every challenge and opportunity thrown their way.

“This evolution of consulting is in recognition of the changing world and of our changing business. It’s about helping customers navigate today’s challenges and anticipating what’s next.”

Related: eCommerce Sales Outpace Robust 7.2% Retail Jump in New Year, Mastercard Data Show

The new practice groups will enable Mastercard to continue bringing integrated solutions that tap “world-class thinking, services and tools and assets — such as Ciphertrace, Finicity and Aiia, Cyber Quant and the Priceless Planet Coalition — to drive smarter decisions with better outcomes across a customer’s entire business,” per the release.

The consulting services with banks and merchants offered by Mastercard cover the gamut of what digital currencies can bring to the table. The basics will be covered, as well as risk assessments and bank-wide crypto, non-fungible token (NFT) strategy, crypto loyalty programs and more.