Mobile banking apps are putting convenient financial tools at consumers’ fingertips, but many customers say that several key app functions still leave a lot to be desired.

Mobile banking apps are putting convenient financial tools at consumers’ fingertips, but many customers say that several key app functions still leave a lot to be desired.

Thirty-six percent of consumers report unsatisfactory experiences when using mobile banking apps to add or remove someone from their bank accounts, for example, and 35 percent say the same about opening new accounts at banks with which they already do business.

It therefore appears that many financial institutions (FIs) have some work to do to optimize their mobile banking apps. But how can they identify the functions that resonate most with consumers, and what can they do to ensure that they hit the mark on meeting customers’ expectations?

The Mobile Banking App Playbook, a PYMNTS and Entersekt collaboration, examines how consumers are using mobile banking apps. PYMNTS surveyed a census-balanced panel of 2,581 United States consumers to glean insights into how FIs can tailor their mobile app features to better serve customers and accelerate adoption.

Requiring too many steps to perform each transaction is consumers’ most commonly reported reason for being dissatisfied with their mobile banking apps. Forty percent of respondents reported that this is a reason for being dissatisfied when opening new accounts at banks with which they already do business.

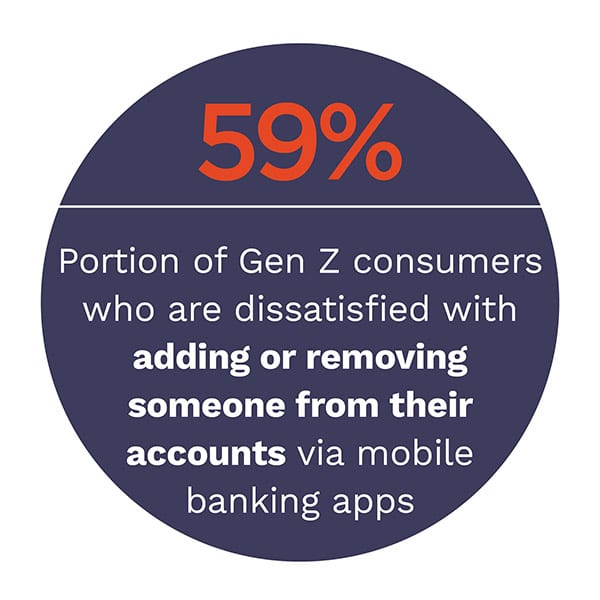

PYMNTS’ research illuminates numerous generational differences when it comes to mobile banking app perceptions. Generation Z consumers stand out for being particularly unsatisfied with certain mobile banking app experiences, with 59 percent expressing high levels of dissatisfaction when adding or removing someone from their accounts. Just one-third of baby boomers and Generation X consumers who use their mobile apps to add or remove someone from their accounts say the same, however.

Consumers do appear to be particularly satisfied with their mobile baking apps in one regard: authentication. The majority of consumers who use mobile apps report being “extremely” satisfied with authentication methods across the board, including voice r ecognition, security questions, one-time passwords, phone numbers, facial identification, PINs, fingerprint scans, email addresses and passwords. Forty percent of consumers use passwords to authenticate themselves on their mobile banking apps, making it the most commonly leveraged authentication method, and 82 percent are “very” or “extremely” satisfied with this option. Voice-based authentication and security questions, on the other hand, are the least satisfying authentication methods, with 34 percent and 33 percent of users being “somewhat” or less satisfied with these options, respectively.

ecognition, security questions, one-time passwords, phone numbers, facial identification, PINs, fingerprint scans, email addresses and passwords. Forty percent of consumers use passwords to authenticate themselves on their mobile banking apps, making it the most commonly leveraged authentication method, and 82 percent are “very” or “extremely” satisfied with this option. Voice-based authentication and security questions, on the other hand, are the least satisfying authentication methods, with 34 percent and 33 percent of users being “somewhat” or less satisfied with these options, respectively.

These findings touch on just a few of the insights outlined in PYMNTS’ research. To learn more about how consumers are using mobile banking apps, and how FIs can ensure they are offering the right features to further engage with customers, download the report.