It’s a poser alright. PYMNTS January 2021 Mobile Banking App Playbook, an Entersekt collaboration, tackles the topic from a variety of salient angles as no commercial entity — from taco trucks to treasury banks — survives bad app experiences unscathed anymore.

This first installment of PYMNTS’ Mobile Banking App Playbook series draws from a census-balanced survey of nearly 2,600 consumers who did not hold back when it came to their mobile banking app preferences. It’s an important read and resource at a decisive time.

Gen Z Probably Thinks Your Banking App Is Slow

Millennials and their nearby demographic cohorts have a reputation for being, shall we say, “discriminating” when it comes to digital experience. They also lead in bank app usage.

It was no shock when researchers discovered that younger demos don’t like outdated apps.

Advertisement: Scroll to Continue

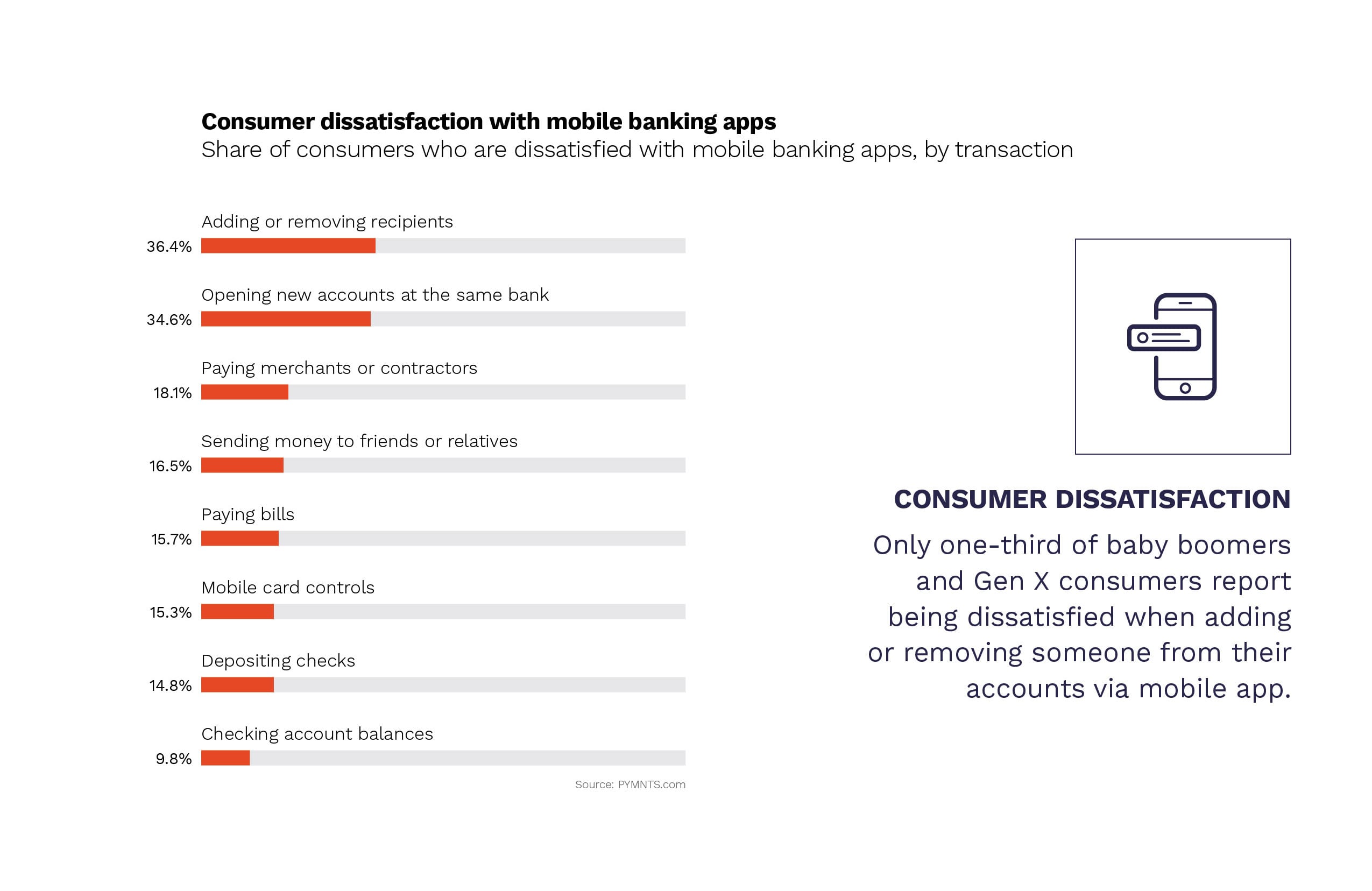

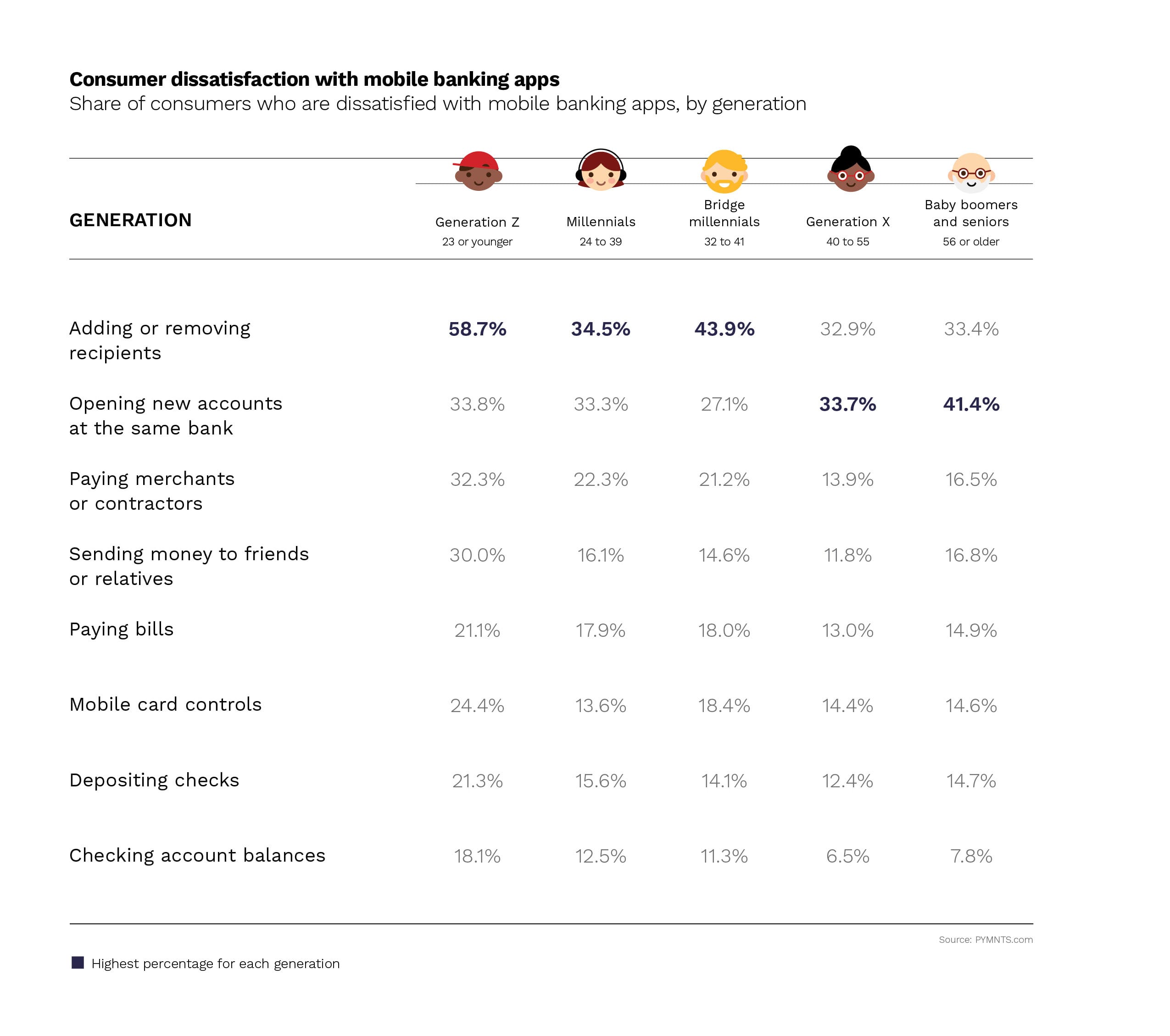

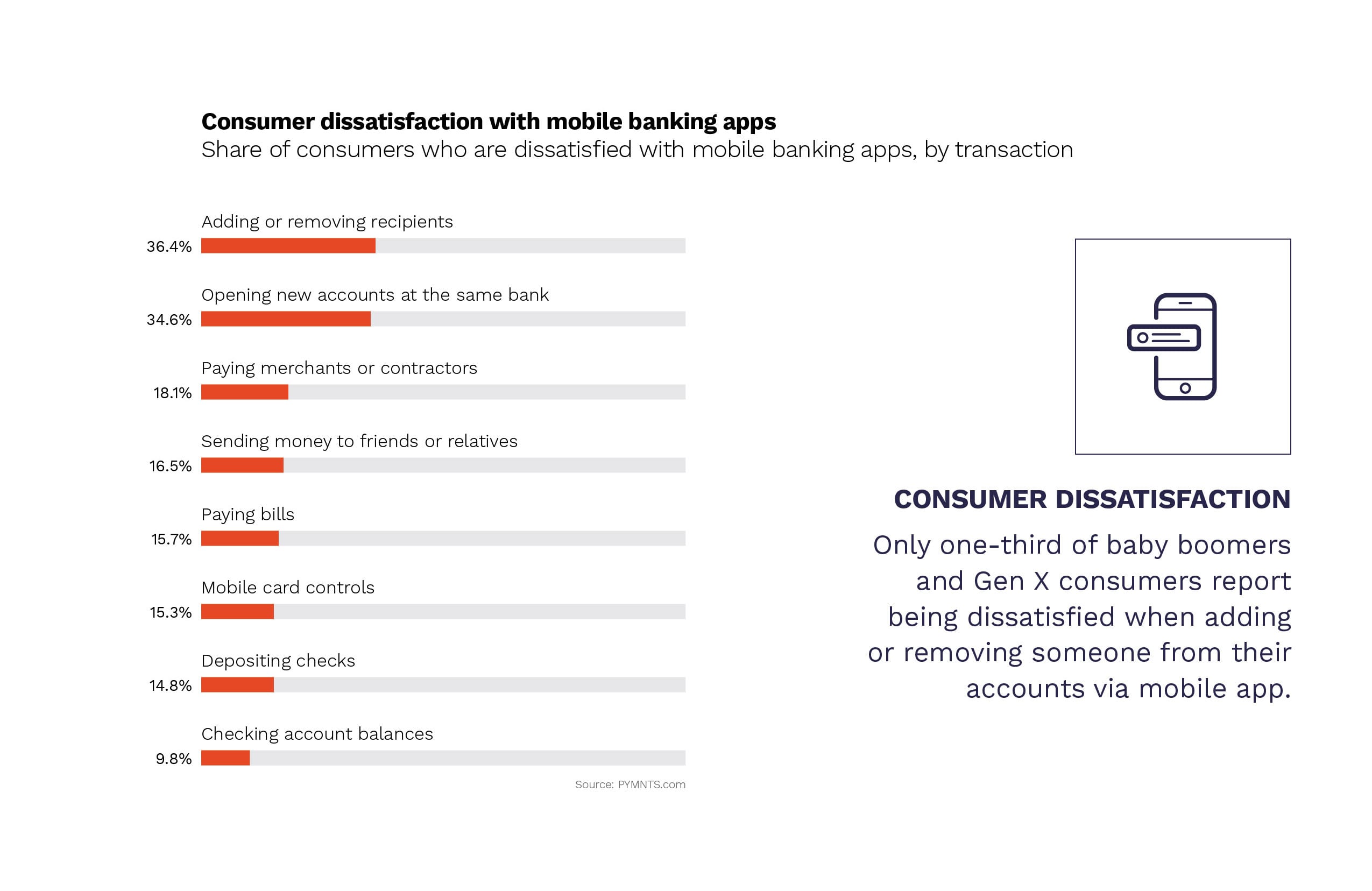

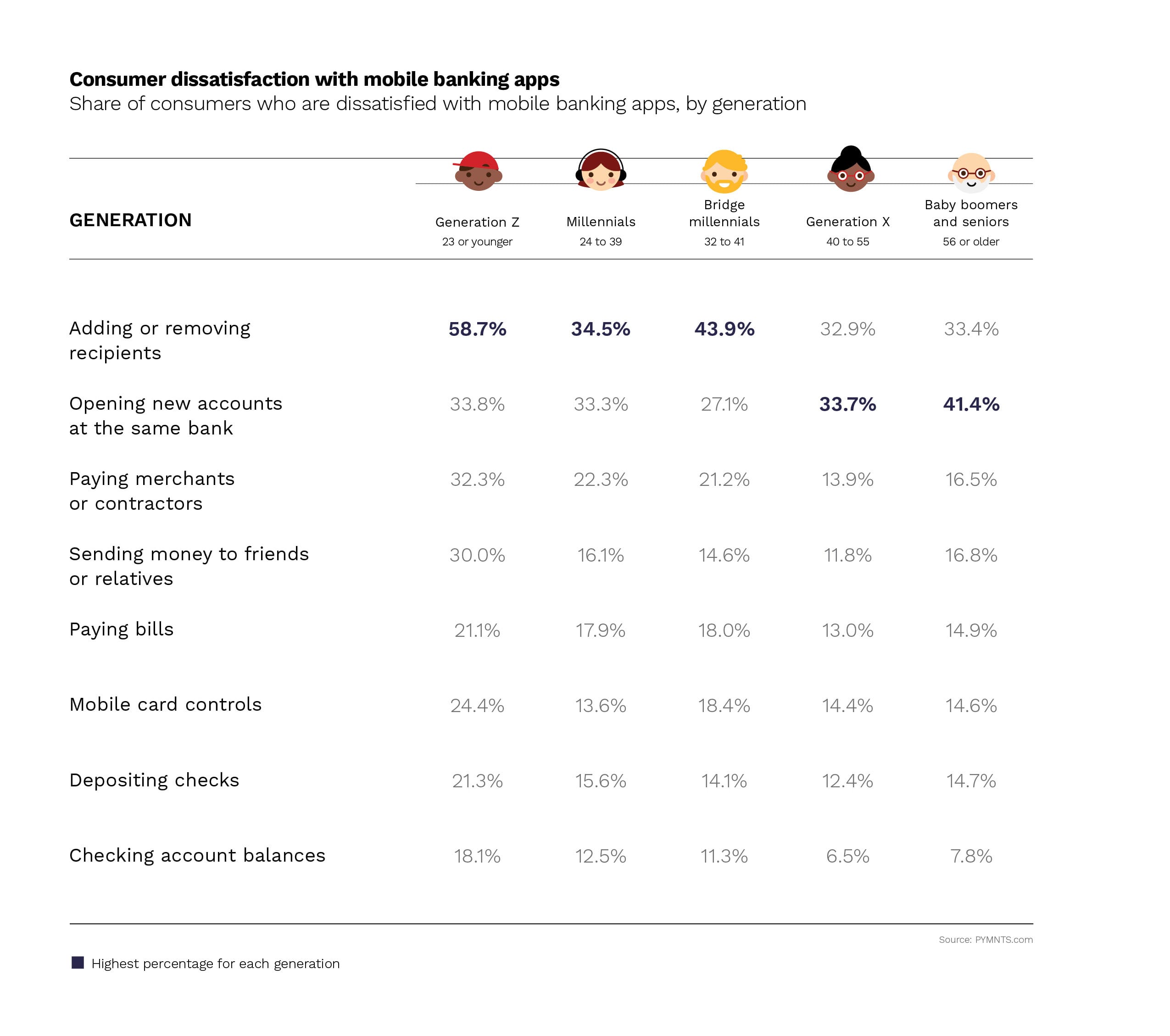

“Gen Z consumers stand out as notably dissatisfied with their mobile banking experience, with 59 percent feeling particularly high levels of dissatisfaction when it comes to adding or removing someone from their accounts,” per the Mobile Banking App Playbook. “Consumers in older age brackets report a lower level of dissatisfaction with their mobile banking apps when performing these functions. Only one-third of baby boomers and Gen X consumers report being dissatisfied when adding or removing someone from their accounts via mobile app.”

What’s doubly strange (and therefore important) in that finding is another. The biggest beef consumers have with legacy mobile banking apps is that their slow, and maybe dangerous.

Per the new Playbook, “The most common reason consumers cite for dissatisfaction with their banking apps is that too many steps are needed to perform each transaction. Forty percent said this was true when opening new accounts at banks at which consumers already had accounts, and an equal share said the same about adding or removing someone from their accounts.”

The moral of that stat? If Gen Z thinks your mobile banking app is unintuitive, fix it. Fast.

Bank App Features That People Do (And Don’t) Like

While this inaugural Mobile Banking App Playbook found dissatisfaction with many aspects of mobile banking apps in-market today, it’s not all bad. After all, people love their apps.

For example, the Playbook notes, “The majority of consumers who use mobile apps report being ‘extremely’ satisfied across all authentication methods, including voice recognition, security questions, one-time passwords, phone numbers, facial identification, PINs, fingerprint scans, email addresses and passwords.”

So, at least authentication is going well. That’s something for banking apps to build on. Which is not to say there’s not plenty of work still to do; there is. However, surgical tweaks can have a transformative effect on mobile app satisfaction. Like shortening how long tasks take in-app.

Per the new Playbook, “Nearly one-third of the 3 percent of consumers who did not complete their transactions said they gave up because the process was too long. Another 29 percent of this group abandoned their transactions because they did not remember their passwords, and 25 percent of this group did not want to enter additional details.”

The bottom line: “A common perception is that online banking offers more functionality than mobile banking apps. FIs that offer mobile apps should take these factors into consideration and address the reality that consumers want simple applications that enable them to perform a wide variety of banking transactions quickly and conveniently,” the new Playbook states.