New Data: 95 Pct. Of Consumers Don’t Use Mobile Wallets For In-Store Purchases

Among its many profound impacts, the COVID-19 pandemic has dramatically altered how consumers shop. Even before large-scale stay-at-home policies went into effect, most consumers sought to limit direct contact with people and objects as much as possible when they went out. One might expect that in these circumstances, consumers would be even more inclined to take advantage of the contactless payment capabilities of mobile wallets, to avoid swiping their cards at point-of-sale (POS) terminals and pressing keypads touched by many other shoppers.

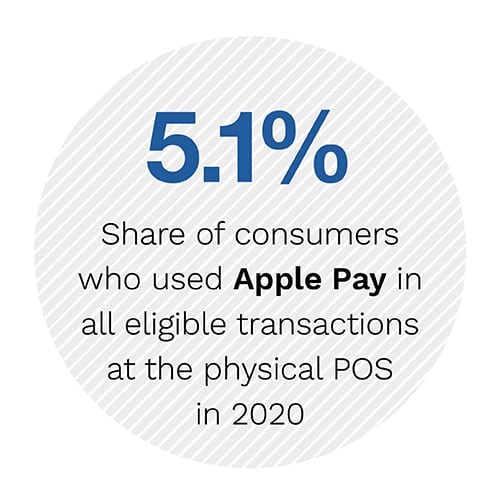

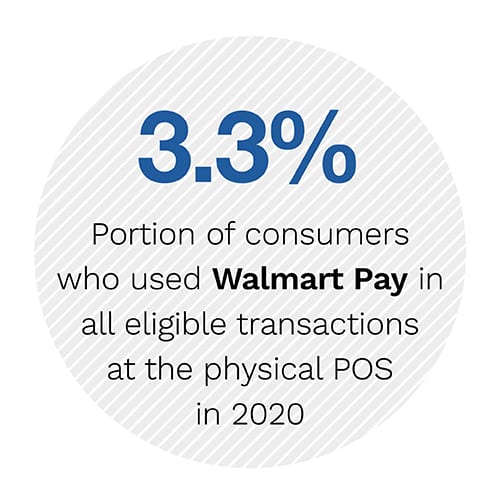

Yet, consumers continue to overwhelmingly prefer physical transactions over contactless methods. Just 5.1 percent of consumers reported using Apple Pay at the POS in early- to mid-March, and just 3.3 percent reported Walmart Pay usage. These are among the key findings in Mobile Wallet Adoption 2020: Mobile Wallet Use And The COVID-19 Pandemic, our latest study in a series tracking the technology since 2015. For the 2020 report, PYMNTS surveyed more than 5,500 U.S. consumers at a time when large-scale restrictions on businesses and public gatherings were just getting underway. For most consumers, essential stores remained open and accessible. In fact, the share of respondents who reported making in-store purchases over the past seven days was 80.2 percent, slightly higher than the 78.1 percent reported in 2019.

Yet, consumers continue to overwhelmingly prefer physical transactions over contactless methods. Just 5.1 percent of consumers reported using Apple Pay at the POS in early- to mid-March, and just 3.3 percent reported Walmart Pay usage. These are among the key findings in Mobile Wallet Adoption 2020: Mobile Wallet Use And The COVID-19 Pandemic, our latest study in a series tracking the technology since 2015. For the 2020 report, PYMNTS surveyed more than 5,500 U.S. consumers at a time when large-scale restrictions on businesses and public gatherings were just getting underway. For most consumers, essential stores remained open and accessible. In fact, the share of respondents who reported making in-store purchases over the past seven days was 80.2 percent, slightly higher than the 78.1 percent reported in 2019.

This does not mean that the pandemic had no effect on how consumers were shopping. In fact, our research shows that purchases in all categories of goods were down in 2020 except for groceries, for which 91.8 percent of respondents reported shopping. Consumers were also considerably less likely to report shopping over the last 24 hours than they were in 2019, an indication that shoppers may have been “loading their carts,” perhaps to limit the frequency of their trips or in anticipation of wider shutdowns.

This does not mean that the pandemic had no effect on how consumers were shopping. In fact, our research shows that purchases in all categories of goods were down in 2020 except for groceries, for which 91.8 percent of respondents reported shopping. Consumers were also considerably less likely to report shopping over the last 24 hours than they were in 2019, an indication that shoppers may have been “loading their carts,” perhaps to limit the frequency of their trips or in anticipation of wider shutdowns.

However, what did not change in consumers’ behavior during this momentous time was their reluctance to use mobile wallets when paying at the register. In fact, Apple Pay’s usage rate declined modestly from 2019 and to an even greater extent from late 2017, when it peaked at 6.9 percent. Usage of Walmart Pay declined to an even greater degree since 2019, from 4.5 percent to 3.3 percent in our latest survey.

These trendlines are all the more remarkable considering the technical progress that has been made since the early days of mobile wallets. Apple Pay now works on 93 percent of all iPhones in the United States, up from just 39 percent in 2015, and it can be accepted at contactless terminals by merchants that collectively generate nearly two-thirds of all retail sales. If Apple Pay and Walmart Pay were used to pay for all the purchases where possible in 2019, the annual sales volume would have totaled close to $3 trillion.

These trendlines are all the more remarkable considering the technical progress that has been made since the early days of mobile wallets. Apple Pay now works on 93 percent of all iPhones in the United States, up from just 39 percent in 2015, and it can be accepted at contactless terminals by merchants that collectively generate nearly two-thirds of all retail sales. If Apple Pay and Walmart Pay were used to pay for all the purchases where possible in 2019, the annual sales volume would have totaled close to $3 trillion.

To learn more about the gap between mobile wallets’ current use and market potential, download the report.