But the appeal of digital wallets — which include Apple Pay, Google Wallet, PayPal and others — doesn’t end with shopping. Digital wallets can also provide other features intended to make the lives of users easier, such as the ability to store important documents like driver’s licenses, passports and event tickets.

But as PYMNTS Intelligence found when researching “Tracking the Digital Payments Takeover: Can New Use Cases Drive Consumer Use of Digital Wallets?” the enthusiasm around using digital wallets to store sensitive documents varies depending on who is asked.

While 51% of U.S. consumers, in general, said they are either somewhat interested or very interested in using digital wallet storage features, 78% of baby boomers and seniors have only a slight interest or no interest in keeping documents on their devices.

The excitement about using digital wallets to store documents climbs when younger consumers weigh in. Forty-nine percent of Generation Z respondents said they are extremely interested, as are 51% of millennials. Forty-six percent of bridge millennials and 26% of Generation X consumers are also extremely interested in using special digital wallet features.

To better understand these varying degrees of enthusiasm, it may help to look at which demographic groups in general use digital wallets.

Advertisement: Scroll to Continue

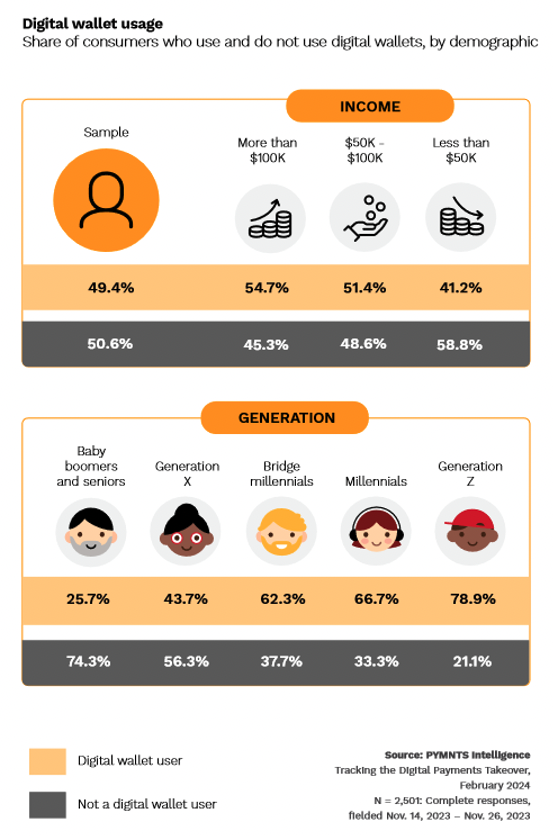

The appetite people have for digital wallets mirrors — to some extent — their excitement about storing documents on their digital devices. Seventy-nine percent of Gen Z consumers are avid digital wallet users, as are 67% of millennials, followed by 62% of bridge millennials and 44% of Gen Xers. Meanwhile, only 28% of baby boomers and seniors use digital wallets.

But age is just one yardstick to judge digital wallet use. How much money people earn each year also appears to shape their interest in digital wallets.

Fifty-five percent of high-earning consumers (those making $100,000 or more annually) are digital wallet users. Fifty-one percent of middle-income consumers (those earning between $50,000 and $100,000 per year) use digital wallets. But excitement around digital wallets tapers off when low-income respondents (those earning $50,000 or less each year) are asked; only 41% of them are digital wallet users.