Digital wallets are becoming essential tools for French consumers, especially as the country embraces the convenience of mobile payment solutions.

In the past year, 38% of consumers in France made online purchases using their digital wallets, and younger generations, particularly Generation Z, are leading the charge in expanding how these tools are used.

While digital wallets are popular for online shopping, the PYMNTS Intelligence report “Digital Wallets Beyond Financial Transactions: France Edition” showed how their role is expanding beyond transactional uses, as many consumers now rely on them for identity verification and travel-related activities.

Digital wallets are popular among French consumers, especially for online shopping. Millennials are particularly active, with 43% reporting using digital wallets for online shopping — representing the highest usage rate among all age groups.

However, in-store use of digital wallets remains less common, with just 22% of consumers having used them for in-person transactions. Gen Z is more likely to use digital wallets in-store, with 39% reporting this behavior, almost double the national average.

The rise of digital wallets for online and in-store shopping is part of a larger trend toward mobile-first payment solutions. This reflects the desire for convenience and speed during shopping experiences, as digital wallets streamline the purchase process by eliminating the need for physical credit cards and cash.

The use of digital wallets for nonpayment purposes is increasing, with younger consumers driving the trend. In the past year, 64% of those using digital wallets for non-transactional services reported high satisfaction.

Gen Z sits at the forefront, with 21% using their digital wallets for travel-related services like boarding passes and hotel keys, nearly double the national rate of 11%. Additionally, 10% of consumers have used digital wallets for ID verification, such as accessing public services or proving age.

This trend shows the potential for digital wallets to function as all-in-one tools for daily life, moving beyond their original financial purpose. With high satisfaction rates for non-transactional uses, consumers are viewing their digital wallets as essential to both shopping and everyday activities.

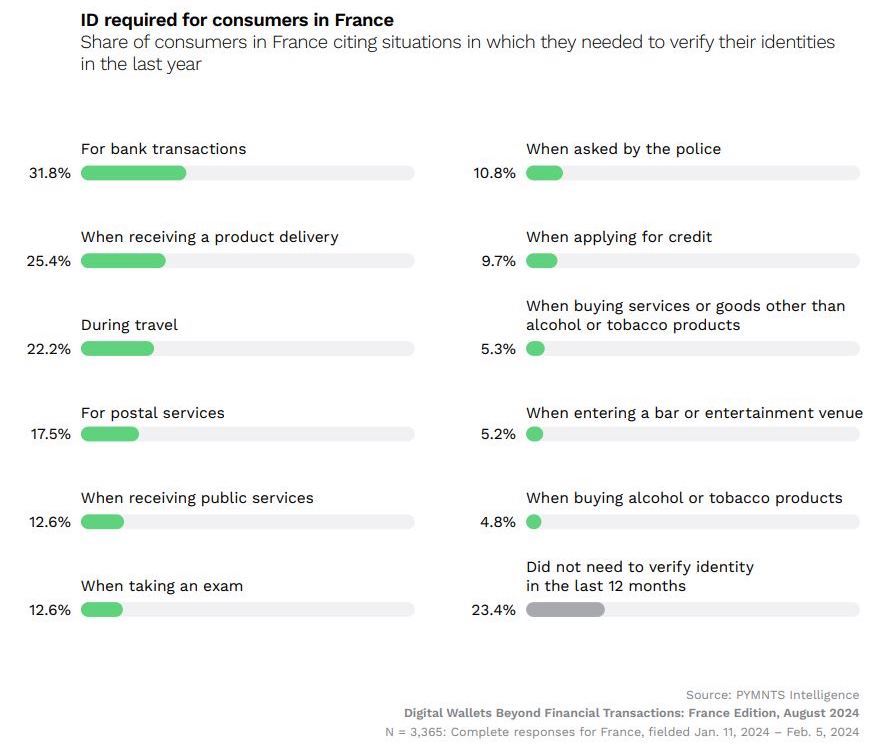

ID verification is another popular use for digital wallets in France. In the past year, 77% of French consumers had to verify their identities for banking transactions, product deliveries or other services. Among these consumers, 25% needed to provide ID when receiving product deliveries, and 32% used digital wallets for banking purposes. Younger consumers, particularly Gen Z, are the most likely to engage in ID verification, with 31% of them reporting that they had to verify their identity during exams.

ID verification is another popular use for digital wallets in France. In the past year, 77% of French consumers had to verify their identities for banking transactions, product deliveries or other services. Among these consumers, 25% needed to provide ID when receiving product deliveries, and 32% used digital wallets for banking purposes. Younger consumers, particularly Gen Z, are the most likely to engage in ID verification, with 31% of them reporting that they had to verify their identity during exams.

As demand for digital ID solutions rises, it’s likely that more services will begin accepting digital wallets for verification, potentially replacing physical IDs in various sectors. Younger generations, particularly Gen Z and millennials, are driving this adoption, and as they expand their use of digital wallets for activities like event access and public services, there is growth potential in the space.