PYMNTS talks with Ben Mendelsohn, director of product management at Fifth Third Bank, about how faster direct deposits have an appeal for workers of all stripes

—

Fifth Third’s journey to early wage access offerings began with immediate funds on check deposits, according to Mendelsohn.

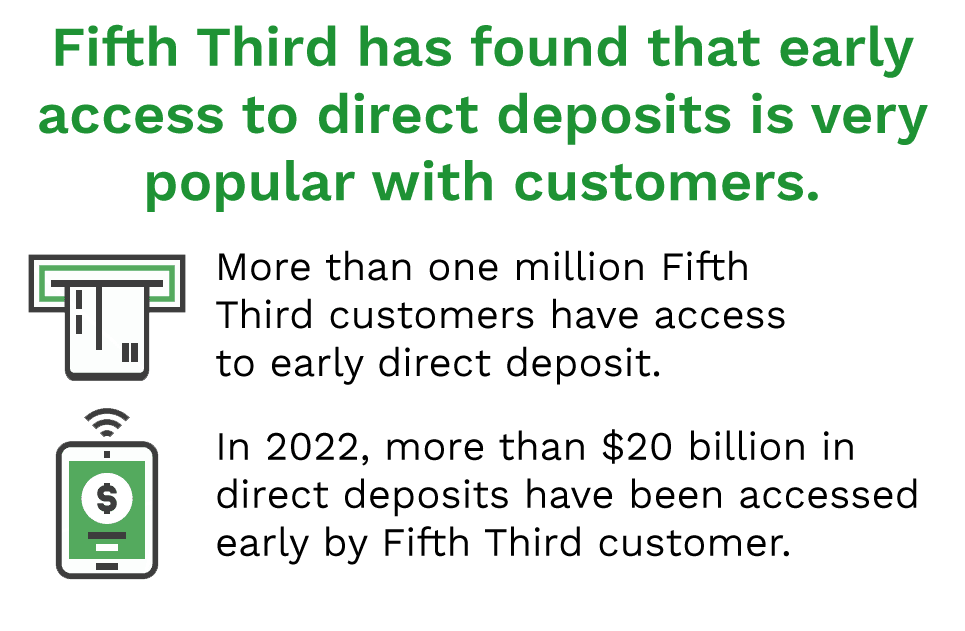

Once FinTechs and other companies began offering faster direct deposit access and similar products, it was not much of a leap for Fifth Third to take its progress in early funds availability and expand it to serve more customers. Regardless of where it is coming from, everyone wants to have the money they are owed available to them as soon as possible. As such, products that allow for quick access to funds appeal to customers across the economic spectrum.

Some companies offer early wage access as an employee perk, but the desire for faster funds availability has a broader audience. Fifth Third’s product was born out of first-party research that noted the growth in the number of 1099 and gig workers, Mendelsohn said. Focus groups showed that many gig workers were already paying fees to their client companies to get their money faster, such as through real-time debit rails.  Since Fifth Third already had the groundwork for faster processing of automated clearing house payments, the bank was able to expand the offering to cover a wide range of direct deposits, even government benefits.

Since Fifth Third already had the groundwork for faster processing of automated clearing house payments, the bank was able to expand the offering to cover a wide range of direct deposits, even government benefits.

Early pay accessed through a full-service bank has significant benefits over the alternatives available to gig workers. Mendelsohn acknowledged that there are a lot of approaches to faster pay, but those outside the banking space have some significant downsides. Rather than simply having money pushed to a card, workers who have early access to direct deposit funds through a bank such as Fifth Third have all the services and products of an actual bank as well. In addition, early access to direct deposits is tied to the user’s account, not to the company making payment. Regardless of which — or how many different — companies a gig worker is paid by, the benefit is the same.