PYMNTS Intelligence: Finding the Way to Better Government Disbursements

The COVID-19 pandemic created a need for unprecedented government disbursements.

The United States federal government alone distributed $931 billion in direct payments to approximately 165 million individuals in 2020 and 2021, far exceeding any previous stimulus payment program in recent history. An estimated 9 million of those individuals were non-filers, adding to the difficulty of ensuring efficient and timely disbursements. At the same time, state and local governments have also experienced delays related to paper processes and struggled due to time-consuming manual processes.

This month, PYMNTS examines the problems faced in making government disbursements meet the needs of modern consumers and businesses.

Individual stimulus payments showed improvement with each round.

The economic stimulus payments made to individuals, beginning with $1,200 paid to each adult and followed by payments of $600 and $1,400 per person, presented a new level of government direct aid to citizens. While there were some initial delays, both the Internal Revenue Service and the U.S. Department of the Treasury were able to make improvements with each iteration. Adding to the complexity of the endeavor, payments were also made to many individuals who had not earned enough to file taxes in recent years, requiring the government to rely on more than tax records for tracking down eligible recipients.

The first round consisted of 89.5 million individual payments sent out during 2020 and still included many payments by paper check. By the third round of payments, in early 2021, the IRS was able to announce in mid-March that it had already made 90 million disbursements. Regardless of these successes, the pandemic payments still demonstrated the need for better government engagement with citizens to facilitate government disbursements of every kind.

Businesses do not have time to wait for lengthy approvals and slow systems.

Paycheck Protection Program (PPP) loans were rolled out in the early days of the pandemic to help businesses keep employees on their payrolls. While some in the commercial lending industry counterpoint some of the problems the program experienced against the speed with which it was implemented, the program was still plagued by delays a year later. As the 2021 round of PPP loans began, applicants experienced weeks-long delays and 30% were either outright rejected or required to file additional paperwork due to errors in the SBA’s system. Although the SBA had adopted some automation for handling applications, the system was reported to produce dozens of error codes that held up a significant number of applications.

Given the speed with which the PPP was rolled out and the approval of 11.8 million forgivable loans, many experts agreed that, even with its pain points, the PPP program was an incredible success. At the very least, it provided a learning opportunity for the future of government disbursements and commercial banking. It also accelerated the digital transformation of commercial loan applications. While the SBA’s computer system had some problems and the online portal often crashed under the weight of applicant demand, digitizing the process enabled capabilities that would not have been realistic using traditional channels.

Consumers and businesses want digital payments and choice.

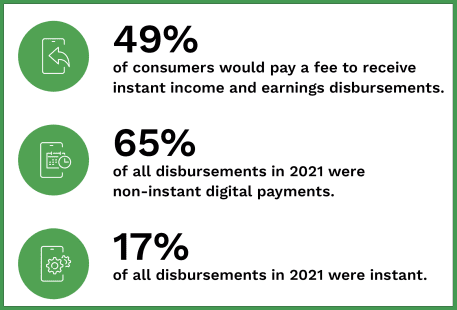

The expectation for low-friction and instant payments has grown during the pandemic for both individuals and businesses. This interest in instant payments is particularly high among millennials and bridge millennials, and while interest is highest for free instant disbursements, many consumers would even be willing to pay to have funds deposited more quickly.

The government needs better digital engagement with citizens.

While the PPP may have transformed how businesses receive aid from the government, disbursements revealed some of the weaknesses in how the government interacts with individuals. Although the federal government has information on citizens that can help to identify and track them down, and even electronic payment capabilities through ACH, it lacks digital engagement and a positive digital payments experience.

There is no interactive touch point for individuals to help facilitate disbursements that meet consumer needs. The technology exists for building that kind of engagement, but it will require a redefinition of how the government and citizens interact. Strategic partnerships with the payments industry could be the solution.