PYMNTS Intelligence: Lack of Payments Modernization Is a Risky Decision

As the online gambling and casino industries continue to grow, payments present both a challenge and a considerable opportunity. Customers involved in gambling have traditionally preferred making and receiving payments in cash due to its anonymity, but times are changing. A KPMG survey taken in the pandemic’s wake found that 55% of respondents would use a mobile application or contactless method of wagering at a casino if given the choice.

As the online gambling and casino industries continue to grow, payments present both a challenge and a considerable opportunity. Customers involved in gambling have traditionally preferred making and receiving payments in cash due to its anonymity, but times are changing. A KPMG survey taken in the pandemic’s wake found that 55% of respondents would use a mobile application or contactless method of wagering at a casino if given the choice.

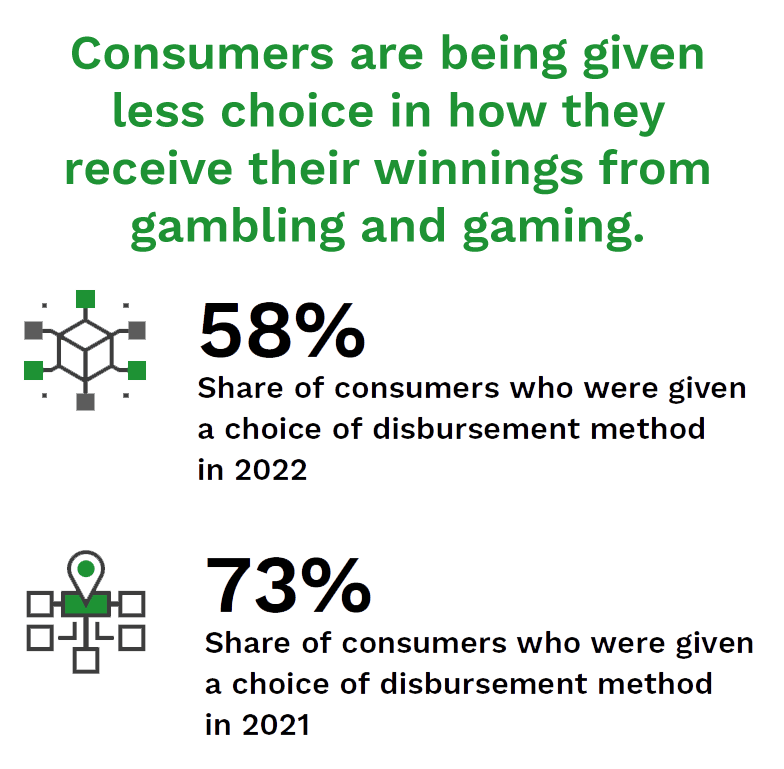

The problem is that customers often are not given a choice. Only 58% of consumers had a choice of disbursement method for their gambling or gaming winnings in 2022, according to a PYMNTS survey. This is a substantial drop from 2021, when 73% of these winners had a choice. Although casinos have started to embrace cashless payment methods, it is clear that the transition is still in its infancy.

Instant Disbursement Options Should Be Table Stakes

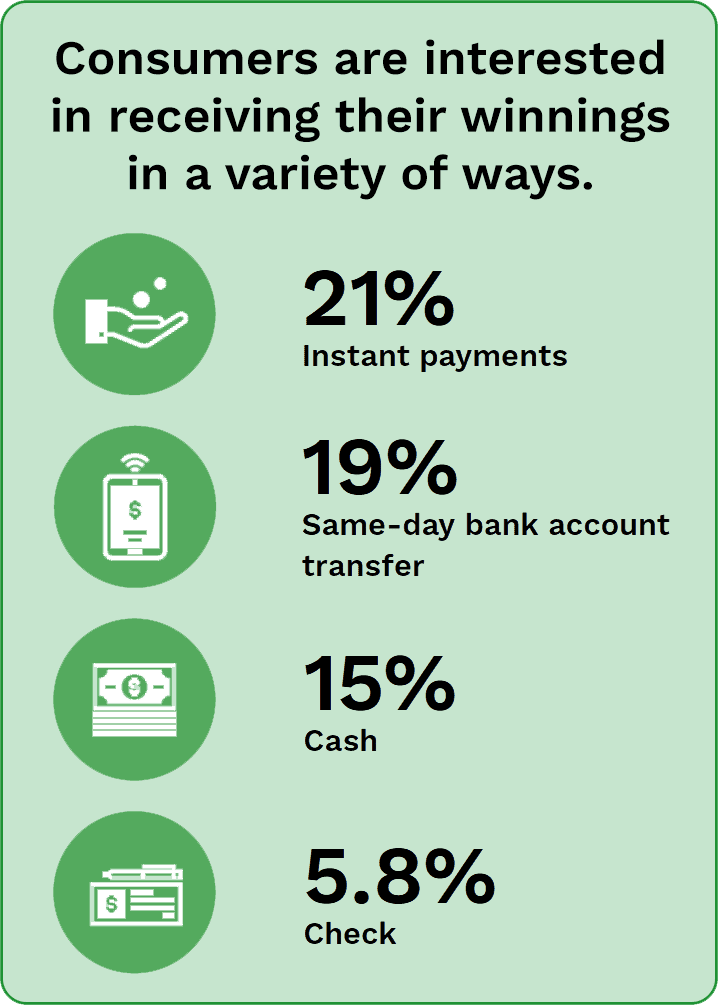

PYMNTS’ survey indicated that consumers want their disbursements through a variety of methods, with instant payments being the most popular. The study found that 21% of recipients selected instant payments to receive their winnings, while 19% went with same-day bank account transfer and only 15% opted for cash.

It is likely that a greater share of people would select instant payments if that option were more widely available. The portion of consumers wanting to receive disbursements via instant payments grew from 40% in 2020 to 47% in 2022, according to the same research. Despite this interest, PYMNTS found that consumers who used instant payments for disbursements more than other options were given 6% less choice in how to receive those disbursements in 2022 than in 2021.

Payments Modernization Can Pay for Itself

All this underscores the need for casinos and online platforms to invest in payments modernization, as using legacy payments systems limits their ability to meet the demand for instant payments.

Although comp anies might be hesitant to upgrade their payments architecture due to upfront costs or the uncertainty of how best to go about the process, modernizing is worth it. An updated payments system that supports instant payments and other payment methods will attract new customers and retain old ones. PYMNTS found that 67% of consumers would be more inclined to continue business with a company that offered instant payments.

anies might be hesitant to upgrade their payments architecture due to upfront costs or the uncertainty of how best to go about the process, modernizing is worth it. An updated payments system that supports instant payments and other payment methods will attract new customers and retain old ones. PYMNTS found that 67% of consumers would be more inclined to continue business with a company that offered instant payments.

Moreover, transitioning away from cash can help assuage regulators’ fears over money laundering as well as enable casinos to put better safeguards in place to deter unhealthy gambling behavior. A shift to real-time or instant payments can also improve accounting efficiency. Finally, there are a variety of FinTechs that can help companies navigate the transition.