Many property managers seek to expedite these payments to prevent errors and enhance tenant satisfaction in the payment process. Modernizing payment practices can also enable property managers to send funds back to renters — potentially in real time — when needed. These include refund payments or returning security deposits.

The “Money Mobility Tracker®” shows the critical need for property managers to use digital and instant payment solutions to expedite transactions, streamline expenses and enhance renter satisfaction.

Economic Factors Push Property Managers to Accelerate Rental Payments Collection

Challenging financial conditions, driven by high inflation and living expenses, are increasing pressure on U.S. renters and homeowners. As a result, nearly half struggle to keep up with their monthly housing payments, according to a study. Many are making significant sacrifices in their daily lives to cover their payments, with some turning to drastic measures. Twenty-two percent of respondents report skipping meals, while nearly 21% work extra hours or sell belongings. Additionally, roughly 18% have borrowed money from friends and family, and 17.6% have pulled money from their retirement savings. Furthermore, 15.6% have either delayed or skipped medical treatments to save money for housing.

These financial challenges — which lead to late or missed rent payments — directly affect property managers’ operational performance and financial stability. In response to renters’ struggles, many property managers may feel compelled to accelerate rent collection by adopting instant payment options. This approach aims to prevent renters from defaulting on their payments should unexpected financial expenses arise in the interim.

To learn more, visit the Tracker’s Revamping Rents section.

Speed Boosts Rental Payments Satisfaction

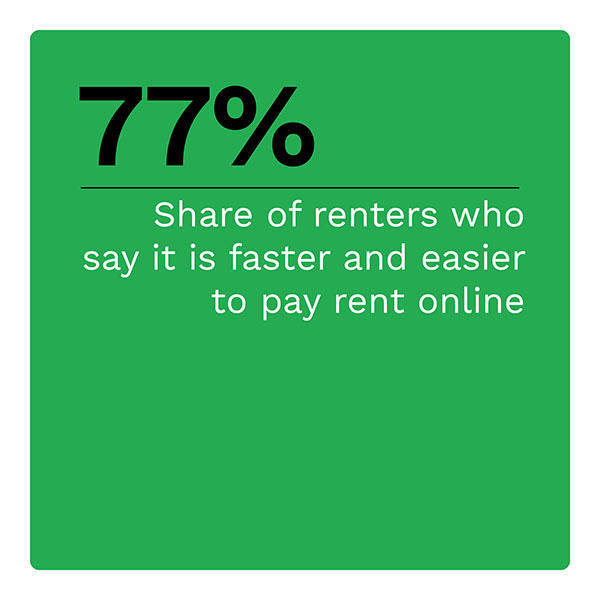

Renters are used to paying rent digitally and want the added convenience of instant payments. More than half of renters pay rent online. Seventy-seven percent cite greater ease and speed than traditional methods as their primary reasons for doing so. Renters who pay online also report a significantly higher satisfaction rate than those who don’t, at 77% and 35%, respectively. Property managers can likely further augment renters’ appreciation for swiftness and convenience by adopting instant payment channels to make payments even faster and easier.

To learn more, visit the Tracker’s Accelerating Rent Payments section.

Leveraging Instant Payments to Optimize Expense Management

In a recent interview with PYMNTS Intelligence, AppFolio’s vice president of product and payments, Adam Feinstein, explained that using push-to-debit systems in the property management sector could make payments faster, reduce reliance on paper checks and invoices and end the typical three-day settlement periods related to ACH transactions. This shift supports cash flow for property managers and the vendors who help maintain properties, such as repair technicians, painters, landscapers, suppliers and so on.

In a recent interview with PYMNTS Intelligence, AppFolio’s vice president of product and payments, Adam Feinstein, explained that using push-to-debit systems in the property management sector could make payments faster, reduce reliance on paper checks and invoices and end the typical three-day settlement periods related to ACH transactions. This shift supports cash flow for property managers and the vendors who help maintain properties, such as repair technicians, painters, landscapers, suppliers and so on.

AppFolio, a cloud-based property management software provider, has teamed up with Ingo Payments to extend push-to-debit services to the thousands of property management clients it currently serves. These services facilitate everything from vendor payments to renter refunds. According to Feinstein, push-to-debit could lead to new opportunities to embed payments more fully into the property manager’s workflow.

To learn more, visit the Tracker’s Streamlining Expense Management section.

About the Tracker

The “Money Mobility Tracker®,” a collaboration with Ingo Payments, looks at the critical need for property managers to use digital and instant payment solutions to expedite transactions, streamline expenses and enhance renter satisfaction.

![]()

![]()