Moneybox, a U.K.-based investment app company, has raised $3 million in its seed funding round ahead of its planned 2016 launch date.

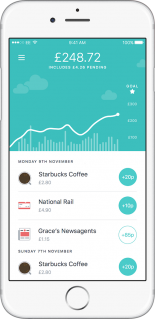

The app, which rounds off a transaction’s value and saves the change for its user, has specifically been designed to target a growing wave of millennials who are moving away from the traditional banking system and are now instead trusting FinTech companies with their money.

It functions by collecting digital spare change to invest in a stocks and shares ISA — a process that strikes many millennials as confusing and complicated. It also allows users to save their spare change in a tax-free Moneybox savings account.

It functions by collecting digital spare change to invest in a stocks and shares ISA — a process that strikes many millennials as confusing and complicated. It also allows users to save their spare change in a tax-free Moneybox savings account.

“For too long, the investment industry has overlooked the younger generation,” said Moneybox Advisor Daniel Godfrey, who previously served as CEO of The Investment Association (IA), the representative body for the U.K.’s £5.5 trillion investment management sector.

“Moneybox, with its capacity to round up digital ‘spare change’ into long-term investments through an ISA, can revolutionize the investment landscape and play a real part in helping people build a better, safer future for themselves,” he added.

The latest round of investment is being backed by Samos Investments and several other angel investors. “The funding will allow us to expand our core team to around 20 people and refine the app as we head towards our U.K. launch,” said Ben Stanway, who cofounded the company with Charlie Mortimer. “By enabling users to get started investing with just £1 and making the investment options clear and simple, we hope that Moneybox can help more and more people achieve their long-term financial goals.”