In the sudden twists and turns of the global stock markets and the guessing games about just how far China might take its currency devaluations and how far the U.S. Fed might raise rates in 2016, Samsung has fired a shot across the bow for both smartphones and mobile payments.

The profit miss that was reported last week by the electronics giant may be in the rearview mirror, but 2016 may shape up to be a rocky year for companies up and down the mobile device ecosystem – and that includes Apple. Samsung, of course, is the biggest display and memory chip maker, and one key tell from results – despite the fact that they are preliminary numbers, with more detail to come – rests with the operating income line, which at about 6 trillion won was notably below the 6.6 trillion won the Street expected.

That miss came despite the fact that revenues were essentially unchanged, year over year, at 53 trillion won. There are no definitive answers as to what moving pieces caused margin pressures, and there were no divisional breakouts or net income details. Not yet, anyway, and investors will get that deeper insight later in the month once audited results come through.

But the tea leaves are there, at least a few of them. No less a presence than Samsung co-chief executive officer Kwon Oh-Hyun had been warning about the competitive landscape in the smartphone market, and that of course has a read across on margins. And Apple shares, of course, dipped below the psychological threshold of $100, and rests now at that level, precariously.

Samsung phone shipments are likely to have another decline, for the second straight year, having been squeezed at both the top end (from Apple) and the low end (several Chinese players). The slump in the Chinese economy – in terms of a slowing growth rate – may spur more consumers there to look toward budget phones. In the meantime, hazarding a guess about divisions: pressure in the components space, which is likely to come, eventually amid falling memory prices, may eventually crimp cash flow that can be reinvested in the phone business, and also the mobile payments business. That’s an eventuality of course, and the mobile device segment still remains profitable, given the movement toward cheaper phones in the Galaxy line.

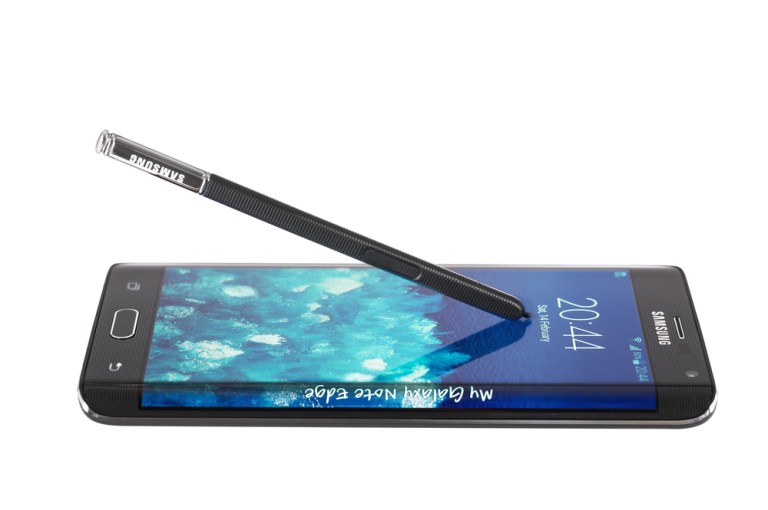

In the meantime, the cash, and global scale, is there to make a concerted effort to get Samsung Pay, and the company’s software focus (and higher margins), into new markets. The move is a necessary one, as the battle against Android Pay and Apple Pay must be waged on new fronts. Australia, Brazil and Singapore will be the new countries to watch, and of course China and Spain have already been declared as new markets for the payments service. Australia will prove an interesting market to watch, as Google is coming there with its own payments in the first half of this year. And Samsung, of course, is also gearing up to bring payments functionality to its smartwatch.

Will the payments push help keep consumers glued to their Samsung devices? Will the Samsung Pay experience prove alluring enough in new markets to keep fickle users from turning to other devices? The tea leaves are harder to read right now, but the stage is set for a wide-ranging, and fiercely contested, battle for payments loyalty.