PYMNTS Intelligence: How Organizations Deliver on Faster Payments

Real-time payments have reached unprecedented levels of demand over the past five years, yet they are still available to just a small number of businesses and consumers. Studies have found that instant payments make up only 2% of corporate disbursements sent and just 1.3% of payments received.

However, this is changing fast as merchants and customers alike react to the growing demand for real-time payments. This month, PYMNTS explores how organizations can deliver speedier payments for both consumer-to-business (C2B) and business-to-business (B2B) transactions as well as the benefits of deploying this payment option.

However, this is changing fast as merchants and customers alike react to the growing demand for real-time payments. This month, PYMNTS explores how organizations can deliver speedier payments for both consumer-to-business (C2B) and business-to-business (B2B) transactions as well as the benefits of deploying this payment option.

Partnering with Banks and FinTechs on Real-Time Payment Technologies

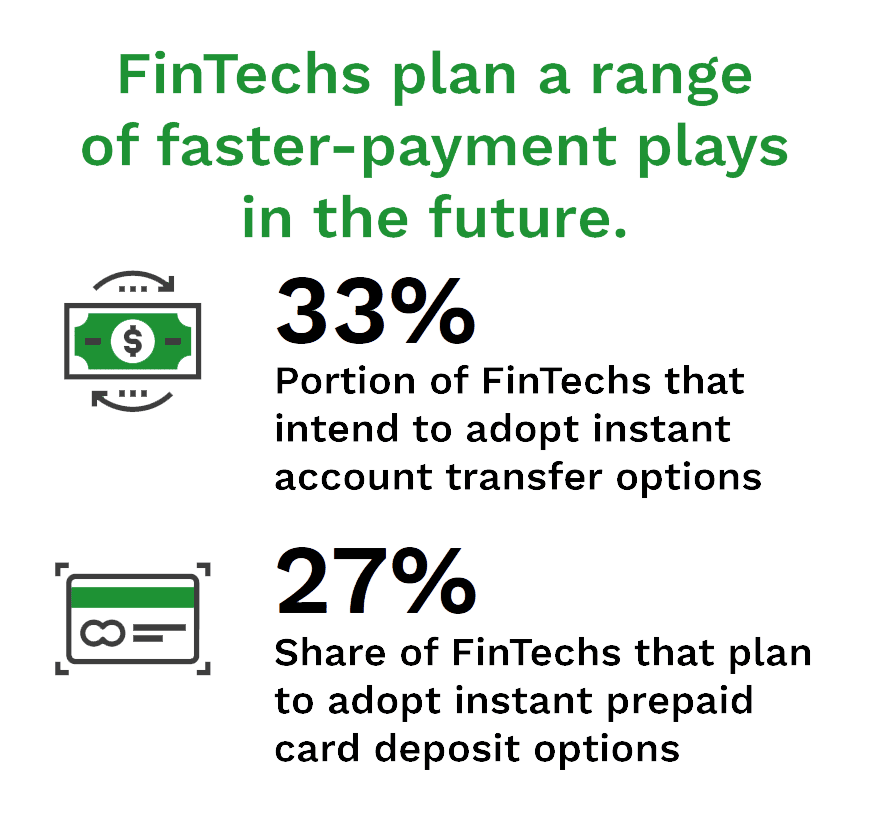

FinTechs have invested an average of 23% of their annual revenues into adding instant payment capabilities over the past three years, making them valuable partners for businesses looking to accelerate their payment experiences. While many leverage The Clearing House’s RTP® network, other instant payment methods have become popular as well: 33% of FinTechs intend to adopt instant account transfer options, for example, and 27% plan to adopt instant prepaid card deposit options over the next three years.

Big banks are also developing new payment technologies to accelerate transactions. One joint initiative from Bank of America, JPMorgan Chase, Wells Fargo and four other institutions will offer customers the ability to pay merchants via digital wallets by the end of the year. Services such as these promise to revolutionize not only the consumer payment experience but also the B2B payment scene.

Larger businesses are particularly interested in developing faster payment capabilities, with 89% of companies with revenues of more than $1 billion saying that real-time payment capabilities are important versus 63% of those with revenues between $250 million and $500 million. Sixty-nine percent of businesses across the board plan to expand their real-time payment capabilities or are currently doing so, many with the help of FinTechs and financial institutions that leverage the RTP network.

Larger businesses are particularly interested in developing faster payment capabilities, with 89% of companies with revenues of more than $1 billion saying that real-time payment capabilities are important versus 63% of those with revenues between $250 million and $500 million. Sixty-nine percent of businesses across the board plan to expand their real-time payment capabilities or are currently doing so, many with the help of FinTechs and financial institutions that leverage the RTP network.

Benefits of Payments Acceleration

Speeding up payments not only benefits consumers, who gain a more accurate snapshot of their financial situations but also helps companies with their cash flow issues. Payment approval and acknowledgment are instant, meaning that companies are immune to having payments bounce back days later, throwing their accounting processes into chaos as they figure out cash flow reconciliation.

Fifty-four percent of companies deploying instant payments expect lower costs due to these benefits, and 50% say they will gain new customers and suppliers. Another 49% believe they could reduce the likelihood of fraud or theft, while 35% cite improved payment process transparency. All these added benefits make faster payments an obvious choice for corporates looking to improve both consumer and B2B payments.