Today, nearly 70.5 percent use data mining, and nearly 60 percent use business rules management systems (BRMS), making them the most commonly used learning systems. On the other hand, use of technologies like fuzzy logic and advanced AI are still relatively rare. Just 14.5 percent of FIs have fuzzy logic technology, and 5.5 percent use AI systems.

Today, nearly 70.5 percent use data mining, and nearly 60 percent use business rules management systems (BRMS), making them the most commonly used learning systems. On the other hand, use of technologies like fuzzy logic and advanced AI are still relatively rare. Just 14.5 percent of FIs have fuzzy logic technology, and 5.5 percent use AI systems.

As use of learning technologies like these grows more ubiquitous, FIs are continuing to learn the business areas in which they can add the most value. This brings up a crucial question, though. Modern FIs are investing big in AI and ML, but for what exactly are they using them?

In the latest edition of the AI Innovation Playbook: Perception Versus Reality in Payments and Banking Services, in collaboration with Brighterion, PYMNTS examines survey response data from more than 200 financial executives to learn how they are leveraging AI and ML to enhance their  business operations.

business operations.

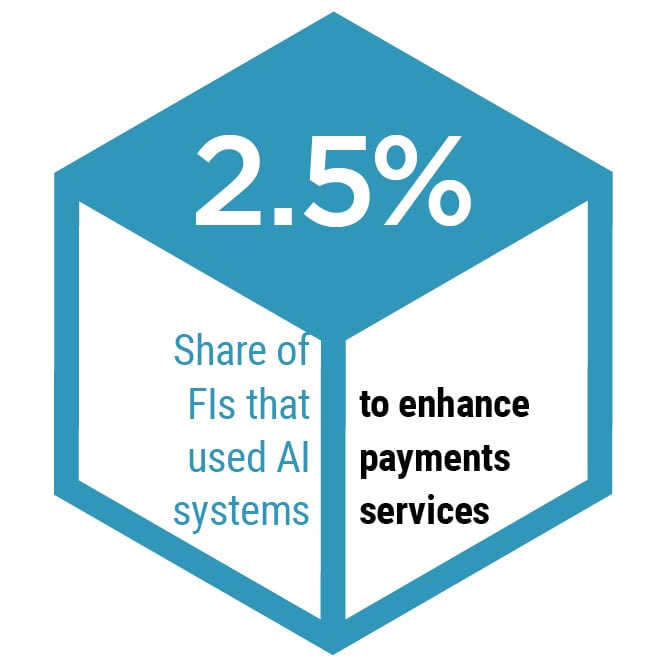

According to PYMNTS research, FIs don’t always use learning technologies optimally. They tend to throw everything into fighting fraud, while putting significantly less effort into enhancing customer-facing operations, like payment services.

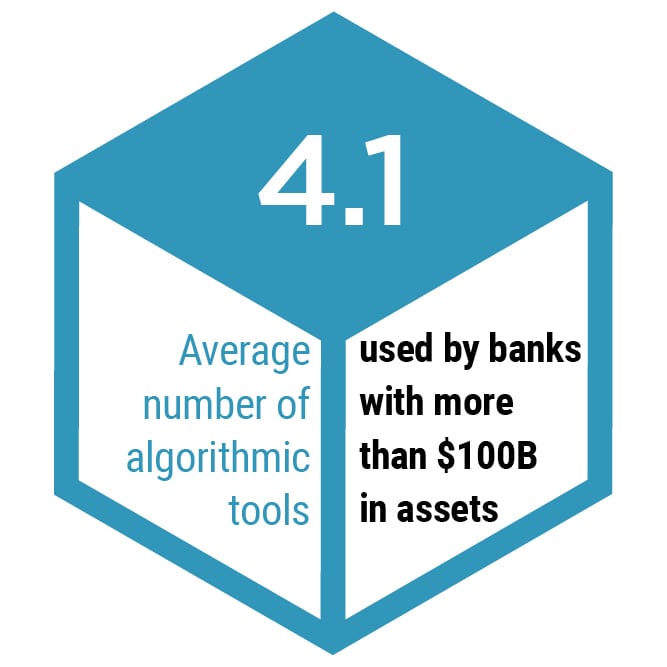

In fact, all the FIs in the study used every technology they had to fight fraud. At the same time, only 26 percent used BRMS to enhance their payment services, and 7.5 percent used it to optimize their merchant services.

Advertisement: Scroll to Continue

How can decision-makers be sure they are getting the greatest possible bang for their buck when it comes to investing in the latest AI and ML innovations? To learn more about how modern FIs are using advanced learning systems, click here to download the report.