Not that long ago banks and financial institutions (FIs) made technology investments that typically put the company’s interests first and its customers’ second (or third). With the pandemic fog of war now lifting, FIs are revisiting and reordering these past priorities.

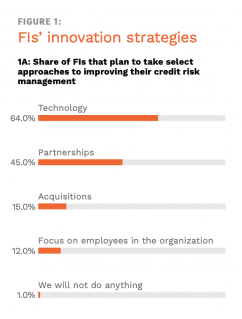

PYMNTS June 2021 AI In Focus: The Bank Technology Roadmap Playbook, a collaboration with Brighterion, based on a survey of 100 FI executives dives right in, noting that “More than three-quarters of FIs say responding to existing customers’ needs is a reason they are investing in technology today — far surpassing the share that cite ongoing digital transformation.”

That puts a new spin on modernization efforts, particularly the expanding use cases for artificial intelligence (AI) in creating customer-centric experiences in digital finance and payments.

How FIs are using AI to improve lending and credit in tandem with other operational upgrades is the focus of the new playbook, packed with practical insights on effectuating an AI strategy.

AI Tackles Credit Risk As FIs Strike A Delicate Balance

Credit risk is first up, as most FI executives surveyed see it as needing urgent attention.

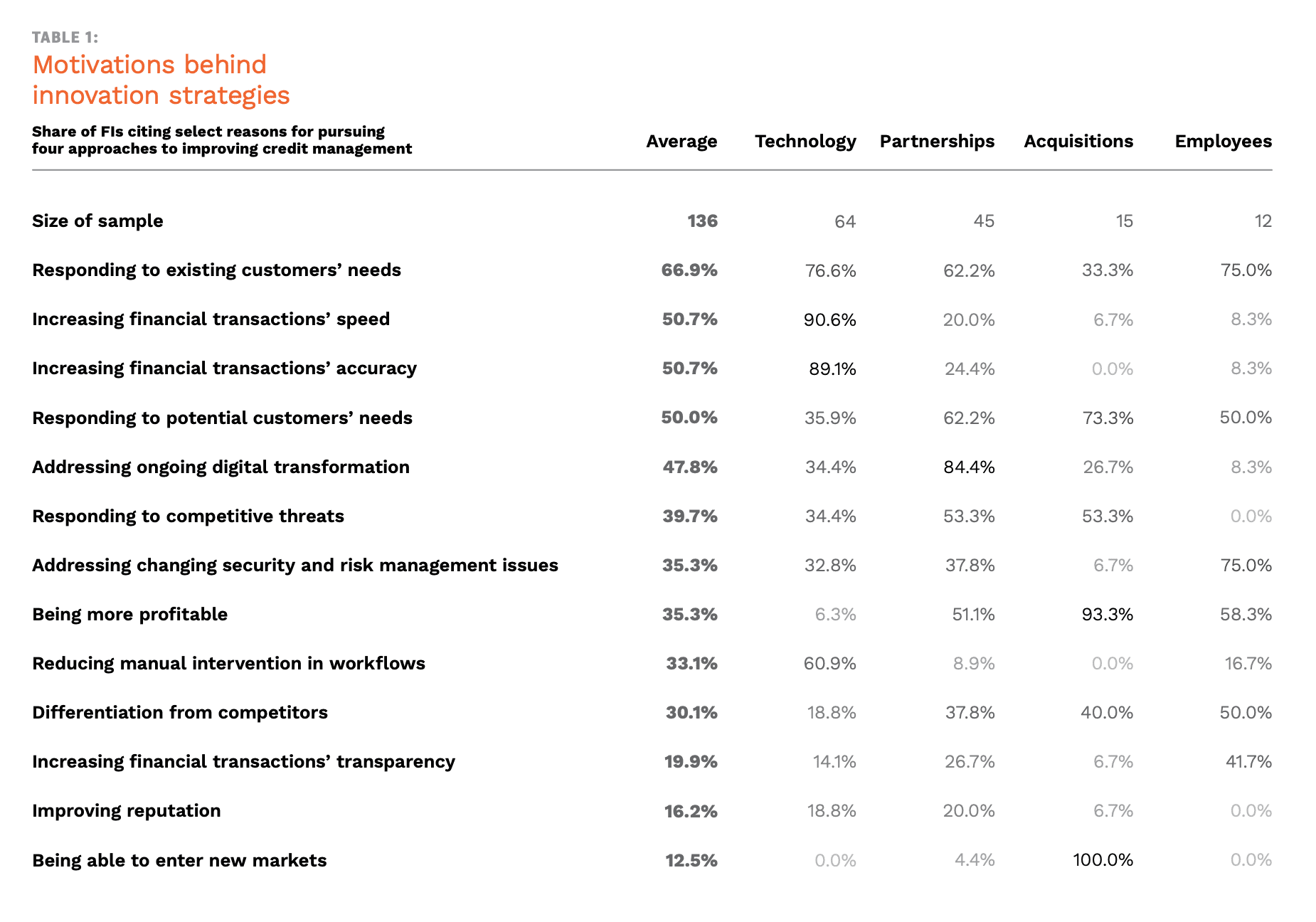

According to AI In Focus, “A majority of FIs — 64 percent — plan to invest in technology to improve their credit risk management over the next six months, which is more than five times the share that plan to do so by focusing on human resources, such as hiring, retraining and reorganization. Just 12 percent of FIs are taking this latter approach.”

Partnerships rank high too, with 45 percent of FIs planning this approach in the next six months.

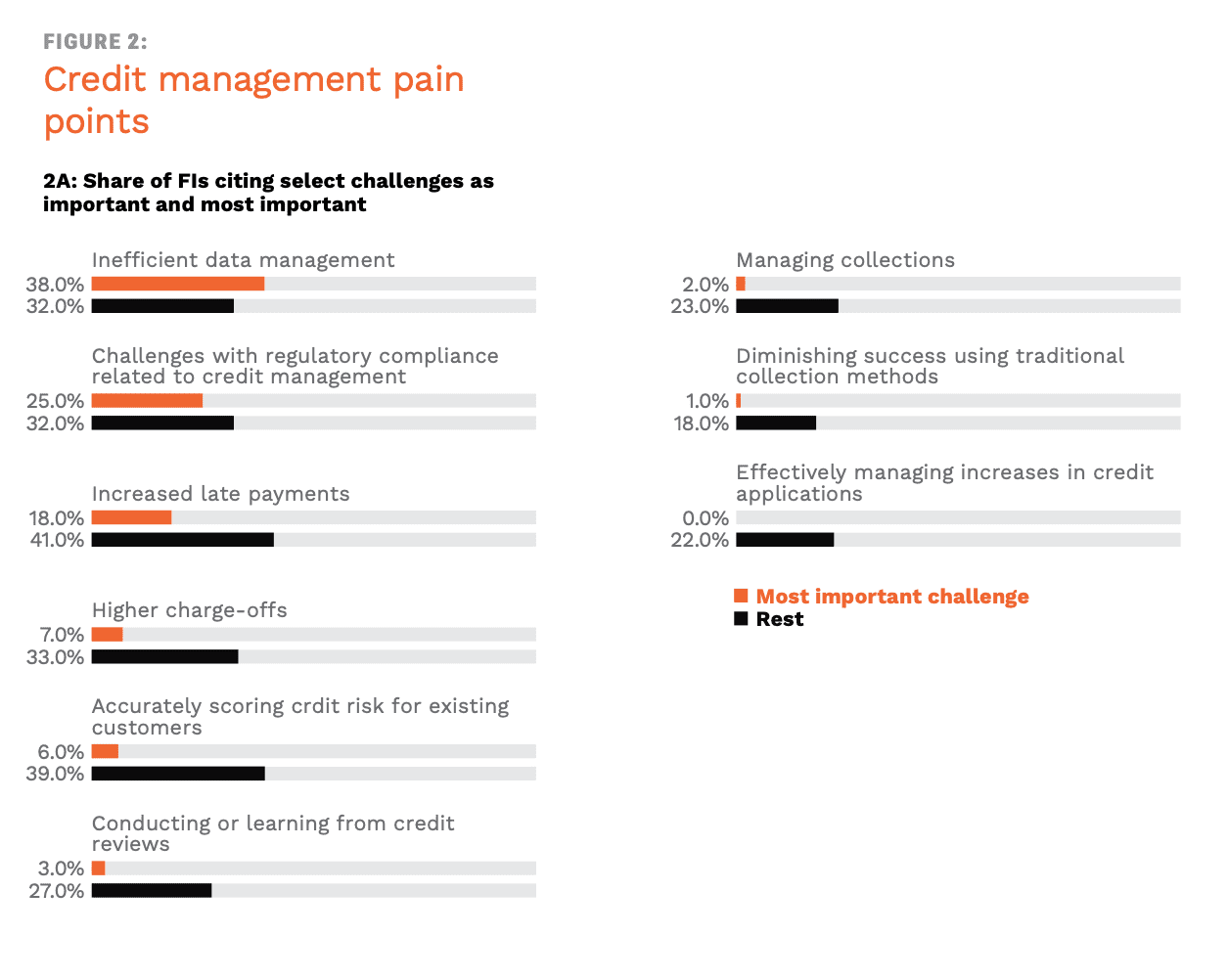

Data is also in the crosshairs, per the Playbook, with 70 percent of FIs considering this a major issue. “Inefficient data management is the most cited challenge by a considerable margin: and 38 percent consider it to be the most important challenge they face in credit operations.”

AI In Focus says the problem confronting FIs in data management and security “is ongoing and systemic. Many FIs lack efficient means of capturing, processing and acting on the myriad sources of data that credit departments deal with on a daily basis.”

This is where AI is being brought to bear with urgency. The June Playbook notes that “AI could be seen as reaching a tipping point in terms of recognition among FIs. Research shows a dramatic increase in both use and interest in the technology. Seventy-eight percent of FIs plan to invest in AI systems over the next 12 months or have already implemented them.”

Use Cases In AI Customer-Centricity

As much as these findings point to FIs still looking out for number one — themselves — there’s strong evidence that the new consumer-centricity we hear of is finally resonating in C-suites.

Per AI In Focus: The Bank Technology Roadmap Playbook, “77 percent [of FI executives] say they are investing in [new technology] to respond to existing customers’ needs. Only 34 percent view addressing ongoing digital transformation as the primary motive.”

It’s a positive sign for the spreading awareness that in a digital-first connected economy, consumers are calling shots as fast as it takes to download — or delete — a smartphone app.

Illustrating this is the use case of Truist, formed from the merger of BB&T and SunTrust. AI In Focus quotes Diana Caplinger, Truist EVP for customer relationship management, intelligent automation and personalization, saying, “We use AI to drive chat bot interactions, to provide personalized real-time client insights based on savings and spending habits and to determine client sentiment. Future use cases include next-best action and conversation along with preemptive client awareness to inform digital and human engagement.”

“Leveraging AI allows for greater client self-service, increased satisfaction and more client needs met regardless of where they are on their financial journey,” she added.