The Federal Reserve’s planned faster payments service, the FedNow Service, is slated to have an impact on the speed with which paper checks are processed, adding a new twist to the U.S.’s path toward faster, digital payments.

Reports in NBC News this week said the FedNow Service aims to tackle the standard three-day wait for checks to clear, providing immediate access to funds when individuals or businesses are paid via paper . check.

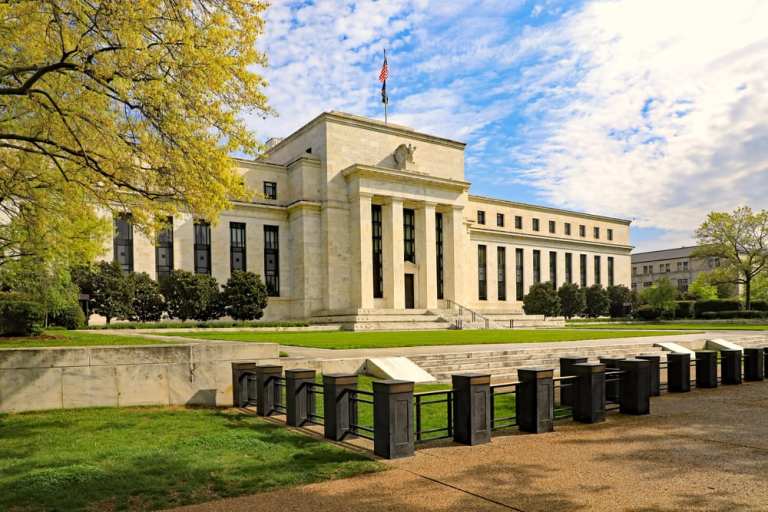

“Immediate access to funds could be especially important for households on fixed incomes or living paycheck to paycheck, when waiting days for the funds to be available to pay a bill can mean overdraft fees or late fees that can compound,” said Federal Reserve Governor Lael Brainard during a speech at the Federal Reserve Bank of Kansas City earlier this week, when the Fed announced the new service.

But reports also noted that the acceleration of check payments could have significant impact for companies and small businesses that use paper checks to pay vendors or employees.

“The longer it takes for payments to move, the longer it takes for us to get paychecks, for small businesses to get funds,” said Federal Financial Analytics Managing Partner Karen Shaw Petrou in an interview with the publication. “It’s costly because people run overdrafts or take out short-term loans, and it’s economically inefficient.”

Keeping Checks In B2B Payments

The impact of the Federal Reserve’s faster payments initiative puts an interesting spin on the nation’s payments innovation efforts overall. Many of the private sector’s efforts to accelerate payments, including those from The Clearing House and SWIFT, aim to promote adoption of electronic payments considering the costs and slow speeds associated with paper checks.

When The Clearing House’s faster payments offering RTP went live in 2017, The Clearing House Senior Vice President for Product and Strategy Steve Ledford pointed to the need for digitization in the business payments space.

“Business-to-business payments have been some of the most resistant to electronics,” he said at the time. RTP aims to encourage businesses away from checks by offering them an electronic payment services that not only accelerates transactions but provides additional transactional data that is key to reconciliation and analysis for corporate accountants and financial professionals.

More recently, in PYMNTS’ May Faster Payments Tracker, Fiserv Vice President of Digital Payments and Data Aggregation Paul Diegelman told PYMNTS about the friction associated with paper checks in B2B transactions, but acknowledged corporates’ hurdles in embracing emerging payments solutions.

“There’s a lot to learn to do it the first time around when embracing faster payments,” he said, “and this slows people down.”

In other words, the friction associated with getting familiar with and implementing a new payments service can prevent businesses from making the switch from paper checks to a faster, digital payments solution.

By addressing one of the largest pain points of paper checks – the lag in clearing and settlement — the FedNow Service, slated to launch in 2023, may provide even greater incentive for businesses to stick with paper.

On the other hand, some businesses continue to use paper checks because they rely on that lag time to hold on to working capital longer while ensuring their vendors that “the check is in the mail.”

It will be interesting to see whether the FedNow Service, and its ability to accelerate check clearing, will encourage businesses to stick with the payment method and avoid having the make the switch to electronic payments, or whether it will cause frustration by removing an important working capital management tactic that businesses have used for decades.