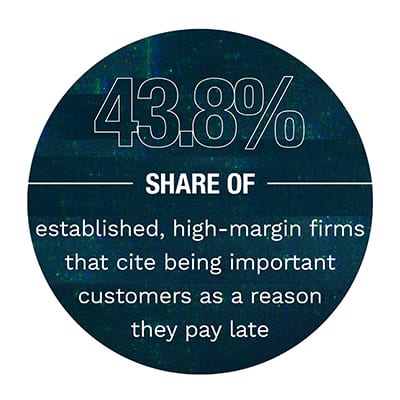

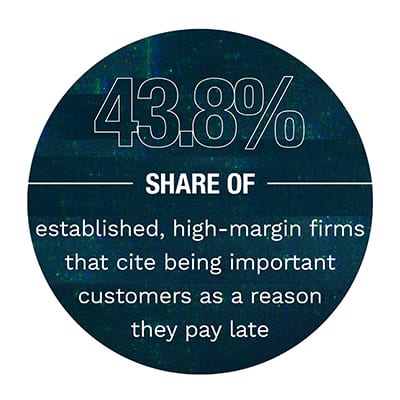

Under this informal system, late payments are common, but the reason cited by a significant portion of firms for paying late is notable: They expect their suppliers to accept late payments because they’re important customers. Not all businesses carry this attitude. While 45.9 percent of firms in business at least six years with high operating margins have this view, only 19.5 percent of firms with low margins do. In fact, they are much more likely to cite poor cash flow as a reason for paying late.

Under this informal system, late payments are common, but the reason cited by a significant portion of firms for paying late is notable: They expect their suppliers to accept late payments because they’re important customers. Not all businesses carry this attitude. While 45.9 percent of firms in business at least six years with high operating margins have this view, only 19.5 percent of firms with low margins do. In fact, they are much more likely to cite poor cash flow as a reason for paying late.

These attitudes provide a window into how current trade credit practices tend to be advantageous to older companies with high profit levels, while squeezing early-stage companies with low operating margins. In the SMB Receivables Gap Playbook, a collaboration with Fundbox, PYMNTS delves into survey data from 1,031 U.S. firms to reveal the disparities between early-stage, intermediate and established firms, and those with operating margins ranging from negative to 75 percent.

operating margins ranging from negative to 75 percent.

The existing trade credit systems offer crucial flexibility to established, high-margin companies, which helps them maintain cash flow and invest in their growth. High-margin businesses are more likely to be extended payment terms that exceed 30 days. For example, 11.7 percent of them report having to pay within 61 to 90 days. In contrast, just 3.1 percent of early-stage, low-margin firms are given such long payment windows. Rather, 30.4 percent of them must pay between one and 15 days, more than three times the proportion of intermediate, high-margin businesses.

High-margin, established companies tend to pass along these terms to their customers and prospective clients. Twenty-one percent of high-margin firms offer payment periods of 61 to 90 days, according to PYMNTS’ research, while ju st 5.8 percent of early-stage, low-margin businesses do so. On the other hand, 74.3 percent of low-margin firms insist on payment within 30 days, compared to 45.7 percent of established, high-margin businesses. Low margin firms also receive lower discounts for paying early compared to high-margin businesses, and they offer lower discounts in turn: 3.7 percent, compared to the 4.5 percent extended by high-margin firms.

st 5.8 percent of early-stage, low-margin businesses do so. On the other hand, 74.3 percent of low-margin firms insist on payment within 30 days, compared to 45.7 percent of established, high-margin businesses. Low margin firms also receive lower discounts for paying early compared to high-margin businesses, and they offer lower discounts in turn: 3.7 percent, compared to the 4.5 percent extended by high-margin firms.

The advantages enjoyed by established, high-margin companies go beyond cash flow and convenience. Our research shows that 46.3 percent of these firms believe the terms they receive allow them to conduct more business, compared to 33 percent of early-stage, low-margin firms. To learn more about the challenges that trade credit poses to low-margin businesses and they might overcome them, download the report.

Advertisement: Scroll to Continue

About the Playbook

The SMB Receivables Gap Playbook, a Fundbox collaboration, is based on survey data collected from more than 1,000 business owners and executives. It examines the tolls that trade credit practices are taking on American SMBs’ cash flows, capital and resources — and explores how they can break the cycle.

Most individuals would feel compelled to have a good excuse if they were late in paying back someone who lent them money. This isn’t the case in the world of trade credit, however, in which millions of U.S. firms sell their products and services to each other with the expectation that they will wait weeks — or even months — to be paid.

Most individuals would feel compelled to have a good excuse if they were late in paying back someone who lent them money. This isn’t the case in the world of trade credit, however, in which millions of U.S. firms sell their products and services to each other with the expectation that they will wait weeks — or even months — to be paid.