The global pandemic introduced many new hurdles for small business owners, but it uncovered a lot of challenges for entrepreneurs that have been lurking below the surface for years.

Understanding the financials of a company is key to success, but many entrepreneurs and sole proprietors aren’t accountants. Indeed, says Accounting Seed CEO Tony Zorc, what the global pandemic did was uncover just how important it is for small business owners to address any financial illiteracy.

“What was happening prior to the pandemic really crystalized, and the reality is, business owners and entrepreneurs today are desperate to be financially literate to keep up with accounting,” he told PYMNTS in a recent interview.

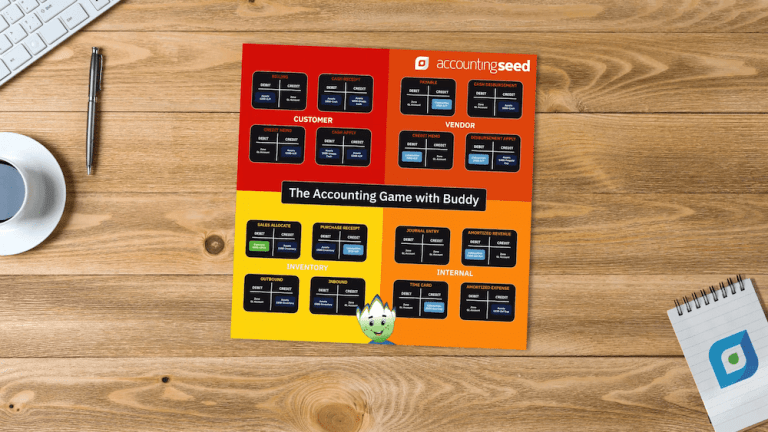

But accounting is unlikely to be most business owners’ favorite past time. In an effort to inject some fun into the function, Accounting Seed recently launched a game to help teach small business professionals the accounting basics. It’s an initiative that Zorc said aims to make learning easier, because understanding the financials remains critical for the survival of small businesses, even as SMB accounting technology becomes further automated.

Education Amid Automation

The small business accounting arena has been the target of significant innovation in recent years. FinTech has set its sights on full automation of accounting solutions, with products like QuickBooks now commonplace for many small businesses.

As a result, some entrepreneurs may question why financial literacy and understanding of accounting is even important if a piece of software can crunch the numbers and generate reports for them.

“Maybe it isn’t as important,” said Zorc. “But it becomes important.”

He explained that for the sole proprietor, there may not be a need for a full understanding of the numbers. Because a single person is operating the business, it’s far easier to understand whether a company is succeeding or not, how much money is in the bank, and generally understand its financial health.

But as a business begins to grow, the need for financial literacy does, too. According to Zorc, the threshold emerges when an operation includes about eight people. That’s the limit at which it becomes far more difficult for a business owner to understand whether a business is financially doing well, because that individual no longer has eyes on each aspect of the operation.

At 25-to-50 people, the complexity and uniqueness of the business begins to surge.

“This is when professionals start needing real accounting data,” Zorc noted. “They can’t see everybody working. They need financial intelligence. The financial literacy needs to go up, especially as you move out of a single operation and into managing a bigger business.”

Gamifying SMB Accounting

Key to promoting small business financial literacy is to understand that most small business owners aren’t CPAs. That’s certainly the case for the typical user of Accounting Seed, according to Zorc, who is usually a C-suite business leader or IT professional.

As such, the traditional accounting lectures and literature may not be the most effective path to education. Even YouTube videos are “usually a person standing in front of a whiteboard and drawing debits and credits,” Zorc said. “It’s not fun.”

Gamification of accounting education can not only make the process more enjoyable, but facilitate learning through play and humor.

“It’s taking a really dry subject and being creative with it,” he continued. “People do so much better with it.”

With the understanding that automated solutions don’t make up for a lack of financial literacy as a business grows, what’s more important than ever amid a volatile market is for small business professionals to be proactive about their understanding of the numbers. According to Zorc, too many entrepreneurs today take a “trust your feelings” approach to running a company, but that is far from sufficient to ensuring success.

“What I feel about it, and what the numbers say, are often two different things,” he said. “I’m not saying don’t follow your gut, but you want valid facts and truth to help you navigate. And small business owners, now more than ever, need it.”