Companies that have not digitized their B2B or other payment processes are still adjusting to the ways that the ongoing pandemic has changed routine operations. Manual or paper-based processes can add more time to payments that many companies can no longer afford.

Companies that have not digitized their B2B or other payment processes are still adjusting to the ways that the ongoing pandemic has changed routine operations. Manual or paper-based processes can add more time to payments that many companies can no longer afford.

This is especially true for entities operating off either limited or alternative revenue models, such as nonprofits that see part of their funding coming from donations, for example. The pandemic has had a severe effect on nonprofits, with one May survey of United States charities noting they expected donations to decrease by 20 percent at a minimum. Making sure payments can get where they need to be at speed, both for the customers they serve as well as for their business partners, is ther efore essential for nonprofits. This means that many are taking a closer look at digital tools and payment solutions that could help eliminate some of the friction points of the more manual systems on which they had been previously reliant.

efore essential for nonprofits. This means that many are taking a closer look at digital tools and payment solutions that could help eliminate some of the friction points of the more manual systems on which they had been previously reliant.

In the latest Digitizing B2B Payments Tracker®, PYMNTS examines how the pandemic is affecting nonprofits and what this means for how such organizations can conduct previously routine B2B payment processes in a digital and remote future. The Tracker also analyzes how emerging payment tools and solutions can be employed to add further transparency and speed to these processes.

Around The B2B Payments World

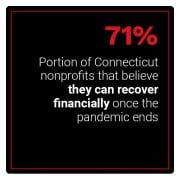

Some U.S. nonprofits have been forced to slash the services they are providing in order to continue operating, in fact. One survey of nonprofits in the state of Connecticut found that two-thirds of them had reduced their services in this matter, for example — while one-third of those surveyed stated they were not sure if they would be able to pay their employees on time. These nonprofits therefore need to manage their payments and operations carefully, meaning they no longer have room in their B2B payment processes for friction points that could swell the cost and time spent finalizing those transactions. Recovering from the financial stresses of the ongoing pandemic will therefore depend upon them adopting more innovative B2B payment tools.

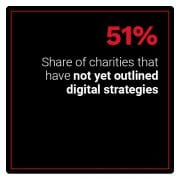

Yet the traditional response from nonprofits regarding digital payment tools has been lukewarm. Another study found that 51 percent of charities currently do not have digital strategies in place that would allow them to upgrade their payments processes, for example. One of the largest barriers in play is the cost of implementing these technologies, something that can be a significant hurdle to clear especially for nonprofits or charities that run mainly on donations. Donation-driven or smaller nonprofits therefore tend to run on check-based payments, and it follows that they are searching for technologies that can keep the familiarity of the check payment while seeking ways to enhance their B2B speed and overall efficiency.

Yet the traditional response from nonprofits regarding digital payment tools has been lukewarm. Another study found that 51 percent of charities currently do not have digital strategies in place that would allow them to upgrade their payments processes, for example. One of the largest barriers in play is the cost of implementing these technologies, something that can be a significant hurdle to clear especially for nonprofits or charities that run mainly on donations. Donation-driven or smaller nonprofits therefore tend to run on check-based payments, and it follows that they are searching for technologies that can keep the familiarity of the check payment while seeking ways to enhance their B2B speed and overall efficiency.

Small- to medium-sized businesses (SMBs) in multiple markets are still struggling to stay afloat during the pandemic. One survey by the Federation of Small Businesses (FSB) in the United Kingdom found that SMBs were owed 23.4 billion pounds (about $30 billion) in 2019 — a number that is only expected to grow in 2020 due to the pandemic’s impact. U.K. lawmakers are therefore considering upgrading the penalties attached to late payments in an attempt to help ease this problem for SMBs. Debate over such penalties and most importantly, what agencies have the power to enforce them, is still currently ongoing.

For more on these and other stories, visit the Tracker’s News & Trends.

How EAF Is Innovating Disaster Relief B2B Via Its Flexible Payment Strategy

The global health crisis is only heightening financial concerns for businesses and consumers, two groups that need to receive any outstanding payments as quickly as possible in this vulnerable time. This is especially the case for those that have been financially or otherwise affected by the pandemic and who might be seeking relief aid — making it critical for nonprofits or relief organizations to support efficient ways to both send money to their grant recipients as well as any B2B vendors or business partners.

Supporting a robust and flexible array of payment options is therefore a must, said Doug Stockham, president of international disaster relief nonprofit Emergency Assistance Foundation (EAF) in an interview with PYMNTS.

To learn more about how EAF is employing flexible payments to keep operations smooth during the ongoing pandemic, visit the Tracker’s Feature Story.

Deep Dive: Why Nonprofits Must Digitiz e Their B2B Payments

e Their B2B Payments

Workforces have gone remote this year, forcing businesses to adapt to new ways to manage tasks that used to be routine, such as the way they conduct B2B payments. This can be difficult especially for nonprofits or smaller businesses that have also seen their revenues and available budgets decline in recent months. Such entities are therefore searching for cost-saving measures that can help them manage payments with more ease and efficiency, such as adopting new digital ways to send out payments to their suppliers or vendors.

This means that those suppliers must also adopt these new payment methods, however, and some are still clinging to more traditional payment types, such as paper checks. It is therefore important for nonprofits to also make spaces for these more traditional methods within their payments processes even as they look to optimize for speed and security.

To learn more about how nonprofits can employ digital technologies to speed their B2B payments without alienating those that are clinging to traditional methods, visit the Tracker’s Deep Dive.

About The Tracker

The PYMNTS Digitizing B2B Payments Tracker®: Taking The Paper Check Digital, a partnership with Deluxe, examines the latest B2B payments trends and events as well as how businesses are using technologies to keep up with clients’ and consumers’ changing needs.