A decade of growth, poised to be upended.

Amid the widespread, and widening, impact of the coronavirus, the latest data from the Main Street Index show that small and medium-sized businesses (SMBs) have enjoyed steady growth in business formation, hiring and wages.

All of that may be put to the test in ways that would scarcely have been imagined a few weeks ago.

The Mechanics

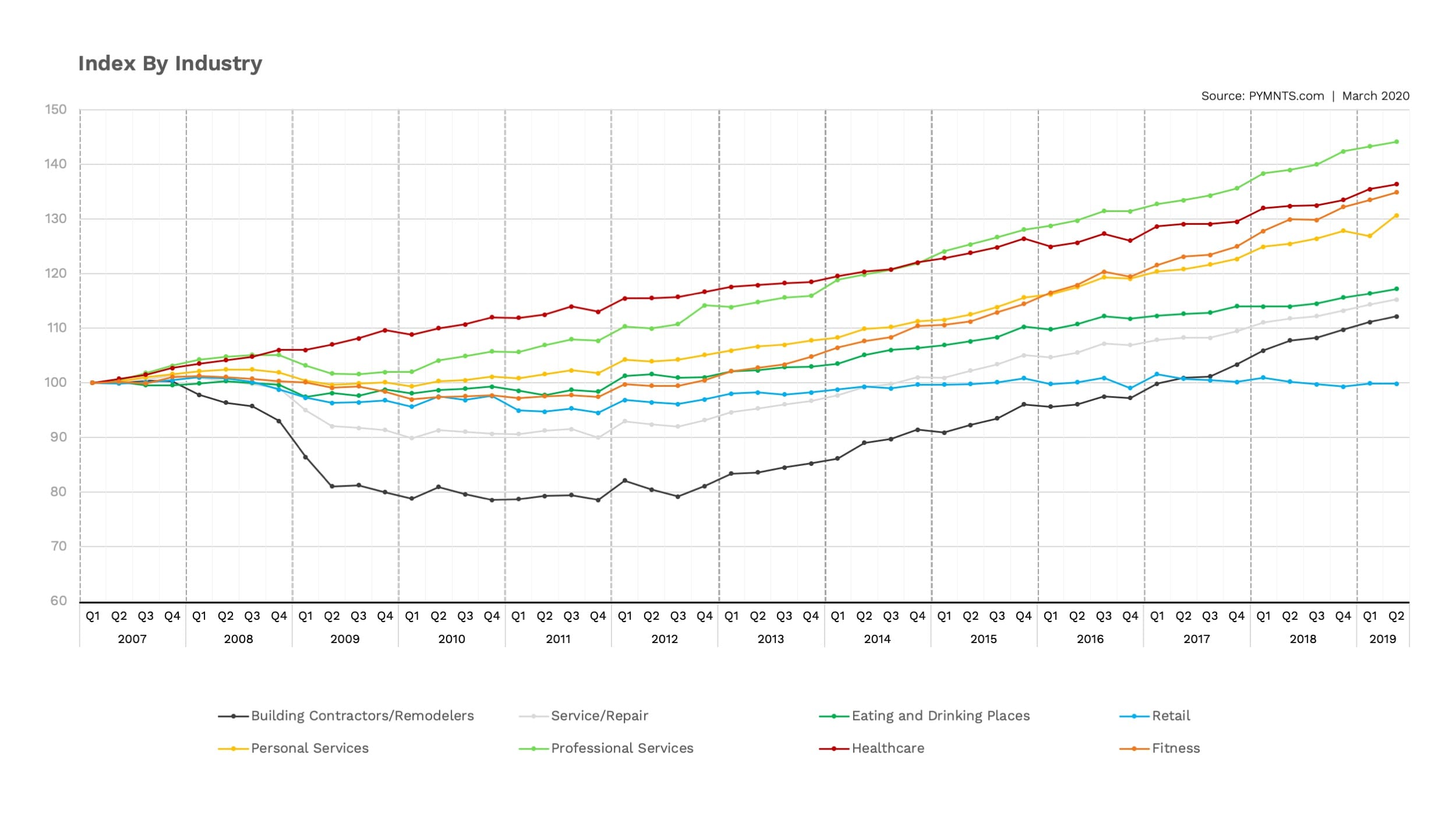

A bit of background is in order: The Index offers up metrics we use to gauge the health of the (typically) smaller firms that populate 3.6 million storefronts across the U.S., and span eating establishments, professional and personal service firms, construction, remodeling and repair, fitness clubs and, of course, a wide range of retail verticals.

Data is culled from the quarterly census of employment and wages, and from the U.S. Bureau of Labor Statistics, and takes into account 10 million data records. Key inputs include the number of establishments, the number of employees at those establishments and wages paid.

Drilling Into The Data

Drilling Into The Data

The latest real data is as of the third quarter of 2019, and readings after that quarter are projections as estimated by PYMNTS using the aforementioned data sources.

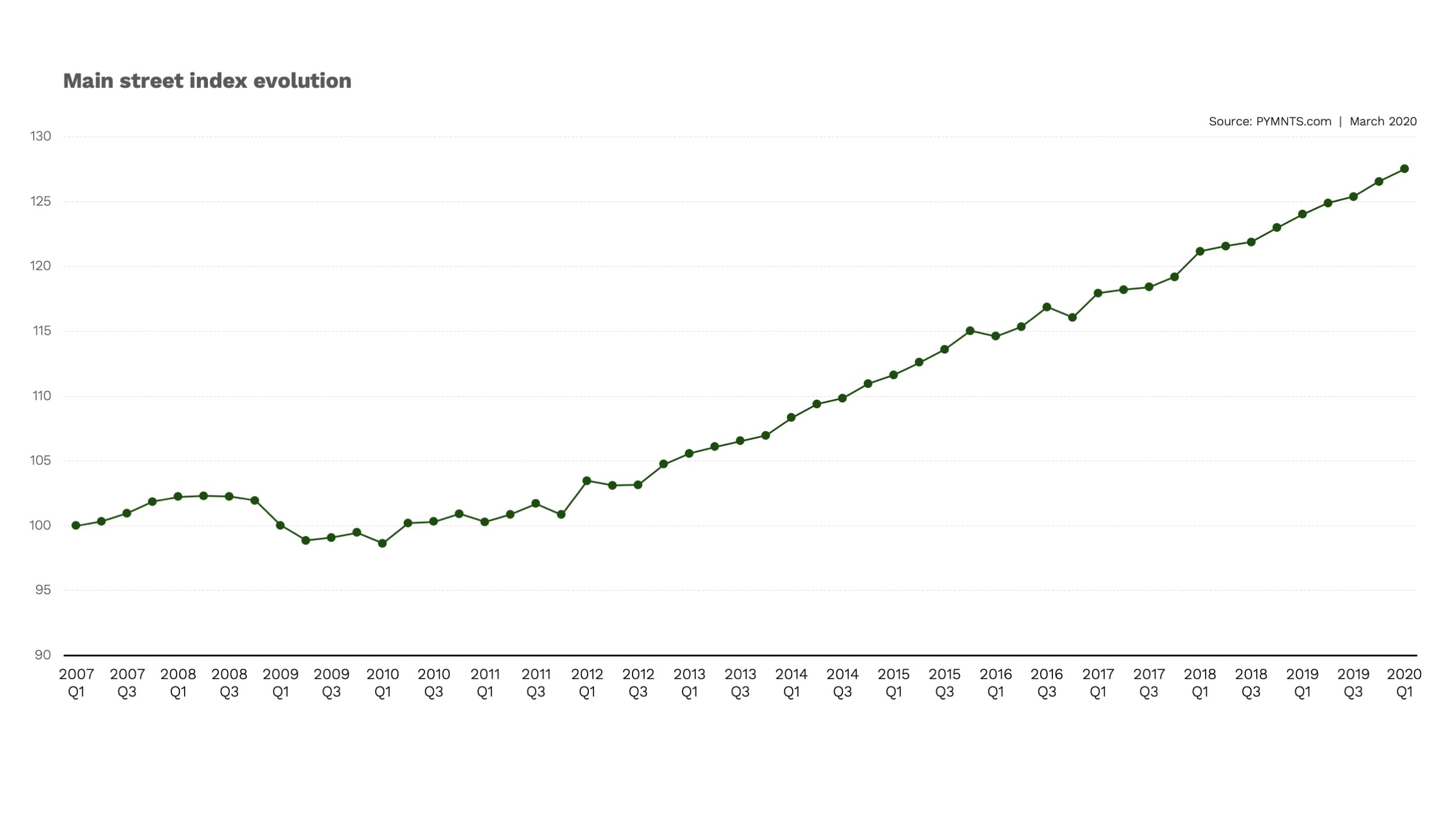

Looking at the numbers, data in the overall Index had a compound annual growth rate of 2.6 percent since the first quarter of 2010, typically seen as the bottom of the recession that followed the financial crisis that took hold of the nation in 2008 and beyond. And while we’re not quite done with the first quarter of 2020, the overall reading of 127.5 represents a peak, up 1.9 percent year over year.

With a nod toward total number of establishments, the third quarter 2019 data show the total number of establishments was up 2.4 percent as measured against 2018. The subsectors that saw the most growth were the building and subcontractors segment, where the number of establishments was up 4.2 percent, employment at those establishments (for the overall sector) was up 3.5 percent and wages surged 7.9 percent; and the professional services segment, which saw total establishments grow by 3.6 percent, employment gains of 2.6 percent and wages soaring 5.8 percent.

In nearly all segments, wages grew faster than employment and the number of establishments.

Retail, perhaps not surprisingly, lagged a bit, likely a nod toward the structural disruption that has come in the age of eCommerce. The number of establishments was down 20 basis points year over year, employment was down more than 1 percent and wages were up a rather anemic 1.3 percent.

The wildcard, of course, is the pandemic, which is shifting attention to emergency planning, worries about demand and of course supply chain issues.

That’s signaled by data released March 13 by the National Federation of Independent Business, which showed that 74 percent of smaller firms say they have yet to be impacted by the coronavirus at all, 23 percent said they were negatively impacted and only 3 percent state that the impact has been positive. The organization said it had polled 300 of its 300,000 members earlier in the week that ended March 13. Of the businesses that were seeing a negative impact, as many as 42 percent said they are experiencing slower sales, and 39 percent had supply chain disruptions.

And in data that speaks to credit, which of course helps these small businesses run day-to-day operations, as many as 32 percent said all credit needs have been met, and more than half said they were not interested in a loan.

That rather sanguine view of credit came from research conducted before President Trump announced that the Small Business Administration would be on hand to extend as much as $50 billion to small business owners to battle the economic shutdown being caused by the pandemic.

To get a sense just how widespread the impact of the coronavirus may be — and it’s just starting to come through in the data — consider the unemployment data released Thursday morning, March 19.

Jobless claims numbered 281,000 during the week that ended March 13, up from 211,000 the previous week and topping expectations that had been for claims to be about 220,000.

The Labor Department said the latest wave of claims were “clearly attributable to impacts from the COVID-19 virus. A number of states specifically cited COVID-19 related layoffs, while many states reported increased layoffs in service-related industries broadly and in the accommodation and food services industries specifically, as well as in the transportation and warehousing industry, whether COVID-19 was identified directly or not.”

The Correlation

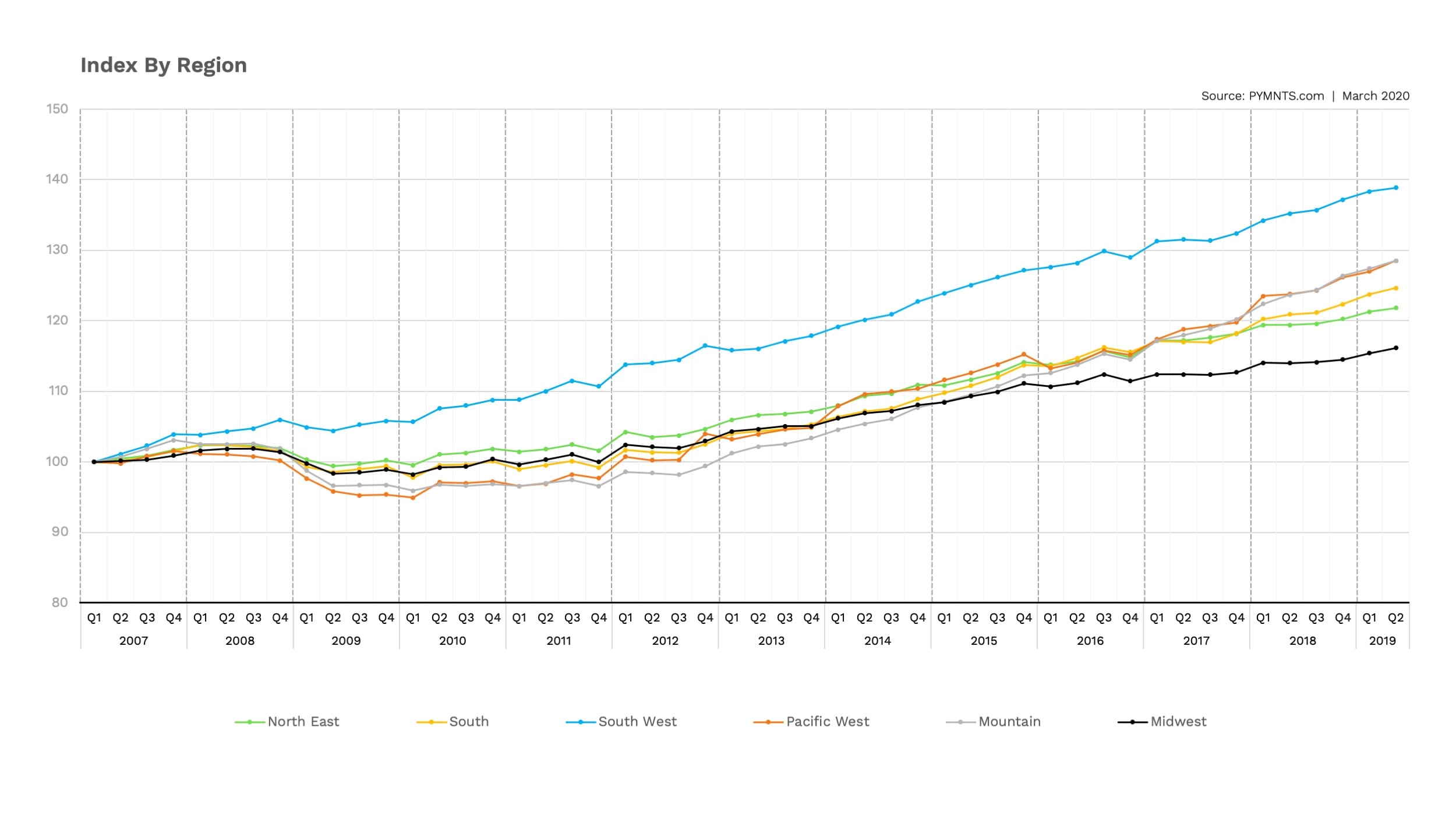

It’s a fair bet that the impact of the coronavirus will be broad-based, geographically speaking, and that the regional activity that has, for example, marked Main Street’s gains — where the Mountain and Pacific West saw respective 4.5 percent and 3.9 percent growth — will face significant headwinds.

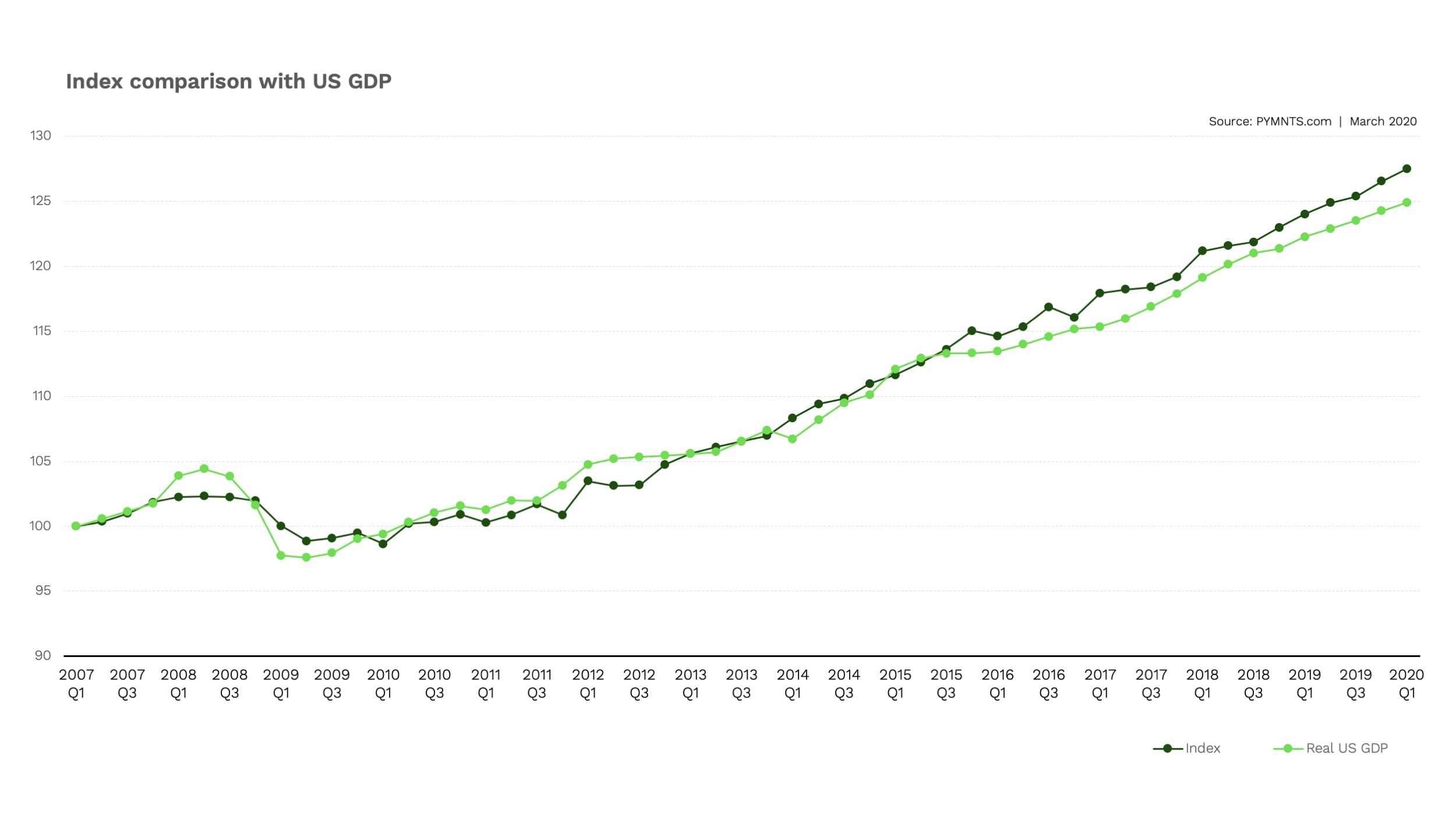

The Main Street Index is also highly correlated with U.S. GDP. Given the fact that Main Street represents 28.3 percent of total employment, 36 percent of total establishments, and 23.2 percent of wages, as Main Street goes, so goes GDP. And, conversely, GDP estimates can provide a glimpse of how Main Street will fare moving forward.

Before the current situation, the Federal Open Market Committee said at the end of last year that U.S. GDP growth would be about 2 percent this year. The pandemic has obliterated that view. In a research note to clients this week, Deutsche Bank said through its global economics team that U.S. GDP will collapse by an annualized 13 percent in the second quarter, snapping back to mid-single-digit rates in the second half of the year, and coming in at 1 percent annual growth for the full year.

The rearview mirror looks fine — the road ahead is bumpy, to be sure, and less than clear.